Korean Economic Association 'Economic Discussion'

Survey Results on the Three Fair Economy Acts

[Asia Economy Reporter Kim Eunbyeol] More than six out of ten prominent domestic economists support the "Fair Trade Act Amendment," which expands the scope of regulations on private benefit appropriation by controlling shareholders.

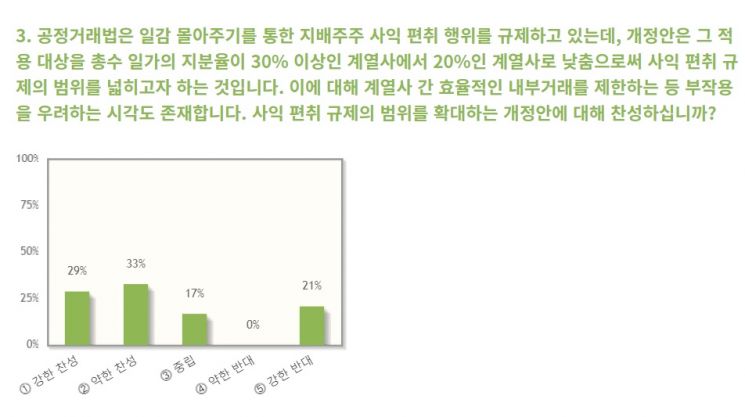

According to a survey on the "Three Fair Economy Laws" conducted during the Korean Economic Association's economic discussion on the 13th, 62% of economics professors voted in favor of the Fair Trade Act amendment that broadens the scope of private benefit appropriation regulations. Among them, 29% expressed "strong support," and 33% showed "mild support." About 21% of professors opposed the amendment.

The Three Fair Economy Laws refer to the "Fair Trade Act Amendment," the "Commercial Act Amendment," and the "Financial Group Supervision Act Establishment." These include ▲ lowering the controlling shareholder family's shareholding threshold subject to private benefit appropriation regulation from 30% to 20%, ▲ mandating holding companies to increase their subsidiary shareholding by 10 percentage points from the current level, ▲ introducing a "multiple derivative lawsuit system" allowing minority shareholders of the parent company to sue if a subsidiary causes problems, and ▲ the "separate election system for audit committee members," which limits the controlling shareholder's influence by electing auditors separately to oversee the company.

Among the various amendments, the Fair Trade Act amendment expanding the scope of private benefit appropriation regulation received the highest approval rate. Professor Kim Woochan of Korea University Business School, who strongly supports the amendment, stated, "This amendment merely broadens the range of companies subject to private benefit appropriation regulation, and does not relax any of the stringent conditions the Fair Trade Commission must prove to impose fines." He added, "Due to these strict conditions, the number of sanctions by the Fair Trade Commission has been only eight cases in five years since the enforcement in February 2015, and unless a corporate group openly engages in private benefit appropriation, there is virtually no chance that internal transactions among affiliates will be restricted." Although some express concerns that the amendment might limit efficient internal transactions among affiliates, the conditions for imposing fines remain largely unchanged.

Even if the scope of companies subject to private benefit appropriation regulation is expanded, the Fair Trade Commission must prove the violation to impose fines. Furthermore, if the controlling shareholder family can prove that the transaction was conducted to achieve "efficiency, security, or urgency" purposes, the company will not be penalized.

Professor Yoon Kyungsoo of Gachon University also strongly supports the amendment, saying, "The amendment aims to eliminate regulatory blind spots, and the illegality of internal transactions under the Fair Trade Act is not judged solely by shareholding ratios." Professor Sung Taeyoon of Yonsei University voted mildly in favor, stating, "It is reasonable to expand the scope of private benefit appropriation regulation while strictly defining and applying the concept of private benefit appropriation itself."

Regarding the introduction of multiple derivative lawsuits allowing parent company shareholders to sue subsidiary directors, 48% of professors supported it (13% strongly support, 35% mildly support), while 39% opposed it (26% strongly oppose, 13% mildly oppose). Professor Yoon Mikyung of Catholic University, who mildly supports it, said, "Since the parent-subsidiary relationship is clear, it seems necessary to apply this only in cases where they are considered one company." Professor Lee Insil of Sogang University’s Department of Economics strongly opposed the system, stating, "This system is not suitable for the Korean context." She added, "There is no clear empirical evidence that multiple derivative lawsuits prevent controlling shareholders from pursuing private benefits, and there are concerns about conflicts of interest between parent and subsidiary shareholders."

Regarding the Commercial Act amendment to separately elect at least one audit committee member at the shareholders' meeting, 46% of respondents supported it, 29% opposed, and 25% were neutral. For the proposal to increase the shareholding ratio that holding companies must maintain in newly incorporated subsidiaries by 10 percentage points, the largest share of opinions, 38%, was neutral.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)