Dow Jones Surges 1600P Intraday

Vaccine Optimism Boosts Interest in Cyclical Sectors

Dollar Weakness May Drive Funds to Asian Markets

Crude Oil Also Soars...Risk Asset Appetite Rises

[Asia Economy Reporters Minwoo Lee and Juseok Naju] The COVID-19 vaccine jointly developed by the American pharmaceutical company Pfizer and the German biotech company BioNTech has shown effects beyond expectations, leading to forecasts of a massive asset shift. While investment sentiment is expected to flow into economically sensitive sectors that had stalled due to COVID-19, the preference for risk assets is also anticipated to strengthen.

Following the announcement of Pfizer's COVID-19 vaccine development success, major global stock markets surged on the 9th (local time). The Dow Jones Industrial Average opened at 29,933.83, soaring more than 1,600 points from the previous close, setting a new all-time high. The S&P 500 index also hit an intraday record high.

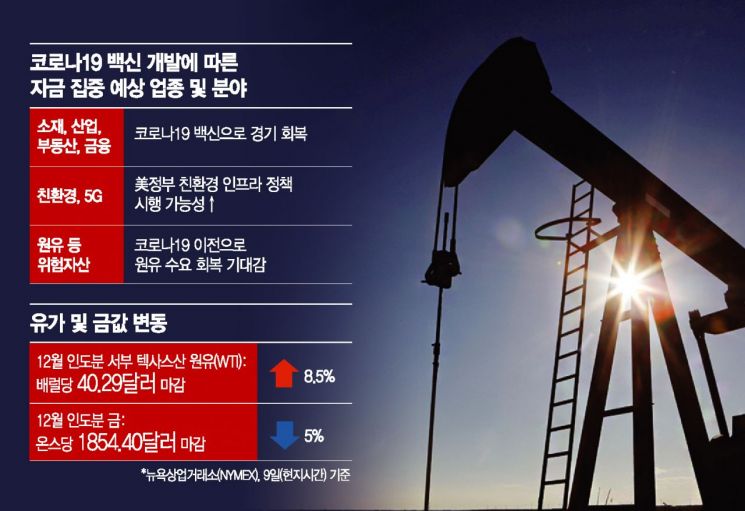

Experts predict that Pfizer's vaccine, which offers hope for a "return to normal," will cause capital to move from non-face-to-face (untact) sectors that benefited from the COVID-19 situation to economically sensitive sectors such as materials, industrials, real estate, and finance. Analysts also expect that once President-elect Joe Biden's policy to expand COVID-19 testing capacity is fully implemented, expectations for a recovery in the service industry will become more tangible. Investment sentiment is also expected to flow into eco-friendly infrastructure sectors. KB Securities researcher Ilhyuk Kim explained, "If the economic recovery trend continues, the scale of additional stimulus measures may decrease, but rather, eco-friendly infrastructure policies are likely to be implemented."

There is also analysis that funds will flow into Asian markets as the dollar continues to weaken. Professor Youngik Kim of Sogang University Graduate School of Economics said, "Next year, as the global economy generally recovers, the decline in the dollar's value is likely to attract funds to growth-oriented Asian stock markets," adding, "In particular, the U.S. stock market is somewhat overvalued, and the fact that stocks account for 47% of household financial assets is also a burden, so Asian stock markets will relatively stand out."

However, there are cautions against overly optimistic forecasts. Since the stock market has already been supported by liquidity, it is expected to take time for the actual economy to catch up with the stock market in the future. Economist Jongwoo Lee said, "The Nasdaq has risen more than 1,000 points from the 2nd until recently, but no positive news has ever driven stock prices up this much in such a short period," explaining, "This means the stock market is overvalued relative to its fundamentals, and rather than further rising, it may have peaked with the Pfizer vaccine announcement." He also viewed that it is difficult to definitively say that the dollar will weaken further. The economist pointed out, "The dollar index, which shows the value of the dollar, has fallen to around 92, indicating significant dollar weakness has already occurred," adding, "A further drop would mean a trend decline in the future, which is unlikely."

With the strengthening of risk asset preference sentiment due to Pfizer's COVID-19 vaccine, international oil prices also surged. This is interpreted as reflecting expectations that suppressed crude oil demand since the COVID-19 outbreak may increase again.

On the 9th (local time) at the New York Mercantile Exchange (NYMEX), West Texas Intermediate (WTI) crude oil for December delivery closed at $40.29 per barrel, up 8.5% ($3.15) from the previous trading day. Brent crude also traded up 7.9% ($3.11) at $42.45. Since COVID-19, crude oil demand has significantly decreased due to lockdowns and reduced travel, but expectations have grown that the current crisis could be overcome thanks to the COVID-19 vaccine.

Conversely, gold prices showed a sharp decline. December delivery gold on the New York Commodity Exchange closed at $1,854.40 per ounce, down 5% ($97.30). This is interpreted as investors reducing their allocation to safe-haven assets following the news of the COVID-19 vaccine development.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.