Q4 Performance Improvement and Bright Outlook for Next Year

[Asia Economy Reporter Oh Ju-yeon] Value stocks, which were left out of this year's stock market rise, are showing strength on expectations of economic recovery next year. Among them, the chemical industry is drawing attention. Although the stock price growth rate was sluggish compared to growth stocks this year, there is an analysis that stock prices could show an upward trend next year along with improved earnings in the fourth quarter.

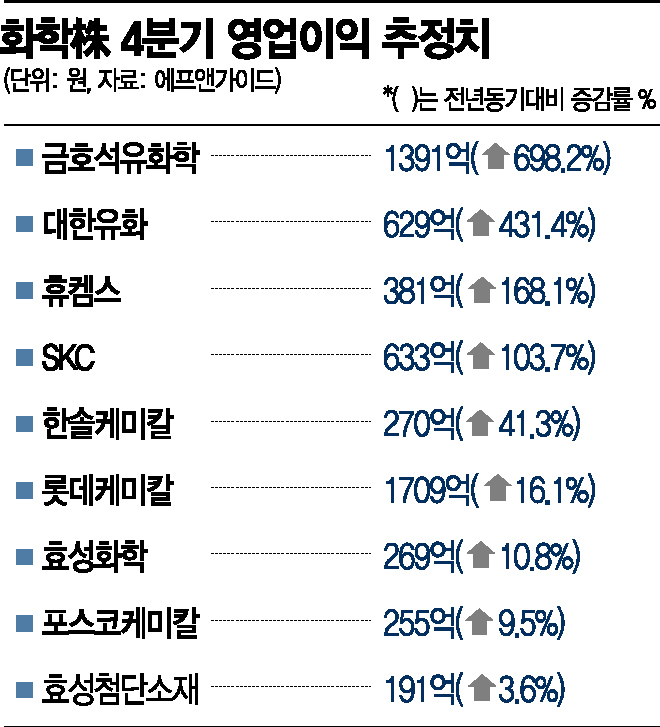

According to financial information company FnGuide on the 11th, the chemical industry is expected to see improvements in factory operating rates and demand, which had fluctuated since the outbreak of COVID-19 earlier this year, leading to a significant increase in operating profit in the fourth quarter compared to the previous year.

A representative company is Kumho Petrochemical. The average operating profit for Kumho Petrochemical in the fourth quarter of this year, estimated by three domestic securities firms, is 139.1 billion KRW, which is expected to increase by 698.2% from 17.4 billion KRW in the same period last year. However, recently, securities firms have been revising earnings estimates upward. Hana Financial Investment forecasts 245.4 billion KRW, expecting it to set a record high in 10 years. Despite regular maintenance and exchange rate declines, synthetic rubber operating profit is expected to reach 130.5 billion KRW, breaking the record set in the third quarter of this year. Yoon Jae-sung, a researcher at Hana Financial Investment, said, "Next year will be a super boom for the synthetic rubber business," and raised the target stock price from 200,000 KRW to 250,000 KRW.

Kumho Petrochemical's stock price has surged sharply over the past month. The stock price, which was around 96,000 KRW at the end of September, rose more than 63% to 156,500 KRW during trading on the 6th of this month. Although the price has recently stalled due to profit-taking following the rapid price increase and concerns about decreased demand for COVID-related products that had been sold due to news of vaccine development, expectations for next year remain valid. Researcher Yoon explained, "Some demand for related products may weaken due to COVID vaccine development, but the recovery of underlying demand related to the normalization of economic activities will more than offset this."

Daehan Petrochemical, SKC, Hansol Chemical, Lotte Chemical, Hyosung Chemical, and POSCO Chemical are also expected to see significant increases in earnings in the fourth quarter of this year. Among them, Daehan Petrochemical's operating profit in the fourth quarter is expected to increase by 431.4% year-on-year to 62.9 billion KRW, and SKC is expected to increase by 103.7% to 63.3 billion KRW. Lotte Chemical, whose stock price has risen sharply over the past three months, is also expected to see a 16.1% increase in operating profit to 170.9 billion KRW in the fourth quarter compared to the same period last year. Lotte Chemical's stock price rose more than 50% from 186,000 KRW on September 1 to 280,000 KRW during trading on the day. Hyosung Chemical (10.8%), POSCO Chemical (9.5%), and Hyosung Advanced Materials (3.6%) are also expected to see increases in operating profit in the fourth quarter compared to the same period last year.

Hwang Kyu-won, a researcher at Yuanta Securities, said, "Next year will be a time of turning adversity into opportunity," and predicted, "Due to the special demand for petrochemical products that surpasses the pressure of global large-scale facility expansions, we can expect a recovery of products that were considered 'laggards' due to poor performance."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.