Shinhan Financial Investment Report

Q4 Operating Profit Estimated at 14.7 Billion KRW

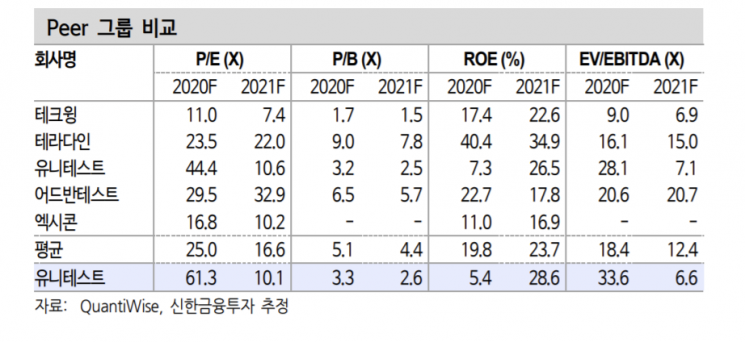

[Asia Economy Reporter Minji Lee] Unitest is expected to achieve performance growth starting next year through diversification of its equipment portfolio and expansion of overseas customers. On the 22nd, Shinhan Financial Investment gave Unitest a buy rating and a target price of 37,000 KRW, predicting further stock price increases.

In the third quarter, Unitest recorded sales of 15.1 billion KRW, down 74% compared to the same period last year. Operating loss turned to 1.1 billion KRW. The decline in orders for DRAM and NAND equipment from domestic customers was the reason for the poor performance. By business division, NAND testers recorded sales of 3.3 billion KRW. Additionally, the solar power segment recorded 4.9 billion KRW, down about 42% from last year, and the other segment recorded 6.8 billion KRW, with maintenance services decreasing by 54% compared to last year.

From the fourth quarter, surprises are expected. This is because orders for semiconductor DRAM burn-in equipment are being reflected and sales of NAND equipment to overseas customers are expected to expand. The solar power segment is also expected to achieve performance growth. Kangho Oh, a researcher at Shinhan Financial Investment, said, “Sales are expected to be revised upward from the previous estimate of 12.2 billion KRW to 14.7 billion KRW, recording 66.9 billion KRW in sales, a 53% increase compared to last year.”

Next year’s investment points are the start of DDR5 equipment sales and growth in NAND equipment sales. During the past DDR4 process transition, orders ranged from 500 billion to 600 billion KRW over about five years. Equipment sales for next year and 2022 are expected to grow 143% and 21% year-on-year to 142.8 billion KRW and 172.9 billion KRW, respectively. Researcher Oh stated, “Sales of DDR5 equipment will begin in the second half of next year and will become full-scale from 2022 during this process transition.”

Growth in NAND equipment sales is expected to be influenced by the expansion of overseas customers and diversification of the product portfolio. Researcher Kangho Oh said, “Delivery of new equipment, NAND wafer tester equipment, is also expected to begin in earnest from next year, with sales growing 36% year-on-year to 48.6 billion KRW.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.