Global 'Eco-friendly Financial Market' Trends

Shinhan Financial's 'Zero Carbon' Declaration

KB Financial's 'KB Greenway 2030'

[Asia Economy Reporter Park Sun-mi] As the global trend of the 'eco-friendly financial market' takes shape, the domestic financial sector is also accelerating its Environmental, Social, and Governance (ESG) management.

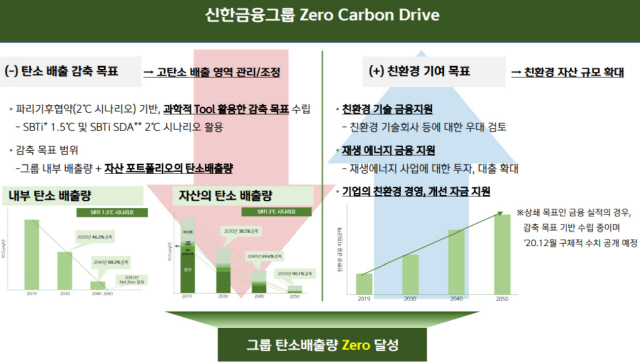

According to the financial sector on the 16th, Shinhan Financial Group recently declared 'Zero Carbon' and decided to reduce the carbon emissions of the assets in its portfolio to 'zero (0)' by 2050. This is a differentiated eco-friendly financial strategy aligned with international carbon neutrality policies, which not only manages loans and investments in high-carbon-emission companies and industries but also contributes to the transition to a low-carbon economy by expanding eco-friendly financial support within the industry.

Going forward, Shinhan Financial plans to reduce the group's own carbon emissions by 46% by 2030 and 88% by 2040, and also reduce the carbon emissions of the group's asset portfolio by 38% by 2030 and 69% by 2040. The group will further advance its carbon emission measurement model and pursue joining the international organization Science Based Targets initiative 'PCAF' to have its emission reduction targets internationally verified.

Shin Yong-byeong, Chairman of Shinhan Financial Group, said, "Expanding eco-friendly finance is an essential role of finance for future generations," adding, "Under the group's mission to make the world better through finance, Shinhan will do its utmost to spread positive influence in our society."

KB Financial Group is also accelerating ESG management at the group level.

In March this year, it established the first ESG Committee within the board of directors among domestic financial groups, with all directors including Chairman Yoon Jong-kyu participating to strengthen the execution of ESG management at the group level. In August, it announced 'KB Greenway 2030,' aiming to reduce the group's carbon emissions by 25% compared to 2017 by 2030 and expand 'ESG products, investments, and loans,' currently about 20 trillion won, to 50 trillion won. In September, it also declared 'coal phase-out finance' for the first time among domestic financial groups.

As a result, on the 14th, KB Financial Group was included in the Dow Jones Sustainability Index (DJSI) World Index for the fifth consecutive year. In particular, it was selected as the global 2nd and domestic 1st in the banking industry for the third time, solidifying its position as a global leader in ESG management. This achievement follows its selection as the top ESG company (1st among financial companies) by the Korea Corporate Governance Service in October.

Samsung Also Declares Coal Phase-Out for Financial Affiliates

Earlier, Samsung Group also declared 'coal phase-out' for all its financial affiliates and decided to completely stop additional investments related to coal power generation.

On the 12th, Samsung Life Insurance and Samsung Fire & Marine Insurance announced that they would not invest in direct loans or financing for coal-fired power plants, nor in corporate bonds issued for the construction of coal-fired power plants. Samsung Securities and Samsung Asset Management have also established ESG investment guidelines, including excluding investments in coal mining and power generation businesses, which will be applied to operations starting in December.

Countries around the world, including the European Union, South Korea, and Japan, have declared carbon neutrality by 2050, and China by 2060, forming an eco-friendly trend by establishing greenhouse gas reduction plans in accordance with the Paris Climate Agreement.

Moreover, with the election of U.S. President Joe Biden, it is expected that green regulations on climate change and eco-friendliness will be significantly strengthened in the U.S., and eco-friendly investments will greatly increase. President-elect Biden has announced plans to achieve carbon neutrality by 2050 and invest $1.7 trillion (approximately 2,000 trillion won) in the Green New Deal.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.