[Asia Economy Reporter Changhwan Lee] Samsung Electronics' global NAND flash market share in the third quarter increased compared to the previous quarter.

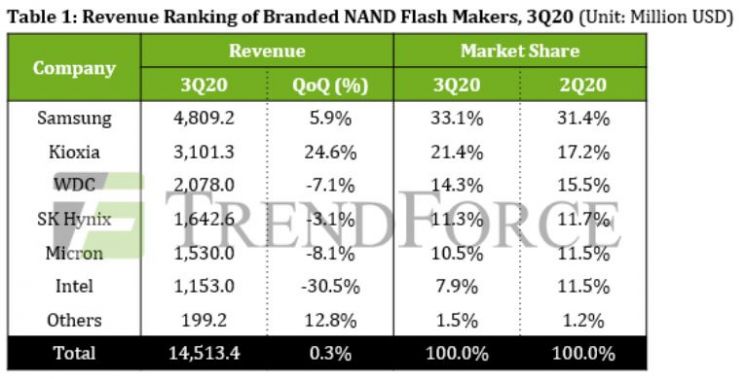

According to market research firm TrendForce on the 28th, Samsung Electronics' global NAND flash market share in the third quarter of this year was 33.1%, up from 31.4% in the previous quarter. Revenue grew by 5.9% quarter-on-quarter to $4.8092 billion.

TrendForce analyzed that the increase in Samsung Electronics' revenue and market share was due to concentrated purchases of Huawei products before the U.S. export restrictions were strengthened in the third quarter, as well as benefits from the launch of Apple's new iPhone. Although orders from server companies remained sluggish in the third quarter, causing product prices to fall, increased sales volume offset this decline.

Second-ranked Kioxia's market share rose from 17.2% to 21.4% during the same period. Revenue increased by 24.6% to $3.113 billion. The significant rise in market share and revenue is attributed to the acquisition of the SSD (Solid State Drive) division of Taiwanese semiconductor company Lite-On.

During the same period, third-ranked Western Digital (WDC) saw its market share decrease from 15.5% to 14.3%, while fourth-ranked SK Hynix also declined from 11.7% to 11.3%.

Looking at the overall NAND flash market, third-quarter revenue was approximately $14.5 billion, up 0.3% from the previous quarter. Although shipment volume increased by 9%, prices fell by 9%, resulting in revenue remaining similar to the previous quarter.

TrendForce explained that while demand for consumer electronics and smartphones increased in the third quarter, the inventory levels of server and data center customers remained high, limiting NAND market growth. They added that as major customers reduced their product procurement volumes, most NAND product prices showed a downward trend.

For the fourth quarter, overall demand is expected to remain sluggish due to server customers' efforts to reduce inventory. The Huawei-related special demand is also expected to disappear. However, demand expansion from other Chinese smartphone brands and demand related to the iPhone series are anticipated to have some positive effects.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.