Average Price 4,180 Won, Similar to Starbucks Cup at 4,100 Won

Halla and Hanil Hyundai Demand 6,000~7,000 Won Increase per Ton

[Asia Economy Reporter Kim Jong-hwa] "The price of a bag of cement (40kg) is equivalent to the price of an Americano sold at a coffee shop."

This is a lament from a cement industry insider emphasizing the justification for the recent cement price increase. Is it true? On the 9th, Asia Economy confirmed with seven cement companies that although prices vary depending on the distribution stage, the average price of a bag of cement (including VAT) at the initial distribution stage was 4,180 KRW per 40kg bag. This is the price at which you can buy a tall-sized Americano (4,100 KRW) at Starbucks.

On September 15th, Halla Cement sent official letters to ready-mix concrete companies requesting a 7,000 KRW per ton increase (based on Portland cement), and on the 25th of last month, Hanil Hyundai Cement requested a 6,000 KRW per ton increase. The cement industry cited reasons for the price hike including worsening management due to the ongoing decline in the construction market, increased labor costs from minimum wage hikes and the 52-hour workweek, increased freight truck rates, carbon emission permit purchase burdens, and local resource facility taxes.

Unexpected factors such as the economic downturn caused by the spread of the novel coronavirus disease (COVID-19) and record-breaking monsoons and typhoons last summer also had an impact. As a result, domestic cement demand in the first half of this year was 22.5 million tons, an 18.5% decrease compared to 27.62 million tons in the first half of last year. The Cement Association expects domestic cement demand this year to be 45.5 million tons, which is even lower than the 45.7 million tons recorded right after the foreign exchange crisis in 1998.

Sales have already been hit. The second-quarter sales of Ssangyong Cement, Asia Cement, Hanil Cement, Hanil Hyundai Cement, and Sampyo Cement fell between 8% and 17% compared to the same period last year.

"Below appropriate value, now at the limit" vs. "Poor market conditions and start of off-season, after Q2 next year"

It is true that domestic cement prices are excessively low. According to an analysis of the 2019 audit reports of seven cement companies by the Cement Association, the average cement price is 61,550 KRW per ton (based on shipment price). This is a 9.6% decrease over five years from 68,100 KRW in 2014. The industry believes that the appropriate domestic price should be around 75,000 KRW per ton.

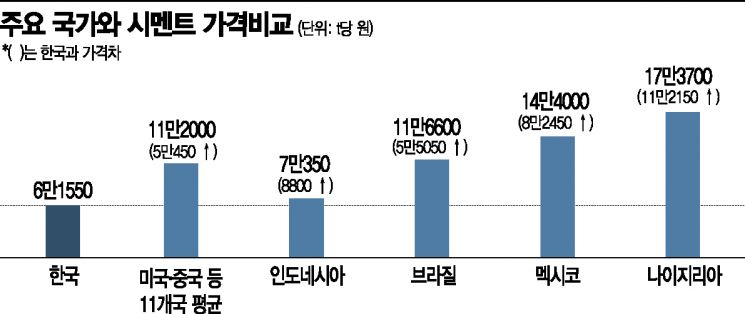

What about other countries? According to a survey by KOTRA on the average cement price per ton (2019) in 11 major countries including the United States, Japan, China, and Germany, the average cement price in these countries was about 112,000 KRW, approximately 50,000 KRW higher than domestic prices. Indonesia was 70,350 KRW, Brazil 116,600 KRW, Mexico 144,000 KRW, and Nigeria 173,700 KRW.

Although the low price makes domestic cement appear competitive in the export market, the reality is different. Competitors such as China and Bangladesh also match export volumes with dumping-level prices, and in distant regions like South America and Africa, high transportation costs often leave little profit. Due to the nature of the cement industry, stopping factory operations results in losses, so exports are pursued as a means to reduce inventory rather than for profit.

A ready-mix concrete industry official who received the price increase request said, "The market is already very poor, and the cold weather has come early, marking the start of the off-season, so asking for a price increase at this time is unreasonable." However, he added, "There are forecasts that the construction market will hit bottom and rebound after the second quarter of next year, so the situation might be different then."

Since both sides are well aware of each other's circumstances, the intention is to discuss again once the market improves. However, from the cement industry's perspective, which is under urgent pressure, it seems difficult to accept this.

A cement industry insider said, "Despite difficult conditions such as a sharp decline in domestic demand, we have endured with cement prices below the appropriate level, but now we have reached the limit," adding, "Since prices have not been raised for six years and five months since June 1, 2014, it is time to ease the pressure."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.