Banks Apply DSR 40% Regulation on Loans Over 100 Million Won Regardless of Income

Loan Restrictions Even for Non-High Earners... Last-Minute Demand Surge Causes Backlash

Savings Banks Also Raise Funding Bar by Reducing Low-Credit Borrower Handling

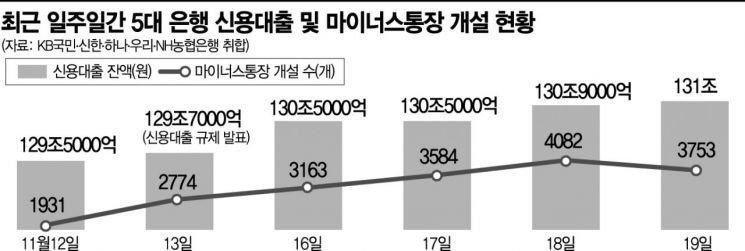

[Asia Economy Reporter Jo Gang-wook] As commercial banks have begun tightening their own credit loans a week earlier than the government’s regulation enforcement date (the 30th), concerns are growing that the "loan cliff" may become a reality. Initially, financial authorities announced that the loan regulations would target high-income earners, but commercial banks are preemptively applying stricter standards to general credit loans as well. Some banks have even reduced the limits on general employee loans and lowered preferential interest rates. Furthermore, savings banks are setting policies not to handle high-interest loans or to recall existing loans ahead of the legal maximum interest rate reduction (from 24% to 20%), raising the funding supply threshold for low-credit borrowers.

Early Credit Loan Regulations Including Reduction of Loan Limits and Preferential Interest Rates

According to the financial sector on the 23rd, major commercial banks have decided to strengthen screening by applying a total debt service ratio (DSR) 40% regulation on loans exceeding 100 million KRW regardless of income. KB Kookmin Bank has tightened loan standards from today, allowing credit loans only within 200% of annual income. Additionally, for applicants whose combined credit loans with other banks exceed 100 million KRW regardless of income, the DSR 40% regulation will be applied. The purpose is to curb excessive credit loans relative to income. Woori Bank plans to start early regulations on credit loans exceeding 100 million KRW within this week once the related IT system development is completed. NH Nonghyup Bank has also tightened credit loans by reducing loan limits and preferential interest rates.

Regulations Affecting Not Only High-Income Earners but Also General Employees

The issue is that these loan restrictions are not only applied to high-income professionals but also affect general employees. Initially, financial authorities described this regulation as a "pinpoint regulation" to block high-value credit loans for high-income earners. However, in the actual loan market, contrary to the policy intent, it has triggered last-minute "excess demand," leading to stronger banking sector regulations and causing what some call a "backfire."

From today, Woori Bank has decided to lower the maximum limit for 'Woori Main Employee Loan' and 'Woori WON Employee Loan' from 200 million KRW to 100 million KRW. Also, the preferential interest rate conditioned on salary account, which was 0.2 percentage points annually, has been reduced to 0.1 percentage points, and the preferential interest rates for Woori Card usage (over 500,000 KRW every 3 months) and automatic payment of utilities and communication fees, which were 0.1 percentage points, have been eliminated. NH Nonghyup Bank lowered the maximum preferential interest rate for 'All One Employee Loan' and 'All One Minus Loan' from 0.5% to 0.3%, a 0.2 percentage point reduction, starting from the 20th. The preferential interest rate conditioned on salary account was reduced from 0.2% to 0.1%, and the preferential interest rate for high credit grades (AS grades 1 to 3), which was 0.1%, was completely removed. Hana Bank reduced the maximum limit of the 'Hana One Q' credit loan from 220 million KRW to 150 million KRW starting from the 8th of last month, and Shinhan Bank already set the maximum limit for overdraft accounts at 100 million KRW last month.

Rising Loan Barriers for Low-Income Borrowers with Low Credit

The loan barriers for relatively low-credit, low-income borrowers are also rising. Following the government’s announcement to lower the legal maximum interest rate, savings banks have preemptively reduced their handling of low-credit borrowers ahead of the implementation in the second half of next year. Some are reportedly not issuing new loans that require interest rates above 20% annually and are even planning to recall existing loans. According to the Korea Federation of Savings Banks, the proportion of loans exceeding 20% interest rate among major savings banks with assets around 3 trillion KRW was in the low 20% range as of October, down more than 10 percentage points compared to six months ago. This raises concerns that vulnerable borrowers such as low-credit and multiple debt holders are being pushed out of the formal financial system.

Yoon Chang-hyun, a member of the People Power Party and former head of the Korea Institute of Finance, pointed out, "Experts estimate that the exclusion rate of low-credit borrowers will average 24%, and in some savings banks, it could expand up to 35%."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)