Bank of Korea 'October 2020 Export and Import Price Index'

[Asia Economy Reporter Kim Eunbyeol] Although exports are recovering after overcoming the crisis caused by the novel coronavirus infection (COVID-19), concerns have arisen that the continued weakness of the dollar could offset the positive effects of the export recovery. Many companies receive export payments in dollars, but as the value of the dollar declines, the amount they receive when converted into Korean won may decrease.

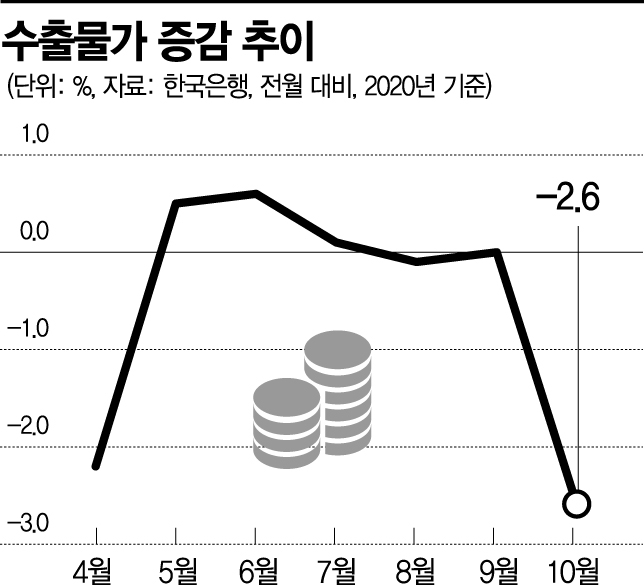

According to the Bank of Korea on the 12th, the export price index last month was 92.51 (2015=100), down 2.6% from the previous month. This marks the third consecutive month of decline and is the largest drop since December 2018 (-2.8%). Compared to the same month last year, it fell by 6.4%, marking a decline for 17 consecutive months. The export price index is an indicator that measures price fluctuations of export items to anticipate their impact on domestic prices, calculated by converting export contract prices into Korean won. When excluding exchange rate effects, the export price based on contract currency rose by 0.1% compared to the previous month.

The main reason for the decline in export prices is the drop in the won-dollar exchange rate. Although absolute export prices, such as semiconductor prices, have also fallen, prices decreased further when reflecting the exchange rate. The average won-dollar exchange rate, which was 1,178.80 won in September, dropped by 2.9% to 1,144.68 won last month.

The won-dollar exchange rate continues to show a downward trend this month as well, suggesting that the weakness in export prices will persist. Kang Hwang-gu, head of the Price Statistics Team at the Bank of Korea’s Economic Statistics Bureau, stated, "Both the average exchange rate and oil prices have continued to decline up to the 10th of this month, which will act as factors lowering export prices."

According to the Korea Customs Service, export value (provisional clearance basis) from the beginning of this month to the 10th reached 14.1 billion dollars, an increase of 20.1% compared to the same period last year. The average daily export value, adjusted for working days, also rose by 12.1%. Even though export value in dollar terms has increased, when factoring in the exchange rate, the amount earned by export companies in Korean won may be less than expected.

Small and medium-sized enterprises (SMEs) are more vulnerable to exchange rate impacts. Large corporations have overseas subsidiaries that can produce products abroad and sell them directly, and they have the capacity to hold export payments in dollars without converting them. As of September, the proportion of duty-free exports (exports from overseas production bases without passing through Korea) was about 14%. Large companies also engage more actively in hedging to avoid risks from exchange rate fluctuations. SMEs often urgently need to secure Korean won and may have to convert export payments despite incurring exchange rate losses.

However, a positive factor is that recently Korean companies’ export items are not competing solely on price competitiveness. Kang explained, "The era when overseas consumers bought Korean TVs and smartphones just because they were cheap is over." Therefore, even if the won strengthens, it is unlikely that overseas consumers will significantly reduce their purchases of Korean products. Whereas Japan was Korea’s main competitor in the past, nowadays it is Chinese companies, which is another reason why won appreciation is not necessarily disadvantageous.

The yen and won often move inversely, but the won and yuan tend to show synchronized movements. The government is carefully monitoring the sharp decline in the won-dollar exchange rate. If the exchange rate falls beyond the expected range, corporate hedging could become ineffective. On the 5th, Kim Yong-beom, the 1st Vice Minister of Strategy and Finance, said, "We will monitor domestic and international financial market trends and promptly implement market stabilization measures if volatility increases."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.