Technology Growth Stocks Stall, Cyclical Stocks Rally

Over 7 out of 10 Companies Improve Earnings in Q4

Contrarian Investment Needed for Undervalued Earnings Improvement Stocks

[Asia Economy Reporter Oh Ju-yeon] As expectations for the development of a novel coronavirus infection (COVID-19) vaccine grow, stocks that are sensitive to the economy and have not risen until now are showing relatively strong performance, surpassing technology growth stocks. Although it may take time for the vaccine to be commercialized, interest in companies with improving earnings is increasing as economic recovery is expected next year. This means that if the market shifts from the current 'liquidity-driven market' based on low interest rates to a 'performance-driven market' next year, new leading stocks may emerge.

According to FnGuide, a financial information company, among 254 listed companies estimated by three or more securities firms for the fourth quarter of this year, operating profits of all companies except 65 are expected to increase compared to the same period last year. This accounts for 78% of the total, meaning more than 7 out of 10 companies are expected to improve their performance compared to last year.

Travel, airlines, and casinos are expected to continue posting losses in the fourth quarter, and including these, 10 companies are expected to see expanded losses or a return to losses. Additionally, 55 companies in retail sectors such as department stores and duty-free shops, which are still struggling to operate normally due to the impact of COVID-19, as well as apparel, cosmetics, and shipbuilding industries, are expected to experience negative growth compared to the same period last year.

Excluding these, all other companies are expected to see improved operating profits in the fourth quarter compared to the same quarter last year. As a result, the leading stocks in the market may change, drawing attention. Sang-ho Kim, a researcher at Shinhan Financial Investment, analyzed, "If we divide this year into the first and second halves, large growth stocks showed strength in the first half, and in the second half, a rebound in small and mid-cap value stocks was confirmed."

Overall, in an environment where profits improve, investment sentiment may focus more on immediate earnings growth rather than distant future corporate growth (growth stocks). With the KOSPI net profit consensus for next year estimated at 127 trillion won, an increase of more than 58% compared to the previous year, the significance of companies with improving earnings in the upcoming fourth quarter can be considerable.

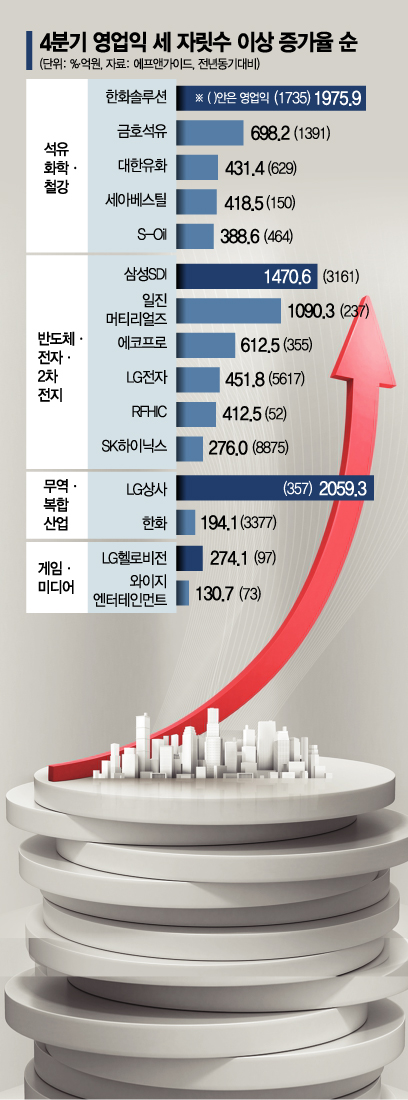

The industries expected to see the most significant improvement in performance compared to the fourth quarter of last year are mainly concentrated in steel, chemicals, electrical and electronics, and semiconductors. Additionally, industries such as trade, construction, and entertainment, which had restricted normal business activities due to COVID-19, are also expected to show significant earnings improvement.

In particular, the petrochemical industry is expected to experience a boom due to the full-scale economic recovery, tight supply and demand, significantly increased facility scale, expansion of new businesses through sound financial structures, and strengthened shareholder return policies. Jaesung Yoon, a researcher at Hana Financial Investment, said, "The supply-demand balance is tight even before the economic cycle recovery, and the combined operating profit margin of major petrochemical companies has reached the 2011 level. A boom beyond the era of cars, refining, and chemicals is expected."

Semiconductors, secondary batteries, and 5G are also expected to perform well next year. Samsung SDI's operating profit for the fourth quarter is expected to increase by 1,470.6% year-on-year to 316.1 billion won, and 5G-related stocks such as EcoPro and RFHIC are expected to increase by 612.5% and 412.5%, respectively, compared to the same period last year. In addition, LG Sangsa (2059.3%) and Hanwha (194.1%) are also expected to see a significant increase in fourth-quarter operating profits, and the entertainment industry, including YG Entertainment (130.7%), is also expected to improve performance.

Jong-jin Moon, a researcher at Kyobo Securities, said, "As we approach next year, concerns about stock selection are increasing, but well-known stocks in the market have already reflected expectations and their stock prices have risen significantly compared to the beginning of the year," adding, "It is time for contrarian investment focusing on undervalued companies with improving earnings."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)