Steel Stocks, Automobiles, Travel, and Airline Stocks, etc.

[Asia Economy Reporter Oh Ju-yeon] As expectations for economic recovery next year grow, cyclical stocks that had been sidelined in the stock market have shown strength over the past month. However, the resurgence of COVID-19 in the US and Europe and the expansion of economic lockdown discussions have hindered the upward momentum of stock prices.

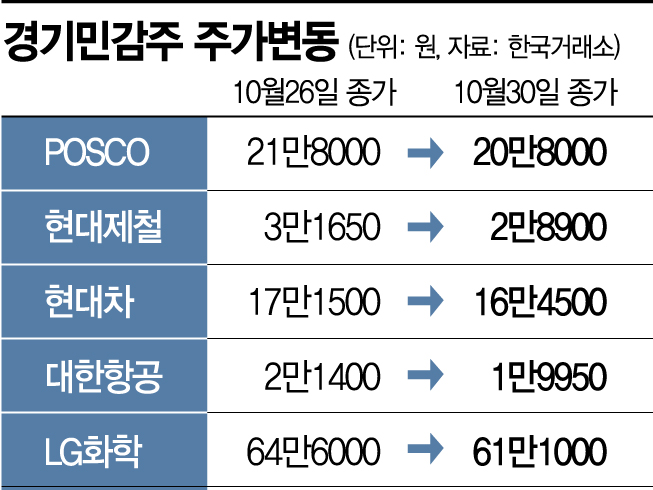

According to the Korea Exchange on the 2nd, steel stocks, representative cyclical stocks, saw their upward trend sharply break in the last week of last month. POSCO's stock price, which was 205,000 KRW on the 5th of last month, rose by 10% to an intraday high of 225,500 KRW on the 26th, but due to increased volatility caused by uncertainties around the US presidential election and the resurgence of COVID-19, it gave back much of the gains and closed at 208,000 KRW on the 30th. This amounts to only a 1.46% increase compared to the beginning of the month.

Hyundai Steel, which showed strong stock performance throughout October due to increased demand from next year's economic recovery and expectations for hydrogen electric vehicles from Hyundai Motor Group, also saw its upward trend break at the end of the month, causing the stock price to retreat. Hyundai Steel's stock rose 21.97% from 26,850 KRW on the 5th of last month to an intraday high of 32,750 KRW on the 23rd, but closed at 28,900 KRW on the 30th, down 11.76% from the peak. The increase compared to the beginning of the month was 7.64%.

Hyundai Motor Company, buoyed by expectations for demand growth due to the Green New Deal and economic recovery, saw its stock price surge from 127,000 KRW in early August to 191,500 KRW in September, but the momentum weakened and turned bearish. The stock price, which was 187,000 KRW at the beginning of last month, fell to 164,500 KRW on the 30th.

Travel and airline stocks also fell again. Korean Air's stock price rose to 21,400 KRW on the 26th of last month, seemingly returning to the 20,000 KRW range for the first time since June, but dropped to 19,950 KRW by the end of the month. Hana Tour and Modetour also peaked in mid-October and then declined.

Given the heightened external uncertainties due to the resurgence of COVID-19 and the US presidential election, domestic stock markets are likely to show volatility for the time being, making investment in cyclical stocks potentially burdensome. Lee Kyung-min, a researcher at Daishin Securities, said, "The market will continue to fluctuate depending on the US presidential election and economic indicator results for the time being. From a long-term perspective, this correction could be an opportunity to increase weightings, but for now, it is advisable to refrain from aggressive buying strategies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.