Recovery of Suppressed Travel Sentiment

Korean Air Hits Intraday Record High

Asiana and Jeju Air Also Surge

Hana and Modetour Up Over 10%

Three Casino Companies Rise Simultaneously

[Asia Economy Reporter Oh Ju-yeon] The stock market's sector colors have reversed 180 degrees following the vaccine good news. Since March, non-face-to-face (untact) related stocks led the stock market rise due to the impact of the novel coronavirus infection (COVID-19), but the mood sharply reversed after U.S. pharmaceutical company Pfizer announced interim results showing a COVID-19 vaccine efficacy rate of over 90%. With expectations that suppressed travel sentiment will recover, travel, airline, and casino-related stocks surged.

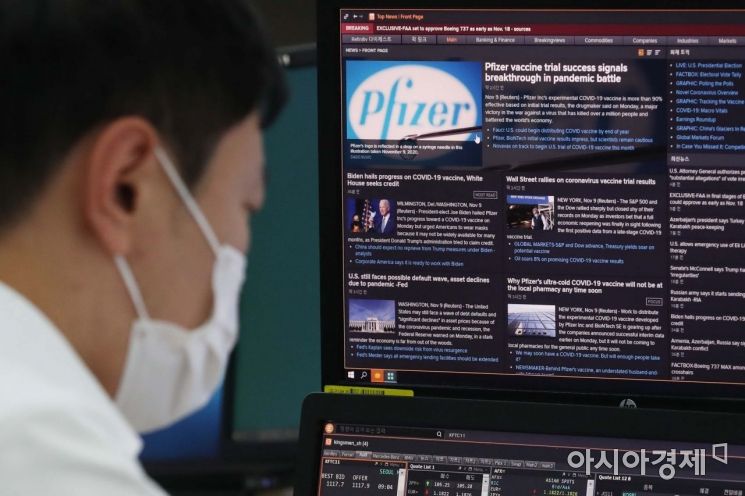

On the 10th, news related to Pfizer's COVID-19 vaccine was displayed on a dealer's monitor at the Hana Bank dealing room in Euljiro, Seoul. On the same day, the KOSPI opened at 2,453.95, up 6.75 points (0.28%) from the previous trading day. The won-dollar exchange rate opened at 1,118.5 won, up 4.6 won. Photo by Moon Honam munonam@

On the 10th, news related to Pfizer's COVID-19 vaccine was displayed on a dealer's monitor at the Hana Bank dealing room in Euljiro, Seoul. On the same day, the KOSPI opened at 2,453.95, up 6.75 points (0.28%) from the previous trading day. The won-dollar exchange rate opened at 1,118.5 won, up 4.6 won. Photo by Moon Honam munonam@

According to the Korea Exchange on the 10th, Korean Air traded at 26,950 won, up 23.62% from the previous trading day, hitting a 52-week intraday high. Korean Air's stock price plummeted to 10,703 won on March 20 as air routes were blocked due to COVID-19. Since then, the stock price hovered around the 10,000 won range, but soared on the day of Pfizer's vaccine announcement. Especially, Korean Air ranked high in portal search terms even before the market opened, confirming high investor interest. Overnight in the New York stock market, airline stocks such as Delta Air Lines, American Airlines, and United Airlines surged more than 10%, raising expectations for airline stocks to rise in the domestic market before opening.

Asiana Airlines, Jeju Air, and T'way Air stocks also soared. Asiana Airlines' stock, which had plunged on the news of a proposed free capital reduction on the 3rd, rose 15.54% intraday on the day. This means it increased by 28.27% from the closing price of 3,130 won on the 4th. Jeju Air and T'way Air also started the day up 19.63% and 24.58%, respectively, compared to the previous trading day.

The airline industry has continued quarterly losses due to limited operations this year. According to financial information provider FnGuide, among four airlines estimated by three or more securities firms for the fourth quarter of this year, three are expected to continue operating losses. Asiana Airlines' fourth-quarter operating profit is estimated at -56.8 billion won, Jeju Air and T'way Air at -57 billion won and -42.4 billion won, respectively.

The vaccine development enthusiasm also spread to travel agencies and casino companies. Hana Tour (-37.7 billion won) and Modetour (-8.6 billion won), expected to widen operating losses in the fourth quarter compared to the same period last year, saw their stock prices surge more than 10%. As of 10 a.m., Hana Tour traded at 45,000 won, up 11.52% from the previous day, and Modetour at 16,000 won, up 10.34%, recovering to pre-COVID-19 stock price levels.

The three casino companies also saw their stock prices rise simultaneously. Casino companies, which have difficulty operating normally due to social distancing, are expected to incur operating losses in the hundreds of billions of won in the fourth quarter. Kangwon Land is estimated to have an operating loss of 46.1 billion won, Paradise and GKL at 32.1 billion won and 24 billion won, respectively, all expected to turn to losses compared to the same period last year. However, investors showed interest in casino-related stocks, expecting a return to normalcy next year. All three companies' stock prices started up 9-13% compared to the previous trading day.

Although contact-related stocks, which had been suppressed until now, showed an upward trend for the first time in a while due to the vaccine news, it is diagnosed that it is necessary to be cautious in investment as it is not yet the stage to prematurely predict the end of COVID-19. Some pointed out that Pfizer's stock price soared 15% intraday but closed at around 7%. In the domestic stock market, travel, airline, and casino companies' stock prices all peaked at the opening price and then partially gave back some of the gains.

A financial investment industry official said, "I judge that an opportunity has come to adjust portfolios due to expectations for vaccine development, but caution is needed about jumping on stocks that surged late."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.