KOSPI Market Cap and GDP Gap Widens... Comparable to Past IT Bubble and Global Financial Crisis Levels

Foreign Investors Driving Stock Rise May Face Increased Pressure... Possible 'Pause' Phase

The KOSPI closed at 2,633.45 on the 27th, up 0.29% from the previous trading day, marking an all-time high closing price. Photo by Yonhap News Agency, showing the dealing room at the Hana Bank headquarters in Jung-gu, Seoul, that afternoon.

The KOSPI closed at 2,633.45 on the 27th, up 0.29% from the previous trading day, marking an all-time high closing price. Photo by Yonhap News Agency, showing the dealing room at the Hana Bank headquarters in Jung-gu, Seoul, that afternoon.

[Asia Economy Reporter Minwoo Lee] Concerns are emerging about overheating in the rapidly rising KOSPI. Although optimistic forecasts continue due to expectations for the commercialization of the novel coronavirus disease (COVID-19) vaccine and the inflow of foreign capital, the gap with the economic fundamentals has not narrowed. Since the market capitalization-to-GDP ratio is rising as it did before the past IT bubble and the global financial crisis, a pause in the rally may occur.

On the 28th, IBK Investment & Securities expressed concern over the widening gap between economic fundamentals and stock prices due to the sharp rise in the KOSPI. They cited the market capitalization-to-GDP ratio, which directly shows the relationship between economic fundamentals and stock prices. Known as the 'Buffett Indicator,' this ratio should consider differences in financial market size and structure by country, but generally, a ratio below 0.8 is considered undervalued, and above 1.0 is considered overvalued. In the U.S., the market cap/GDP ratio exceeded 1.0 in 2012 and is currently approaching 2.0.

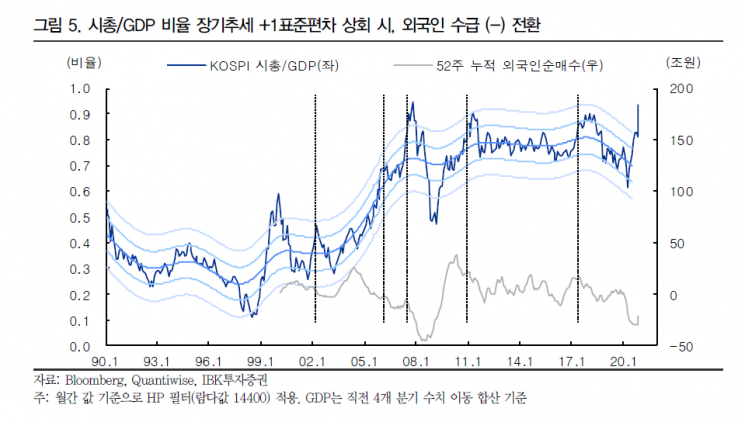

Even considering the national context, the long-term trend of the KOSPI's market cap/GDP ratio is at a somewhat burdensome level. Soeun Ahn, a researcher at IBK Investment & Securities, explained, "The KOSPI market capitalization ratio to the sum of nominal GDP for the last four quarters (Q3 2019 to Q2 2020) has surpassed 0.9, exceeding the +2 standard deviations of the long-term trend extracted using the Hodrick-Prescott (HP) filter. Historically, the KOSPI exceeded this range during the 2000 IT bubble and just before the 2008 global financial crisis." The HP filter is a function developed jointly by Robert Hodrick, a professor at Columbia University, and Edward Prescott, a professor at Arizona State University and 2004 Nobel laureate in Economics. It is used to extract cyclical components when analyzing complex real economic data and is also utilized to estimate South Korea's potential growth rate.

The deviation from the long-term trend in the market cap/GDP ratio represents the size of the gap between fundamentals and stock prices. This includes expectations not yet reflected in GDP, such as COVID-19 vaccine development and commercialization, hopes for the U.S. Joe Biden administration, large-scale policies like the Korean New Deal, and economic recovery prospects. Researcher Ahn warned, "Even considering these expectations, the market cap/GDP ratio significantly exceeds the long-term trend. If these market expectations do not materialize, it may be difficult to rationally accept the current stock index levels."

If this ratio continues to rise steadily, the inflow trend of foreign capital currently driving the domestic stock market rally could also change. After the COVID-19 outbreak, foreign investors who had withdrawn funds from the domestic market have been steadily re-entering despite the KOSPI hitting consecutive new highs. Since net selling of 12.55 trillion won in March, foreign investors consistently net sold every month except July. However, this month, they net purchased 7.43 trillion won, leading the index's rise. Due to relatively superior COVID-19 containment and the decline in the won-dollar exchange rate, capital has concentrated in South Korea among emerging markets.

However, if foreign investors begin to feel the burden of overvaluation in the domestic stock market, strong buying momentum may weaken. This pattern has been repeatedly confirmed in the past between the KOSPI market cap/GDP ratio and foreign investor flows. Researcher Ahn explained, "Whenever the market cap/GDP ratio exceeded +1 standard deviation of the long-term trend, foreign investor flows turned to net selling. In 2008, when it exceeded +2 standard deviations as it does now, the scale of selling was substantial due to the special circumstances of the global financial crisis."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.