Insurance Company Commissions 2.2268 Trillion Won 3.6%↑

Commissions Significantly Increased Mainly for Large Companies

Last Year's Commission Payment Competition Overheated

[Asia Economy Reporter Oh Hyung-gil] Despite pledging to refrain from excessive commission competition and even making a voluntary agreement just a year ago, non-life insurance companies have been increasing recruitment commissions again this year. With commissions rising significantly among major companies, they appear to be leading the competition. Even while benefiting from the ripple effects of the novel coronavirus disease (COVID-19), they are providing excessive awards and incentives to agents for performance.

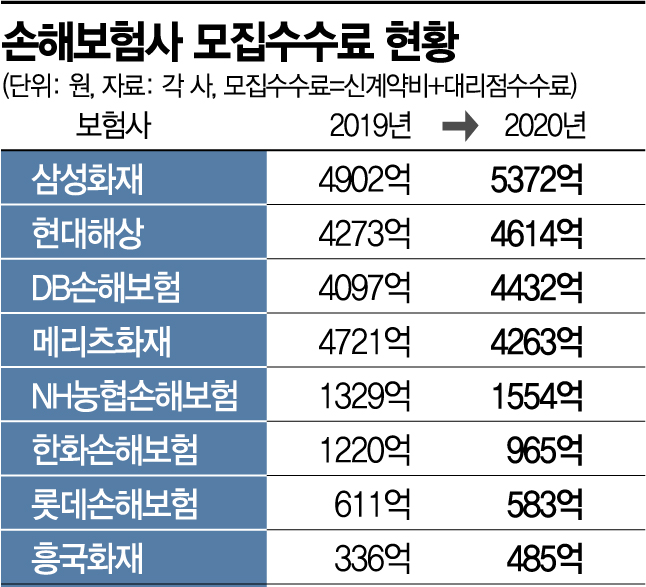

According to the insurance industry on the 20th, the recruitment commissions (new contract fees + agency commissions) of eight non-life insurers increased by 3.6%, from 2.1489 trillion won last year to 2.2268 trillion won on a cumulative basis through the third quarter.

Industry leader Samsung Fire & Marine Insurance recorded cumulative recruitment commissions of 537.2 billion won through the third quarter, up 9.5% from 490.2 billion won during the same period last year. New contract fees rose 19.8% from 171.7 billion won to 205.7 billion won, while agency commissions increased 4.0% from 318.5 billion won to 331.5 billion won.

During the same period, Hyundai Marine & Fire Insurance's recruitment commissions rose 7.9% year-on-year to 461.4 billion won, and DB Insurance also increased by 8.1% to 443.2 billion won. NH Nonghyup Property & Casualty Insurance's new contract fees (allowances + branch operating expenses, etc.) surged 16.9%, from 132.9 billion won last year to 155.4 billion won this year.

On the other hand, Meritz Fire & Marine Insurance's recruitment commissions decreased by about 45.8 billion won (9.7%), from 472.1 billion won last year to 426.3 billion won this year. Hanwha General Insurance, which recorded a loss last year, and Lotte Insurance, acquired by the private equity fund JKL Partners, also reduced recruitment commissions through cost-cutting measures.

Insurance companies deduct a portion of the premiums paid by policyholders as operating expenses, which include agent commissions. Commissions can be paid up to 1700% of the monthly premium in the first year of subscription. Additionally, commissions are provided to corporate agencies (GAs) under the name of operational support.

Last year, non-life insurers excessively paid commissions to agents and GAs to increase sales of protection insurance, leading to overheated commission competition. Agents recommended products with higher commissions rather than those suitable for customers, raising concerns about consumer harm.

As the situation worsened, in November last year, CEOs of non-life insurers, led by Kim Yong-duk, chairman of the Korea Non-Life Insurance Association, voluntarily agreed to participate in the appropriate execution of operating expenses. However, recruitment commissions are rising again after just one year, diminishing the impact of this voluntary agreement.

Moreover, the '1200% recruitment commission rule' is scheduled to be implemented next year, raising concerns that commission competition will continue through the end of the year. This system limits recruitment commissions to 1.2 million won in the first year for a policy with a monthly premium of 100,000 won.

An industry insider said, "It appears that commissions have increased as some companies have started selling long-term protection insurance," adding, "If new contracts increase, new contract fees inevitably rise to some extent."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.