Life Insurers, Surrender Refunds of 18.6216 Trillion KRW

Non-Life Insurers, Long-Term Cancellation Refunds of 7 Trillion KRW

Concerns Over Household Economic Deterioration Due to Prolonged COVID-19

[Asia Economy Reporter Ki Ha-young] Due to the impact of the novel coronavirus infection (COVID-19), household finances have worsened, leading to a sharp increase in people who cancel their insurance policies prematurely or take out loans using their insurance benefits as collateral. The rise in cancellations of insurance contracts, considered the last line of defense, and the increase in recession-type loans such as insurance policy loans indicate how difficult the perceived economic reality has become. The industry also reports that this year, cases of insurance cancellations to raise funds for stock investments amid the craze for 'Yeongkkeul' (borrowing to the limit) and 'Debt Investment' have increased.

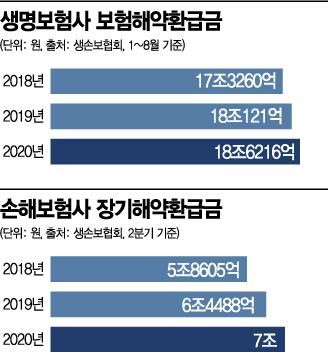

According to the Life Insurance Association on the 12th, the surrender value, which is the amount refunded to policyholders when they cancel their insurance prematurely, is increasing. From January to August this year, the surrender value paid by 24 domestic life insurance companies amounted to 18.6216 trillion KRW, an increase of 3.38% (609.4 billion KRW) compared to the previous year. The surrender value is refunded after deducting operating expenses and cancellation fees by the insurance company. Therefore, if the insurance contract is canceled before maturity, the policyholder inevitably suffers a loss.

The situation is similar in the non-life insurance industry. According to the General Insurance Association, the long-term surrender value paid by major domestic non-life insurers until June this year reached 7 trillion KRW, an increase of 8.55% (551.2 billion KRW) compared to the previous year. The long-term surrender value refers to the amount paid by insurers when policyholders cancel long-term insurance products.

Recession-type loans such as 'insurance policy loans' are also on the rise

Insurance policy loans, which allow borrowing against the surrender value, are also on an upward trend. In the third quarter, the new loan amount from major life insurers such as Samsung Life, Kyobo Life, and Hanwha Life reached 5.8569 trillion KRW, a sharp increase of 29.8% compared to the previous quarter (4.5131 trillion KRW). Insurance policy loans allow policyholders to borrow within the surrender value using the premiums they have paid as collateral. Although the interest rates range from 4% to 10%, higher than those of commercial banks, these loans are easily accessible regardless of credit or collateral, making them popular among ordinary people who need urgent funds. They tend to increase during economic downturns, hence being called 'recession-type loans.'

The sharp rise in premature insurance cancellations and loans secured by insurance is interpreted as a signal that household finances have deteriorated significantly. According to a survey conducted last year by the Korea Consumer Agency targeting 500 consumers aged 30 to 60 who had experience canceling life insurance, 44% responded that they canceled their insurance due to economic difficulties, the need for a lump sum, or difficulties in paying premiums. Those who canceled received on average only about 70% of the premiums paid.

Some analyses suggest that the number of 'retail investors' who cancel insurance policies not only for living expenses but also to invest in stocks is increasing. In the case of variable insurance, there are cases of cancellations for new investments as the principal can be recovered due to stock price increases.

An industry official said, "Insurance policy loans are used by ordinary people who find it difficult to secure a lump sum immediately or feel burdened by monthly premium payments. Although they know that canceling insurance results in losses as they do not fully recover the principal and lose coverage, prolonged economic recession forces ordinary people to inevitably choose to cancel their insurance."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.