[Asia Economy Reporter Minji Lee] The global healthcare industry is experiencing both crisis and opportunity due to the novel coronavirus infection (COVID-19), and it is expected to create various investment opportunities.

On the 26th, Schroder Investment Management stated in its 'Global Healthcare Market Outlook Analysis Report' that with the importance of quarantine and prevention emerging after COVID-19, the core healthcare industry is shifting to a new paradigm such as preventive medicine and non-face-to-face medical care. The active research and development (R&D) of COVID-19 treatments and vaccines is expected to bring diversity to healthcare industry investments.

Schroder analyzed that the current global healthcare market size is estimated to be about 8 trillion dollars. The key growth factors of the healthcare industry were identified as ▲ expansion of outsourcing service markets ▲ development of medical equipment and devices ▲ mergers and acquisitions (M&A) for developing superior treatment methods.

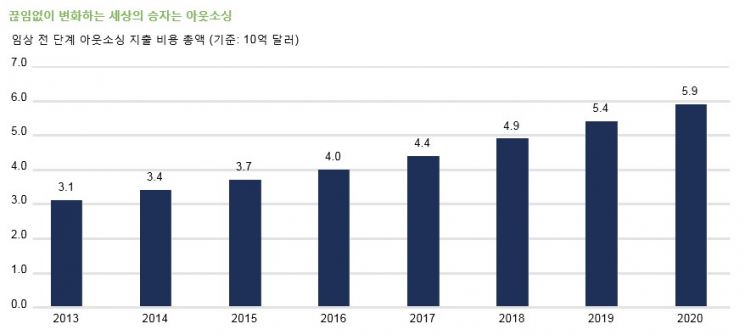

The report analyzed that due to increasing regulations and cost issues, medical institutions in various countries are closely cooperating with outsourcing service companies, enabling medical institutions to improve work efficiency while reducing unnecessary costs. Accordingly, the size of outsourcing service companies is rapidly growing, with the market size expected to grow from 3.1 billion dollars in 2013 to 5.4 billion dollars in 2019, and about 5.9 billion dollars in 2020.

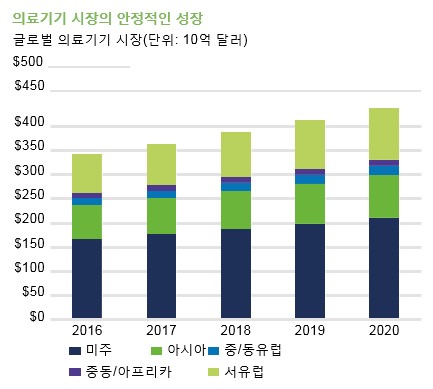

The COVID-19 pandemic has also driven growth in the non-face-to-face medical market. Schroder forecasted that the global medical equipment and device industry will achieve significant growth over the next 10 years, with the Asian market leading this growth. Schroder also highly evaluated the growth potential of the new drug development market. With heightened interest in vaccine development following the third wave of COVID-19, active mergers and acquisitions (M&A) are expected between existing pharmaceutical companies and new drug developers to create synergy.

When forecasting the global healthcare market, Schroder predicted that private equity will create significant opportunities in healthcare investment, considering that many healthcare companies are unlisted. Currently, about 146,000 unlisted healthcare companies are distributed across the US, Europe, and Asia, which contrasts sharply with approximately 2,700 listed companies in the same regions, indicating a large potential for future investment opportunities through healthcare private equity.

A representative from Schroder Investment Management said, “Compared to other industries, the healthcare industry is less affected by economic cycles, and especially in emergencies like COVID-19, it creates new value, attracting high interest from investors. Since it is a field that requires thorough understanding of various regulations and stakeholders as much as its growth potential, it is necessary to approach investments through experts who can provide strategic recommendations according to the company’s growth stage.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.