From the 30th, DSR Regulations and

High-Income Earners' Credit Loan Restrictions

Yeouido and Gangnam Areas

Consultations for Early Loan Applications

[Asia Economy Reporters Sunmi Park and Minyoung Kim]#. Kim Youngsik (alias, 44), a team leader at a large corporation in his 40s, called the bank for a loan consultation immediately after arriving at work on the morning of the 16th. He heard that from the 30th, it would become difficult to obtain credit loans exceeding 100 million KRW while having a mortgage loan ('judamdae'), so he intended to secure funds by taking out the maximum additional amount on top of his existing 50 million KRW credit loan.

On the morning of the 16th, the first business day after the announcement of targeted regulations on high-income earners' credit loans, the Yeouido branch of Hana Bank was busy with loan inquiry calls right after opening. Although few customers visited the branch in person early on Monday, the phone kept ringing at every counter. The situation was similar at the Gangnam area KB Kookmin Bank branch. That morning, calls from customers about additional loan limits flooded commercial bank branches, and bank staff were busy explaining the changing regulations. Especially at branches located in areas densely populated by high-income earners, inquiries surged from those trying to get more credit loans before the regulations took effect.

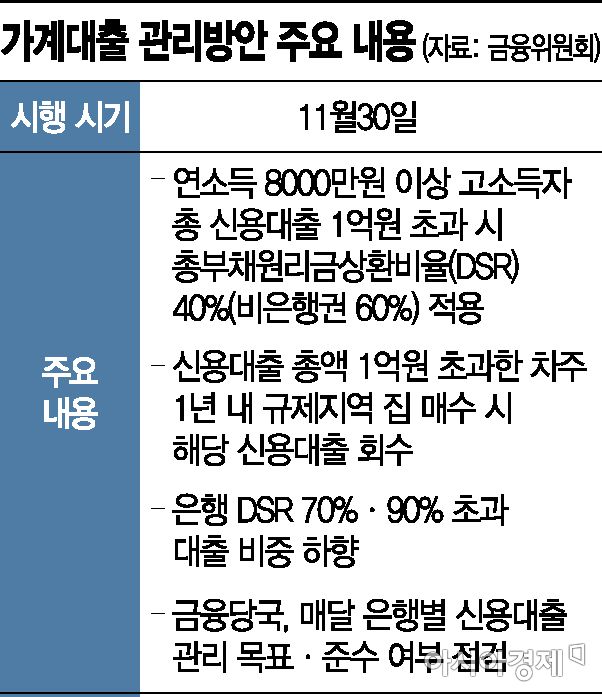

On the 13th, the Financial Services Commission and the Financial Supervisory Service jointly announced household loan management measures aimed at strengthening the Debt Service Ratio (DSR) regulations on high-income earners to block large credit loans. This is a 'targeted regulation' to prevent money from flowing into the real estate market for investment purposes. If a high-income earner with an annual income exceeding 80 million KRW takes out a credit loan exceeding 100 million KRW, the DSR regulation (40% for banks, 60% for non-banks) will be applied on an individual basis. Furthermore, if they take out a credit loan exceeding 100 million KRW and purchase a house in a regulated area within one year, the loan will be recalled within two weeks. This regulation will be enforced starting from the 30th.

"Get loans in advance before the 30th"

Accordingly, inquiries about loans increased from people trying to secure loans before the enforcement date of the 30th. A Hana Bank official in Yeouido said, "Most high-income earners already have credit loans, so there are many inquiries from existing credit loan holders," adding, "Borrowers with upcoming maturities mainly ask whether they can extend the maturity and whether the loan limit will be reduced after the 30th." The official also said, "Although existing borrowers are not affected by this measure, many are worried that their limits might be reduced or loans recalled."

At Woori Bank's Yeouido Central Financial Center, almost no customers visited in person to inquire about loans from the morning. However, many phone inquiries came asking whether credit loans are currently available.

Bank branches in Jamsil, where many high-income earners are concentrated, also received many questions from people who had already taken out credit loans exceeding 100 million KRW, asking whether they could get additional housing purchase loans.

Online real estate communities also saw frequent inquiries about bank loans.

In response to a question about concerns over the difficulty of obtaining credit loans exceeding 100 million KRW from the 30th for those planning to buy an apartment early next year with an annual income exceeding 100 million KRW, many comments suggested that getting loans in advance is the only option.

A high-income, non-homeowner planning to buy a house under 900 million KRW posted that they intended to use a credit loan as short-term funds in January next year to pay the balance combined with a mortgage loan, proceed with interior work, and then repay the credit loan with the deposit from a jeonse (long-term lease) house. However, due to the sudden new government loan regulations, they are worried about funding disruptions and are considering taking out the maximum credit loan before the 30th.

However, many on-site views express concern that this targeted regulation on high-income earners' credit loans may instead fuel 'Yeongkkeul' (all-in) loans and real estate price increases as side effects.

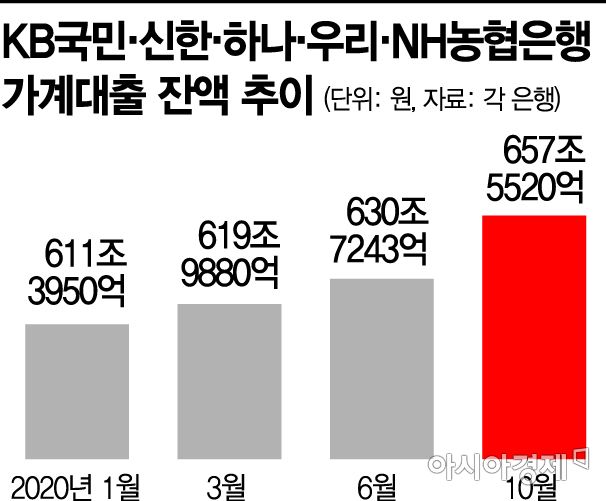

Due to the government's strengthened regulations, people feeling anxious that it will become harder to secure housing loans through 'Yeongkkeul' loans over time are rushing to secure funds as soon as possible to jump into housing purchases, leading to continued loan increases and real estate price rises for the time being. Especially, with financial authorities planning to lower the target ratio of high DSR loans in the financial sector and continuing to tighten loans, there is a widespread perception that now is the 'last train' for loans.

Critics point out that the sudden tightening of loans by financial authorities blocks new loan channels for people who have been diligently repaying debts, spreading the perception that 'debt should not be repaid when money is available but should be taken out as much as possible when possible and held for investment.'

Financial Services Commission: "Strengthening credit loan regulations will not affect low-income earners and small business owners"

In response to controversies that the current regulations make it harder for non-homeowners to buy their own homes, the Financial Services Commission stated, "This measure was prepared under the fundamental principle of protecting low-income earners and genuine demanders as much as possible," and emphasized, "It strengthens banks' own credit loan management efforts within the scope that does not affect low-income earners and small business owners."

They further explained, "Even borrowers with annual incomes exceeding 80 million KRW who are homeowners but have not separately taken out mortgage loans are not significantly affected in terms of credit loan amounts even if borrower-level DSR is applied. It is expected to effectively prevent some high-income groups from using excessive credit loans to evade mortgage loan regulations or engage in gap investments."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)