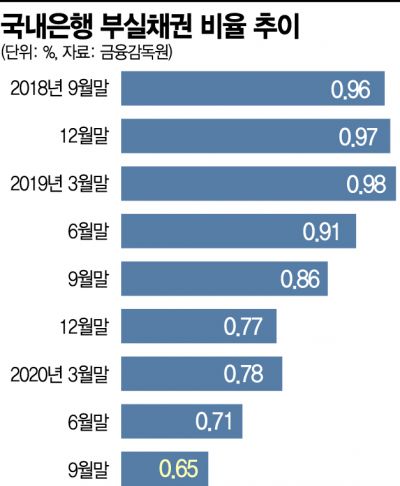

0.65% at the End of September... 0.20%p Decrease Compared to the Previous Quarter

[Asia Economy Reporter Kim Hyo-jin] The proportion of bank loans overdue for more than three months, which may become irrecoverable, recorded the lowest level ever as of the end of September.

Despite the overall impact on finance and the real economy due to the COVID-19 pandemic, such favorable indicators are maintained because various grace measures have prevented the immediate surfacing of non-performing loans. Banks are focusing on strengthening their loss absorption capacity in preparation for potential defaults.

On the 26th, the Financial Supervisory Service announced that the non-performing loan ratio of domestic banks stood at 0.65% as of the end of September, marking a record low. This is a 0.20 percentage point decrease compared to the end of the previous quarter (0.86%).

The non-performing loan ratio in the banking sector has consistently remained in the 0% range since the end of the third quarter of 2008 (0.96%) and has now reached a new low.

Although the total loan amount increased by 4.37 trillion KRW from the end of the previous quarter and by 18.9 trillion KRW compared to a year ago, reaching 2,148.7 trillion KRW, the amount of non-performing loans decreased by 90 billion KRW and 2.7 trillion KRW, respectively.

By sector, the non-performing loan ratio for corporate credit was 0.92%, down 0.07 percentage points from 0.99% at the end of the previous quarter. The non-performing loan ratio for household credit was recorded at 0.23%, a 0.02 percentage point decrease from 0.25% at the end of the previous quarter.

The delinquency rate on won-denominated loans at domestic banks (based on principal and interest overdue for more than one month) also recorded the lowest level since statistics began, at 0.30% as of the end of September.

A financial sector official pointed out, "Due to measures such as loan maturity extensions, non-performing loans have not surfaced, creating a kind of optical illusion. The real issue will arise after these grace measures end."

Accordingly, banks have raised their loan loss provision coverage ratio to 130.6% to prepare for sudden defaults and losses.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.