IPO Public Offering System Improvement Forum

Plan to Expand Individual Allocation to 30%

Expected to Apply as Early as Next Month

[Asia Economy reporters Jihwan Park and Minji Lee] The allocation of shares for general individual investors in public offerings is set to be expanded from the current 20% to a maximum of around 30%. Starting as early as next month, the portion of shares allocated to individuals in public offerings is expected to increase by nearly 10%.

According to the financial investment industry and financial authorities on the 13th, the Financial Services Commission plans to implement the improved policy as early as next month after gathering opinions from the 'Public Offering Allocation and Initial Public Offering (IPO) System Improvement' forum hosted by the Korea Financial Investment Association the day before. This forum was created to collect industry opinions on the proposals discussed by the public offering system task force (TF) team. Since this system improvement involves revising the industry's self-regulatory rule, the 'Regulations on Securities Underwriting Business, etc.', it can be applied immediately after the revision without any separate procedures.

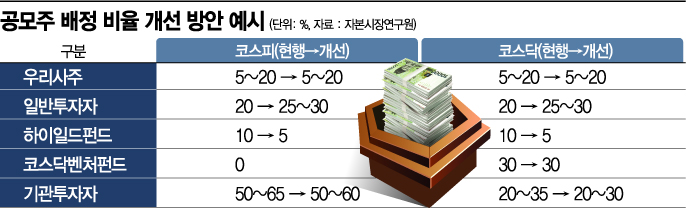

To summarize the discussions, the allocation to individuals will be increased while minimizing stock price volatility after listing to normalize the market. Based on the KOSPI market, individuals currently receive about 20% of the shares in the public offering market. The rest are allocated to institutions (50-65%), employee stock ownership associations (5-20%), and high-yield funds (10%) in that order. Any unsubscribed shares from employee stock ownership associations are fully allocated to institutions.

Currently, authorities are considering increasing the individual allocation from 20% to up to 30%. This involves lowering the high-yield fund allocation ratio to 5% and allocating up to 5% of the unsubscribed shares from employee stock ownership associations to individuals. Within the individual allocation, an 'equal distribution' method will be applied. Since the number of shares that can be allocated depends on the capital size, for some portion, if a minimum deposit is made, all applicants will be able to receive an equal number of shares.

Measures to reduce stock price volatility to stabilize the public offering market will also be introduced. Previously, Big Hit Entertainment raised subscription deposits amounting to 59 trillion won but saw its stock price drop about 55% from the peak after listing. Although less than a month had passed since the listing, individual investors who bet on a price increase were stuck at the peak due to large-scale institutional selling. Seokhoon Lee, a research fellow at the Korea Capital Market Institute, argued, "It is worth considering introducing an 'over-allotment option' that allows underwriters to allocate an additional 15% of the public offering shares and a 'cornerstone investor' system where some shares are preferentially allocated and held long-term."

The over-allotment option system allows the lead underwriter to allocate up to an additional 15% of the public offering shares. Although the number of shares increases, when the stock price falls sharply after listing, the underwriter buys shares equivalent to the allocated amount to prevent a price drop. The cornerstone investor system is being reviewed as a measure to enhance the appropriateness of the public offering price.

Overseas, systems for individual investors in public offerings have already been in operation. In countries such as Japan, Hong Kong, and Singapore, to ensure fairness among investors and prevent large deposits from dominating share allocation, methods such as prohibiting multiple account subscriptions for mandatory allocations to general subscribers, preferential treatment for small subscriptions, and lottery systems have been adopted.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.