Top 5 Companies' 3Q Cumulative Net Profit 1.89 Trillion Won... Up 18% YoY

Vehicle Usage Declined Due to COVID-19... Loss Ratio Expected to Decrease Further in 4Q

[Asia Economy Reporter Oh Hyung-gil] Non-life insurance companies that suffered from high loss ratios in auto insurance last year are now smiling this year. Although their performance was poor last year due to the worst loss ratios on record, the situation has reversed this year as loss ratios have stabilized.

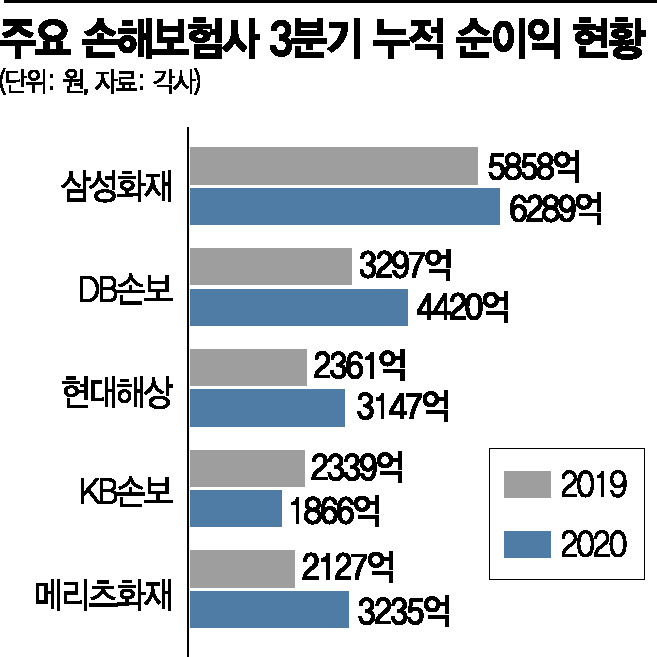

According to the insurance industry on the 17th, the cumulative net profit of the top five domestic non-life insurers in the third quarter reached 1.8984 trillion KRW, an increase of about 18.7% compared to 1.5982 trillion KRW in the same period last year.

Samsung Fire & Marine Insurance posted a net profit of 628.9 billion KRW, increasing by only 7.4% from last year but still far ahead of other non-life insurers in scale. DB Insurance's net profit grew by 34.5%, from 329.7 billion KRW last year to 442 billion KRW this year. Hyundai Marine & Fire Insurance also increased by 33.2%, from 236.1 billion KRW to 314.7 billion KRW.

Meritz Fire & Marine Insurance, which recorded a net profit of 212.7 billion KRW last year, saw a remarkable growth rate of 52.1% this year, reaching 323.5 billion KRW. On the other hand, KB Insurance's net profit fell by 20.2%, from 233.9 billion KRW last year to 186.6 billion KRW.

The insurers explained that the main reason for the increase in net profit was the decrease in auto insurance loss ratios.

Due to the impact of the novel coronavirus disease (COVID-19), vehicle movement decreased and hospital visits were avoided, leading to a reduction in insurance payouts. Although there were concerns that loss ratios would surge due to flood damage caused by concentrated heavy rains in the summer, the results were better than expected.

In the case of Samsung Fire & Marine Insurance, the combined ratio (loss ratio + expense ratio), which measures insurance business efficiency, fell by 0.6 percentage points from the previous year to 104.3%. Looking at loss ratios by category, long-term insurance dropped by 1.2 percentage points to 82.2%, and auto insurance decreased by 3.3 percentage points to 84.8%. However, general insurance rose by 6.8 percentage points to 81.6% due to an increase in large claims and natural disasters.

With the quarantine authorities raising the social distancing level in the metropolitan area to 1.5 amid signs of COVID-19 resurgence, there are forecasts that auto insurance loss ratios will decrease further in the fourth quarter.

The auto insurance loss ratios (preliminary closing basis) of Samsung Fire & Marine Insurance, Hyundai Marine & Fire Insurance, DB Insurance, and KB Insurance last month ranged from 84.0% to 86.3%, dropping more than 10 percentage points compared to the same period last year.

Samsung Fire & Marine Insurance recorded 86.3%, down 10.8 percentage points from 97.1% last year, while Hyundai Marine & Fire Insurance improved by 12.9 percentage points to 84.0% from 96.9% the previous year. DB Insurance also decreased by 12.3 percentage points to 85.5% from 97.8% last year. KB Insurance dropped 13.9 percentage points to 85.0% compared to last year.

The auto insurance loss ratio refers to the ratio of insurance claims paid to policyholders relative to the premiums collected by the insurer. The industry considers the appropriate auto insurance loss ratio to be between 78% and 80%.

However, the non-life insurance industry pointed out that the loss ratios are still higher than the appropriate level (78-80%) and that the deficit structure has not been overcome. A non-life insurance company official said, "Although the auto insurance loss ratio has improved due to the impact of COVID-19, it is not a situation to be complacent about," adding, "How the loss ratio changes by the end of the year will depend on the effects of heavy snow and cold waves in winter."

Experts are optimistic about the performance of non-life insurers next year. Jeong Joon-seop, a researcher at NH Nonghyup Securities, said in a report on the day, "The net profit of the five non-life insurers next year is expected to increase by 8.8% to 2.2374 trillion KRW compared to the previous year," and predicted, "The auto loss ratio will improve by 1 percentage point due to rate hikes."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.