The government has rolled up its sleeves to foster small but strong companies in the materials, parts, and equipment (So-Bu-Jang) sector. Last year, when the Japanese government imposed export restrictions on core semiconductor and display materials, a state of emergency was declared for major domestic exporters including Samsung Electronics. At that time, Samsung Electronics Vice Chairman Lee Jae-yong personally visited Japan to resolve the issue. With the strengthening of protectionism and the impact of the novel coronavirus (COVID-19), changes are also occurring in the global value chain (GVC). Concerns are growing that failure to secure core materials, parts, and equipment stably could lead to being left behind in competition. Against this backdrop, Samsung Electronics invested 74 billion KRW in four domestic So-Bu-Jang companies on the 2nd, the day it held its 51st anniversary ceremony. This is analyzed as a 'declarative' investment to directly acquire stakes in strong small companies in the So-Bu-Jang sector, which had a high dependence on overseas sources, and to maintain long-term cooperative relationships. Asia Economy examines the technology and financial structure of Mikko and LOTE Vacuum, companies in which Samsung Electronics has invested, to gauge their growth potential.

[Asia Economy Reporter Park Hyung-su] LOTE Vacuum, a developer of dry vacuum pumps, held a board meeting on the 2nd and resolved to conduct a third-party allotment paid-in capital increase worth 19 billion KRW. The new shares will be entirely acquired by Samsung Electronics, a business partner. The issue price of the new shares was set at 14,980 KRW, applying a 10% discount to the reference price. The scheduled listing date for the new shares is the 30th of this month. LOTE Vacuum explained that it will aggressively invest in research and development (R&D) to strengthen product competitiveness by establishing a solid alliance with global semiconductor companies.

◆Recognition of Dry Vacuum Pump Technology= Established in 2002, LOTE Vacuum develops dry vacuum pumps necessary for semiconductor, display, solar power, and secondary battery production processes. Semiconductor manufacturing processes mostly proceed under vacuum conditions. Semiconductor equipment itself can be seen as a vacuum system, and maintaining the appropriate vacuum level according to process characteristics is essential to enhance semiconductor productivity. Semiconductor manufacturing processes are more complex and difficult than general manufacturing. Due to high pump demand, a separate 'vacuum pump market for semiconductor manufacturing' has been formed.

In semiconductor processes, dry vacuum pumps and turbo molecular pumps are mainly used among vacuum pumps. Since high vacuum pumps do not operate at atmospheric pressure, dry vacuum pumps, which provide a medium vacuum environment, serve as the primary pumps. Generally, the demand ratio for dry pumps in semiconductor manufacturing processes is 48% for thin films (CVD), 33% for etching, 14% for diffusion, and 5% for others. LOTE Vacuum mainly supplies pumps centered on the CVD manufacturing process of DRAM. It supplies 70% of the demand from major customers. Demand for vacuum pumps is also increasing in industries similar to semiconductor manufacturing processes, such as display and solar power.

Vacuum pump technology used in high-difficulty processes such as semiconductors and displays is mainly held by Sweden, Germany, and Japan. LOTE Vacuum acquired the U.S. factory of Leybold Vacuum, the world's first vacuum pump company based in Germany, in 2002. Based on the acquired technology, it succeeded in domestic production of vacuum pumps in 2003 and was selected as a Samsung Electronics partner. Since 2007, it has introduced the 'Six Sigma quality improvement system' through Samsung Electronics. By supplying dry vacuum pumps for solar cell manufacturing processes to German Oerlikon Leybold Vacuum on an original equipment manufacturer (OEM) basis, it accumulated systematic quality management know-how from Germany.

LOTE Vacuum holds numerous patents related to vacuum pumps and competes with global pump companies. Its technology has been verified in the most delicate and difficult processes in the semiconductor industry.

Last year, it built an integrated new headquarters in Osan, Gyeonggi Province, doubling its production capacity. It is collaborating on domestic production of the entire process with major semiconductor customers. Minhee Lee, a researcher at IBK Investment & Securities, said, "LOTE Vacuum has set a goal to double its market share in the entire process by the end of next year from the current level," adding, "It is expected to benefit as demands for domestic production of semiconductor equipment increase."

◆Samsung Electronics Collaborates with LOTE Vacuum on Localization= The background for Samsung Electronics' decision to invest in LOTE Vacuum appears to be related to investments in extreme ultraviolet (EUV) processes essential for producing semiconductors below 7 nanometers. Samsung Electronics is making large-scale investments in semiconductor EUV processes. The EUV lithography process, which is more complex than existing processes, requires many high-performance vacuum pumps. Edward, a British company, mainly supplies vacuum pumps to ASML, which produces EUV equipment.

As the need for localization of core So-Bu-Jang grows, LOTE Vacuum's role has become important. There is a high possibility of increased production of DRAM and V NAND centered on the EUV line. If domestic companies secure related vacuum pump technology, it will be advantageous in creating a stable value chain.

In May, LOTE Vacuum was selected for two national projects: development of vacuum pumps for semiconductor processes and ultra-high vacuum turbo molecular pumps for display semiconductor process equipment. It is conducting a research and development project worth 25.1 billion KRW. If Samsung Electronics actively supports equity investment and technology development, the localization schedule can be accelerated.

Seongjun Na, a researcher at Shinhan Financial Investment, said, "Vacuum pumps are among the easiest items to achieve localization results," and predicted, "LOTE Vacuum will increase its market share in the etching process within Samsung Electronics, where the British competitor Edward holds over 50% market share."

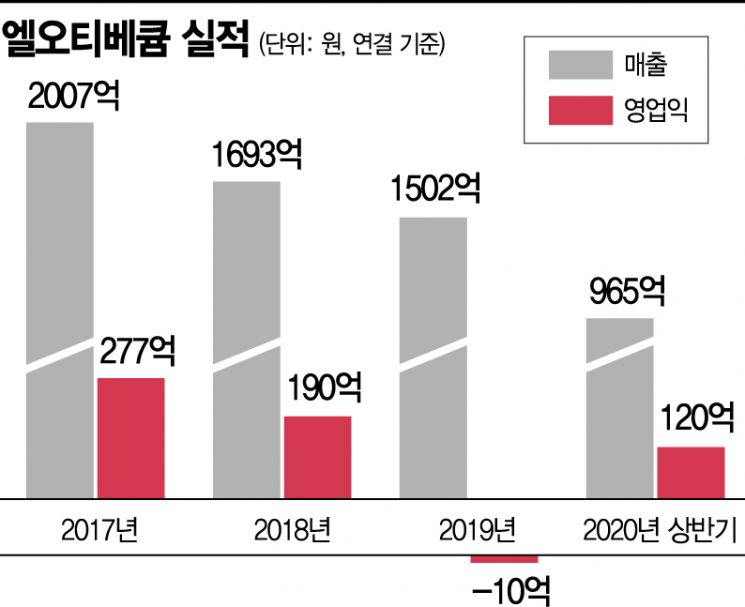

LOTE Vacuum recorded cumulative sales of 96.6 billion KRW and operating profit of 12 billion KRW in the first half of this year. Sales increased by 42.6% year-on-year, and operating profit turned positive. Although performance is expected to be sluggish in the second half due to weakening memory demand, business opportunities are expected to grow as localization attempts increase. Its financial structure is also solid. As of the end of last year, its debt ratio was 66%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.