Foreign Investors Net Buy Over 7 Trillion Won This Month

Purchasing Semiconductor Stocks Including Samsung Electronics and SK Hynix

On the 25th, when the KOSPI index hit an intraday all-time high for the second consecutive day, dealers were working in the Hana Bank dealing room in Euljiro, Seoul. Photo by Mun Ho-nam munonam@

On the 25th, when the KOSPI index hit an intraday all-time high for the second consecutive day, dealers were working in the Hana Bank dealing room in Euljiro, Seoul. Photo by Mun Ho-nam munonam@

[Asia Economy Reporter Kum Boryeong] The KOSPI, which ushered in the '2600 era,' set new records for two consecutive days. At the center of this were foreign investors who bought semiconductor stocks such as Samsung Electronics and SK Hynix, as well as secondary battery stocks.

According to the Korea Exchange on the 25th, the KOSPI closed at 2617.76 the previous day. This marked the highest closing price for two consecutive trading days. The closing price of 2602.59 on the 23rd was the highest ever in 2 years and 10 months since January 29, 2018. On that day, the KOSPI started with an upward trend and soared to 2642.26 at one point in the morning, instantly surpassing the previous day's intraday high of 2628.52.

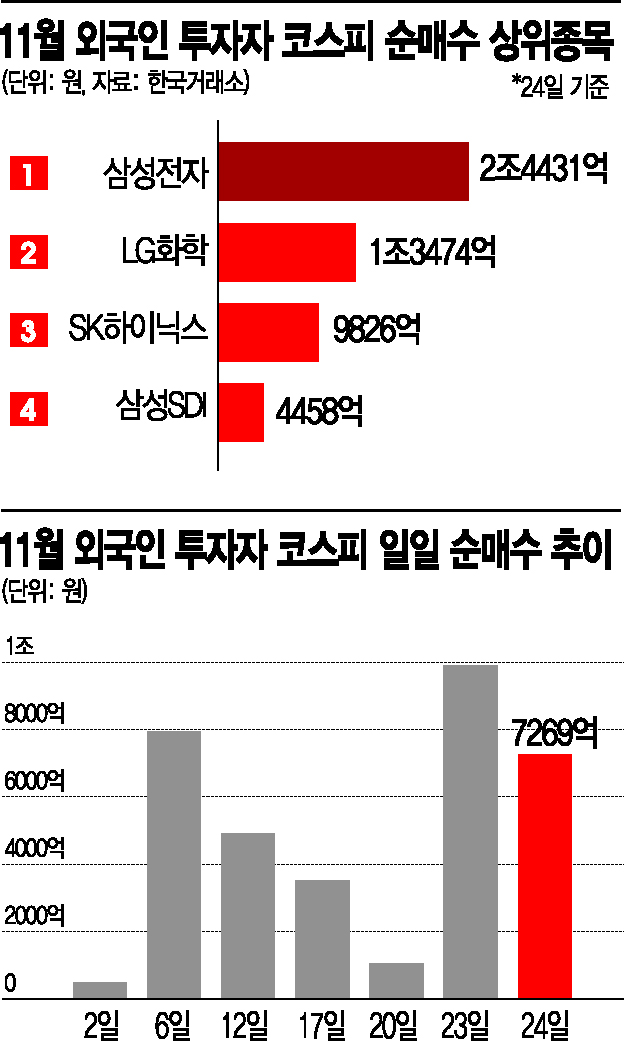

The rise in the KOSPI is being led by foreigners. Foreign investors have continued a net buying trend in the KOSPI for 14 consecutive trading days since the 5th. This month alone, they have purchased stocks worth more than 7.14 trillion won in the KOSPI market. On the 5th, they showed net buying of 1.1411 trillion won in a single day. On the other hand, individual investors have net sold stocks worth 5.9618 trillion won this month.

Kim Jungwon, head of the investment strategy team at Hyundai Motor Securities, said, "When comparing the historical highs of the domestic stock market based on dollar conversion, the MSCI Korea index in dollar terms exceeded the previous high by 0.4% as of the closing price on the 23rd, while the dollar-converted KOSPI is still 4.2% below the previous high," adding, "From the perspective of foreigners based on the dollar-converted KOSPI, there is room for additional KOSPI gains up to the previous high."

Foreign investors tended to invest mainly in semiconductor and secondary battery stocks. The top foreign net purchase stock in the KOSPI market in November was Samsung Electronics, with a total purchase of 2.4431 trillion won. This was followed by LG Chem (1.3474 trillion won), SK Hynix (982.6 billion won), and Samsung SDI (445.8 billion won).

In the case of Samsung Electronics, the stock price, which was in the 50,000 won range at the beginning of this month, is on an upward trend and is about to break through 70,000 won. The closing price was 56,600 won on the 30th of last month and rose 19.61% to 67,700 won the previous day in less than a month. On the previous day, it recorded 69,500 won during the session, setting a 52-week high. SK Hynix showed a similar trend. The closing price was 79,900 won on the 30th of last month and jumped 23.4% to 98,600 won the previous day.

Semiconductor stocks are attracting attention because the outlook for the DRAM industry is bright. Park Yooak, a researcher at Kiwoom Securities, explained, "The DRAM industry will enter a supply shortage in the first quarter of next year and continue a long-term boom for two years until 2022," adding, "Operating profits in the DRAM sector for Samsung Electronics and SK Hynix are expected to surge to 37 trillion won and 24 trillion won respectively in 2022, which will serve as a basis for further stock price increases." Securities firms have raised their target prices for Samsung Electronics. Shinhan Financial Investment raised it from 82,000 won to 85,000 won, and Eugene Investment & Securities raised it from 76,000 won to 80,000 won.

Secondary battery stocks such as LG Chem and Samsung SDI also played a role in boosting the stock market. LG Chem, ranked third in market capitalization, rose 30.77% from 611,000 won on the 30th of last month to 799,000 won the previous day, and Samsung SDI also increased 24.89% from 442,000 won to 552,000 won.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)