COVID-19 Vaccine Side Effects Persist... Supply and Distribution Also Key

Economic Slowdown Due to COVID-19 Resurgence Outweighs Vaccine Effects

Various Indicators Already Signal Recession... Excessive Optimism Cautioned

On the afternoon of the 18th, citizens are lining up at the screening clinic of the National Medical Center in Jung-gu, Seoul. [Image source=Yonhap News]

On the afternoon of the 18th, citizens are lining up at the screening clinic of the National Medical Center in Jung-gu, Seoul. [Image source=Yonhap News]

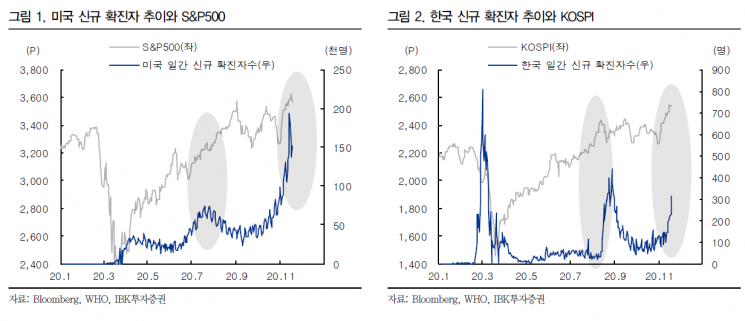

[Asia Economy Reporter Minwoo Lee] Despite the sharp increase in new COVID-19 cases both domestically and internationally, the stock market surged steeply due to optimism about COVID-19 vaccines. However, there is an analysis that before relying solely on vaccine effects, reasonable consideration should also be given to concerns about economic slowdown caused by the resurgence of COVID-19 and lockdown measures.

On the 21st, IBK Investment & Securities pointed out the need to be cautious about the recent vaccine optimism seen in the stock market. Soeun Ahn, a researcher at IBK Investment & Securities, said, "The recent stock market trend looks similar to the end of July when major pharmaceutical companies in the U.S. such as Moderna and Pfizer, as well as Chinese companies like Sinovac and Sinopharm, which had less market attention, announced the start of Phase 3 clinical trials," adding, "Despite the second wave of COVID-19 spreading in the U.S., stock prices rebounded, and the domestic stock market also followed suit. However, since it is difficult to immediately verify the results of Phase 3 clinical trials, market expectations gradually weakened, and the domestic stock market saw the resurgence of COVID-19 and economic concerns offset the positive vaccine-related news."

Although expectations for economic normalization after vaccine-related good news have driven the stock market up, it is pointed out that these are still just expectations. According to a survey of experts by the global management consulting firm McKinsey, the most likely time for the end of COVID-19 is the second half of next year. This scenario is possible if a COVID-19 vaccine receives approval from the U.S. Food and Drug Administration (FDA) between the end of this year and early next year, followed by large-scale production and widespread distribution within six months. The plans of leading vaccine developers such as Moderna and Pfizer are similar, but risks such as controversies over distribution methods and targets, as well as unexpected side effects, cannot be ruled out.

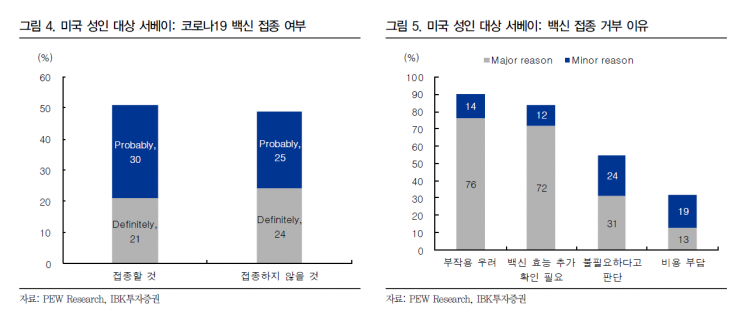

Moreover, even if the vaccine is effective, low trust could make widespread administration difficult. This issue of trust has already been raised in advanced countries with the capacity to purchase vaccines on a large scale. Researcher Ahn said, "In the U.S., according to some survey results, about half of adults are refusing vaccination due to concerns about side effects," adding, "Considering that about 70% of the population needs to be vaccinated to achieve herd immunity, half is a significantly low figure. Unless trust in the vaccine rises to a meaningful level, forming herd immunity and nationwide economic normalization may be difficult."

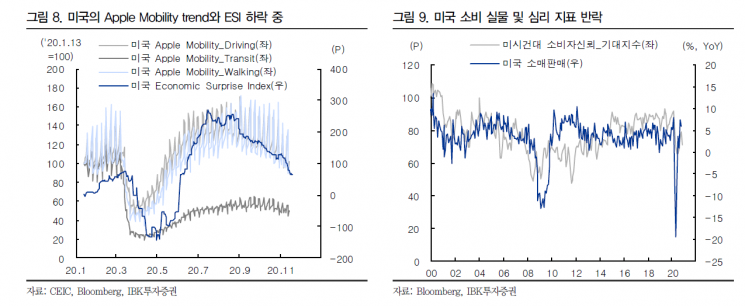

The situation the stock market is likely to face before vaccine effects is the economic shock caused by the resurgence of COVID-19. Europe, which experienced the resurgence and reimplementation of lockdown measures ahead of the U.S., is already seeing major indicators being readjusted. The Purchasing Managers' Index (PMI) and consumer sentiment indicators in Europe, which had shown a clear rebound, have recently declined again. Following Europe, lockdown measures have begun to be reinstated regionally in the U.S. On the 19th, New York City suspended in-person attendance at all public schools. Mobility indicators compiled by Apple have already slowed down with the third wave of COVID-19 in the U.S., and if regional lockdowns expand, the downward trend of these indicators is expected to continue. The contraction in economic activity due to movement restrictions is expected to manifest as poor economic indicators, as confirmed since the beginning of the year.

U.S. consumer indicators are already reflecting the impact of the third wave of COVID-19. The retail sales growth rate in October and the University of Michigan Consumer Sentiment Index in November both fell compared to the previous month and were below market expectations. Researcher Ahn pointed out, "Especially in the sub-items of the consumer sentiment index that precede consumption, the decline in the future expectations index was more pronounced than the current situation index," adding, "Without controlling the resurgence of COVID-19, it is difficult to recover with vaccine expectations alone."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.