[Asia Economy Reporter Changhwan Lee] It was found that 98.7% of rental stores within large supermarkets are operated by small business owners, and 86.6% suffer disadvantages such as decreased sales due to operating restrictions on large supermarkets.

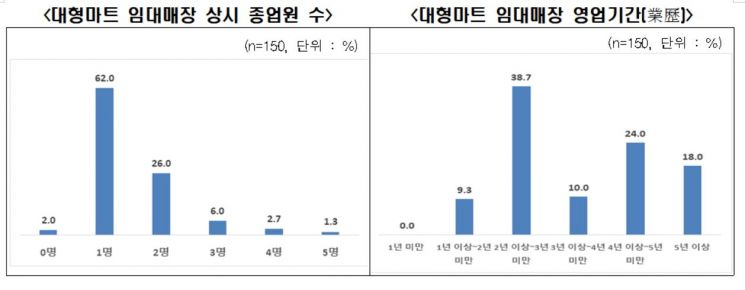

The Federation of Korean Industries announced on the 3rd that a survey conducted on rental stores within 150 large supermarkets in the Seoul and Gyeonggi areas revealed that 98.7% of these rental stores have fewer than five full-time employees.

The highest proportion was stores with one employee at 62.0%, followed by two employees at 26.0%, three employees at 6.0%, four employees at 2.7%, five employees at 1.3%, and 2.0% of stores had no employees at all.

The duration of operation for these rental stores was surveyed as follows: less than 1 year (0.0%), 1 year to less than 2 years (9.3%), 2 years to less than 3 years (38.7%), 3 years to less than 4 years (10.0%), 4 years to less than 5 years (24.0%), and 5 years or more (18.0%).

Due to operating restrictions on large supermarkets such as mandatory closure twice a month on weekends and prohibition of late-night operations (from midnight to 10 a.m.), 86.6% of rental stores responded that their sales decreased, with an average decline of 12.1%.

The most common response regarding the extent of sales decline due to these restrictions was a 10% to 20% decrease at 36.0%, followed by a 0% to 10% decrease (27.3%), and a 20% to 30% decrease (23.3%).

Regarding difficulties in operating rental stores within large supermarkets, the most cited issue was reduced customer accessibility due to restrictions on large supermarket openings at 24.0%. This was followed by unreasonable demands from surrounding stores (20.6%), operating hour restrictions (20.3%), and unfair competition with food material marts not subject to distribution regulations (16.5%).

Rental business operators in large supermarkets, already struggling with operating restrictions, are facing a double hardship this year due to the impact of COVID-19. In response to questions about sales performance in the first half of this year compared to the same period last year, all 150 rental stores (100%) reported a decrease, with an average decline of 37.3%.

The highest proportion of responses indicated a 30% to 40% decrease in sales in the first half at 28.0%, followed by a 40% to 50% decrease (26.0%), 20% to 30% decrease (17.3%), and 50% to 60% decrease (16.0%).

Looking ahead, 90.6% of rental stores expect sales in the second half of this year to decline compared to the same period last year. The average expected decrease is 24.7%, with the highest proportion (30.7%) anticipating a 10% to 20% decline. Due to the prolonged COVID-19 pandemic and ongoing economic uncertainty, sales in the second half are expected to remain negative following the first half.

Regarding measures to cope with the expected sales decline in the second half, reducing daily expenses was the most common response at 54.4%, followed by employee layoffs (32.2%), wage reductions (7.8%), and temporary closures (5.1%).

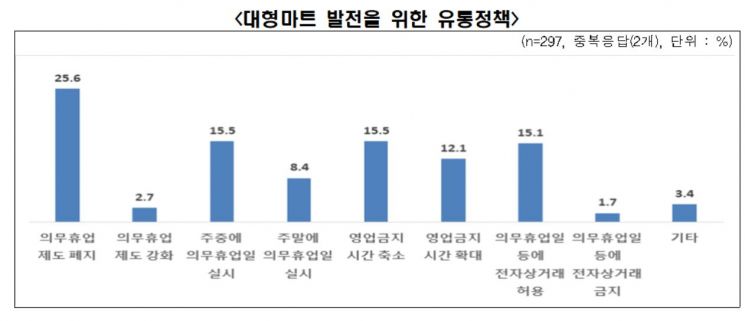

Yoo Hwan-ik, Director of Corporate Policy at the Federation of Korean Industries, stated, "Rental stores within large supermarkets, mostly operated by small business owners, should not be disadvantaged compared to small business owners in surrounding stores simply because they are located inside large supermarkets. The system needs to be revised accordingly." He added, "For the development of the distribution industry, considering the rapidly increasing online sales and the changing retail market environment, measures should be taken to minimize operating restrictions on offline stores such as large supermarkets by abolishing mandatory closure days and allowing e-commerce on those days."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.