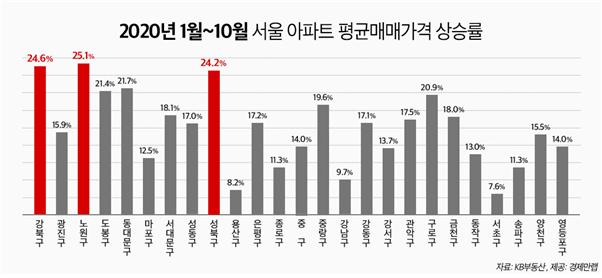

[Asia Economy Reporter Donghyun Choi] This year, apartment prices in Nowon-gu have risen by more than 25% in 10 months, recording the highest increase rate among Seoul's 25 districts. This appears to be due to the intensification of the 'panic buying' phenomenon, with prices soaring even in the outskirts of Seoul, following the government's strong regulations and the impact of the Lease Protection Act 2 (Jeonse and monthly rent cap system, contract renewal request system).

On the 25th, according to a review of KB Real Estate's housing price trends by the real estate information provider Economy Man Lab, the average apartment sale price per 3.3㎡ in Nowon-gu was about 22,787,000 KRW in January this year, but rose 25.1% to 28,499,000 KRW in October.

The average apartment sale price per 3.3㎡ in Gangbuk-gu was also 20,427,000 KRW in January this year but increased by 24.6% to 25,448,000 KRW in October, and Seongbuk-gu rose 24.2% from 25,010,000 KRW to 31,055,000 KRW during the same period.

In addition, the average apartment sale price per 3.3㎡ in Dongdaemun-gu rose 21.7% from 25,863,000 KRW in January to 31,472,000 KRW in October this year, while Dobong-gu and Guro-gu also increased by 21.4% and 20.9%, respectively, with the average apartment sale price increase rate reaching 20% this year.

The sharp rise in apartment prices in Nowon-gu can also be confirmed by actual transaction prices. According to the Ministry of Land, Infrastructure and Transport's actual transaction price statistics system, an 84㎡ apartment (exclusive area) in Sanggye-dong, Nowon-gu, 'Junggye Central Park,' was traded for 660 million KRW (1st floor) in January, but on the 6th of last month, it was traded for 890 million KRW (2nd floor), soaring by 230 million KRW in 10 months. An 84㎡ apartment in Junggye-dong, 'Cheonggu 3rd Complex,' was traded for 990 million KRW (11th floor) in January this year but was traded for 1.19 billion KRW (14th floor) on the 26th of last month, rising by 200 million KRW this year alone. An 84㎡ apartment in Wolgye-dong, 'Lotte Castle Luna,' also rose by 185 million KRW in 10 months, from 645 million KRW (5th floor) to 830 million KRW (6th floor) during the same period.

As apartment prices in Nowon-gu continue to soar, the transaction volume has also significantly increased. According to the Korea Real Estate Board, the apartment transaction volume in Nowon-gu from January to October this year was 11,458 cases, the highest since 2006 (14,258 cases).

Hwang Hansol, a research fellow at Economy Man Lab, said, "Despite the government's continuous real estate regulations, side effects keep appearing, and as house prices and jeonse prices fail to stabilize, even jeonse demand is turning to purchasing mid- to low-priced apartments, causing apartment prices in Nowon-gu to soar. It seems that if the government resolves the jeonse crisis with effective real estate measures, the rapidly rising sales market can also calm down."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.