[Asia Economy Reporter Koh Hyung-kwang] The Korean stock market is heating up. This is thanks to foreign investors purchasing over 5 trillion won worth of Korean stocks in the KOSPI market alone this month. With expectations that foreign investors' buying momentum will continue for the time being, attention is focused on whether the KOSPI can set a new all-time high. Individual investors, who had been steadily accumulating stocks since the beginning of the year, appear to be realizing profits by showing large-scale net selling this month.

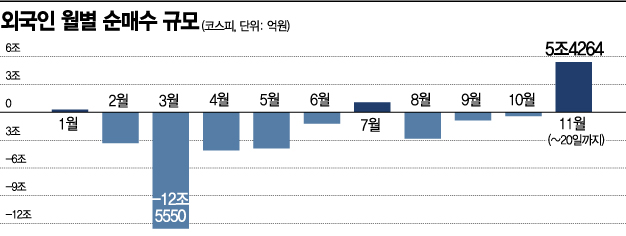

According to the Korea Exchange on the 23rd, foreign investors have net purchased stocks worth 5.4264 trillion won in the KOSPI market over 15 trading days through the 20th of this month. Although there are six trading days left until the end of November on the 30th, the current monthly net purchase amount is the highest in 7 years and 2 months since September 2013 (7.6362 trillion won). It ranks 4th in the all-time monthly net purchase rankings for foreigners. Due to the impact of the COVID-19 outbreak, foreign investors recorded net selling for five consecutive months from February to June this year. They showed a brief net purchase in July (1.0791 trillion won) but returned to net selling from August and maintained this trend until the previous month.

However, this month has seen a sharp reversal. Foreign investors have continued a net buying streak on all but one day, November 4th, out of the 15 trading days this month. In particular, the net purchase amount on November 5th ranked 9th all-time at 1.1411 trillion won. Thanks to this, the KOSPI has risen nearly 13% since the last trading day of the previous month, October 30th (2267.15). As of 10 a.m. on this day, the KOSPI index recorded 2590.71, up 1.46% from the previous trading day, closely approaching the all-time closing high of 2598.19 set on January 29, 2018, by just 7.48 points.

The inflow of foreign capital is interpreted as a result of reduced uncertainty in global financial markets following the U.S. presidential election and expectations that U.S. economic stimulus measures will be fully implemented. Investors anticipating a decline in the dollar's value are moving funds to emerging markets. The financial investment industry widely expects foreign buying momentum to continue for the time being. Experts believe that the pace of earnings improvement in Korean companies is faster than in other countries, leading to additional foreign capital inflows due to the weak dollar. Although concerns about a resurgence of COVID-19 still dominate the market, the stock market is accepting corporate earnings improvements as a given, making a sustained upward trend inevitable.

Seosangyoung, a researcher at Kiwoom Securities, said, "Foreign investors have significantly increased their net purchases in the domestic stock market recently as the Korean won has strengthened against the U.S. dollar and expectations for COVID-19 vaccine development have grown. Emerging market currencies are undervalued, and with rising expected inflation, capital inflows are expected to continue for the time being, driving index gains."

The stock most purchased by foreign investors this month is Samsung Electronics, with net purchases amounting to 2.0453 trillion won. This is over 1 trillion won more than LG Chem, which ranks second with 980.1 billion won. SK Hynix ranks third with 890.4 billion won, also a semiconductor stock. Roh Dong-gil, a researcher at NH Investment & Securities, explained, "Recently, foreign investors have been actively increasing their investment weights in the domestic market in sectors such as semiconductors, secondary batteries, and the smartphone value chain."

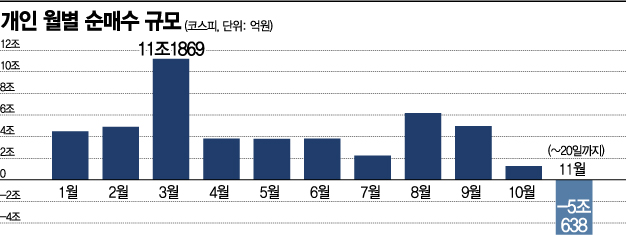

On the other hand, individual investors, who had maintained a net buying trend every month this year, have turned to net selling this month. As of the 20th, the amount of stocks sold in the KOSPI market by individuals reached 5.0638 trillion won. If this trend continues until the end of the month, individuals are expected to switch to net selling on a monthly basis for the first time this year. From the beginning of the year until last month, individual investors' net purchases in the KOSPI market amounted to 46.6234 trillion won.

Individuals have net sold about 2.0526 trillion won worth of Samsung Electronics stocks this month. Additionally, they have purchased the most of the 'KODEX 200 Futures Inverse 2X' exchange-traded fund (ETF) in the KOSPI market, with net purchases of 584.7 billion won. This product is a representative inverse ETF that tracks the KOSPI 200 futures index inversely by two times. It is usually bought by investors who expect the stock market to decline. Lee Jae-seon, a researcher at Hana Financial Investment, explained, "Individual investors are realizing profits mainly on stocks that have risen significantly. The large-scale purchase of inverse products seems to reflect the view that the market has overheated somewhat, as the KOSPI index has risen about 13% this month."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)