Expectations of Crude Oil Production Cuts Boost WTI by 20.3% Since Late October

ETPs Rise Alongside Oil Price Recovery

[Asia Economy Reporter Eunmo Koo] International oil prices have risen on expectations of COVID-19 vaccine development and crude oil production cuts, lifting the spirits of investors in oil-related exchange-traded products (ETPs) as well.

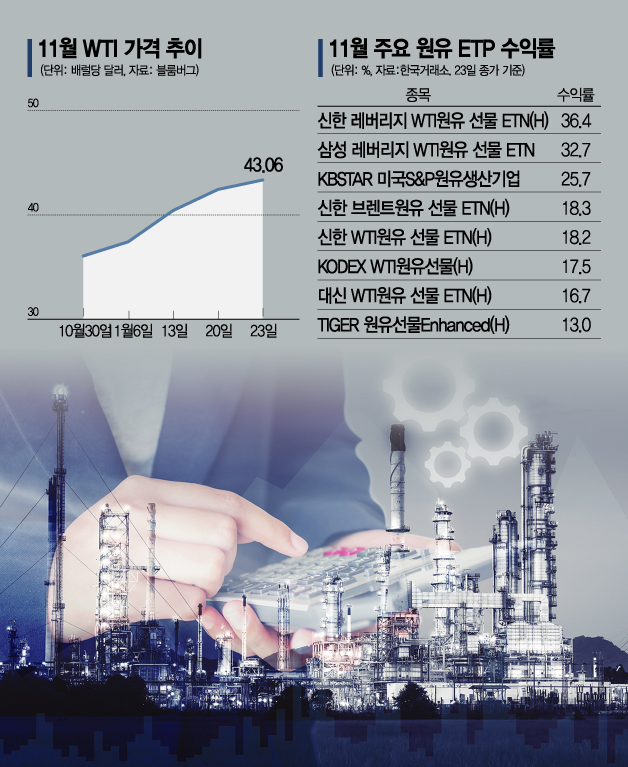

According to Bloomberg on the 24th, West Texas Intermediate (WTI) crude oil for January delivery on the New York Mercantile Exchange (NYMEX) closed at $43.06 per barrel, up 1.5% ($0.64) from the previous day (local time). This marks a 20.3% increase compared to the end of October ($35.79). Brent crude for January delivery on the London ICE Futures Exchange also closed up $1.10 (2.5%) at $46.06, rising 22.9% so far this month.

As international oil prices show a recovery trend, ETPs linked to crude oil prices are also rising. According to the Korea Exchange, KODEX WTI Crude Oil Futures (H) closed at 6,510 KRW, up 2.04% (130 KRW) from the previous trading day. It has risen 17.5% this month, surpassing the KOSPI's recent record high increase of 14.8%. Over the past 10 trading days, KODEX WTI Crude Oil Futures (H) ranked third among the most net-purchased stocks by institutional investors in the KOSPI market, with net purchases totaling 88 billion KRW during this period.

During the same period, KBSTAR US S&P Oil & Gas Exploration & Production Companies (Synthetic H) (25.7%), Shinhan Leverage WTI Crude Oil Futures ETN (H) (36.4%), Samsung Leverage WTI Crude Oil Futures ETN (32.7%), Shinhan Brent Crude Oil Futures ETN (H) (18.3%), and Daishin WTI Crude Oil Futures ETN (H) (16.7%) also recorded returns exceeding the KOSPI's rise.

Recent consecutive announcements of COVID-19 vaccine clinical results have driven international oil prices higher. The day before, British pharmaceutical company AstraZeneca announced that the vaccine jointly developed with Oxford University showed 90% efficacy. Additionally, Moncef Slaoui, chief of the U.S. government's "Operation Warp Speed" vaccine development team, stated in a broadcast interview that vaccinations would begin on November 11 or 12, shortly after the emergency use authorization of the Pfizer-BioNTech vaccine, further boosting vaccine expectations.

Meanwhile, news that the Organization of the Petroleum Exporting Countries (OPEC) and the 10-member coalition of major oil-producing countries including Russia, known as OPEC+, are considering maintaining current production cuts beyond next year has positively influenced oil prices from the supply side. At last week's OPEC+ Joint Ministerial Monitoring Committee (JMMC) meeting, official discussions on extending production cuts took place, and major countries reached an agreement to extend cuts at least through the first quarter of next year.

Kiwoom Securities analyst Soobin Shim said, "Considering the recent resurgence of COVID-19 and strengthened lockdowns in various countries leading to demand slowdown, as well as increased Libyan oil production, expectations for OPEC+ to extend production cuts will likely continue ahead of next week's regular OPEC+ meeting," adding, "These factors will continue to ease downward pressure on oil prices."

However, signs of internal conflict within OPEC+ due to prolonged production cuts may limit the rebound in oil prices. Recently, the United Arab Emirates (UAE) questioned the benefits of OPEC+ membership, citing strict production cut controls. This is seen as the accumulated fatigue of compliance countries like the UAE surfacing after long-term large-scale production cuts.

Samsung Securities analyst Jonghyun Jin commented, "Libya's production is resuming rapidly, and Iran's production is expected to return next year, weakening the cohesion compared to the production cut agreement in April," and added, "As fatigue from prolonged production cuts becomes apparent, if oil recovery does not accompany the easing of COVID-19 next year, OPEC will find it difficult to maintain a prolonged strict production cut policy to support oil prices, and the rebound in oil prices will be limited."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.