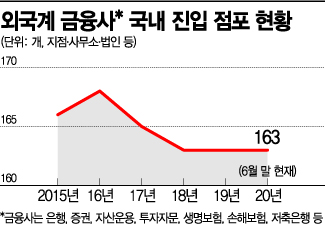

Number of Domestic Branches of Foreign Financial Companies

168 in 2016 → 163 in 2020

[Asia Economy Reporter Park Sun-mi] The entry of foreign financial firms into Korea is steadily decreasing. While international financial cities such as New York and London maintain world-class financial competitiveness through communication and synergy maximization among financial institutions, Korea's financial competitiveness is declining, with Seoul and Busan ranked 25th and 40th respectively. This indicates a diminishing appeal of the Korean financial market. There are calls for urgent measures to enhance competitiveness.

According to the Financial Supervisory Service's Financial Hub Support Center on the 9th, the number of domestic branches of foreign banks has been decreasing annually. The number of foreign bank branches and offices, which was 60 in 2016, has dropped to 54 as of the end of June this year.

The situation is similar not only for banks but also for securities, asset management, investment advisory, life and non-life insurance, and savings banks. The number of domestic branches of foreign financial companies decreased from 168 in 2016 to 165 and 163 in 2017 and 2018, respectively. Since then, it has remained stagnant at 163 as of the end of June this year.

After a concentrated withdrawal of foreign financial firms from the Korean market in 2017, new entries have been slow. In 2017, three foreign banks?Goldman Sachs from the U.S., RBS from the U.K., and BBVA from Spain?closed their Korean branches. Subsequently, Swiss bank UBS closed its branch in 2018, followed by Australia's Macquarie Bank and India Overseas Bank last year. This year, Prudential Life and AXA Non-Life Insurance have exited the Korean market.

In February, Financial Services Commission Chairman Eun Sung-soo convened representatives of foreign financial firms. At the meeting, Chairman Eun appealed, "Foreign financial firms can discover new business opportunities in the Korean financial market," emphasizing that "collaboration with fintech startups, revitalization of the asset management market through corporate-centered capital shifts, and the continuous growth of pension funds will be important opportunity factors."

Government and Financial Authorities Strive to Develop Korea as an Asian Financial Hub...

International Financial Center Index: Seoul 25th, Busan 40th

The government established the Financial Hub Promotion Committee in 2008.

Since then, it has been actively working to develop Korea as an Asian financial hub by establishing basic plans for financial hubs every three years. According to the '5th Basic Plan for the Creation and Development of Financial Hubs (2020?2022)' prepared in May this year, the key tasks include ▲focused support for financial industry comparative advantages such as fintech innovation, asset management market revitalization, and strengthening overseas investment of public funds ▲internationalization of financial infrastructure such as financial data utilization, anti-money laundering systems, foreign exchange systems, and enhancement of international compatibility of financial regulations ▲successful establishment of financial hubs, regional strategy formulation, and effective governance establishment for each financial hub.

However, the effects of these initiatives have been minimal. According to the Global Financial Centers Index (GFCI), a major indicator evaluating the competitiveness of global financial centers, as of September this year, Seoul ranks 25th and Busan 40th. This is significantly behind cities like New York (1st), London (2nd), Shanghai (3rd), Tokyo (4th), and Hong Kong (5th). Although rankings, which hit bottom in 2017 and 2018, have slightly recovered, the overall trend is declining compared to China and Japan.

Kim Hee-gon, a member of the National Assembly's Political Affairs Committee from the People Power Party, pointed out that 74.5% (468 million KRW) of the 1.154 billion KRW budget for next year's financial hub promotion project was concentrated on auxiliary projects including policy promotion and events. He also stated that the failure to properly address innovative agendas such as tax reform, easing foreign exchange transaction regulations, and labor market structural improvements for several years is making it difficult to enhance financial competitiveness.

There are also calls to establish a plan to leap forward as a financial hub highlighting the advantages of the Seoul metropolitan area. On the 6th, Song Jae-ho, a member of the Democratic Party, held a forum titled "New Challenges of the Seoul Metropolitan Area, Vision and Strategy of Asian Financial Hub Policy," emphasizing the importance of finance in the strategic aspect of national balanced development and urging the establishment and implementation of a plan for the Seoul metropolitan area to advance as a financial hub that highlights its own strengths rather than being subject to reverse discrimination.

At the forum, Kang Da-yeon, a research fellow at the Financial Economy Institute (FEI), advised, "With Seoul failing to establish itself as an international financial center, the overlapping designation of Busan as a financial hub is preventing the proper utilization of network and agglomeration effects," adding, "A multifaceted plan to promote the development of a global financial hub centered on Seoul is necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.