Stock Price Adjustment Period Due to Early Reflection of Q3 Earnings

Analysts Say "It Should Be Seen as a Buying Opportunity"

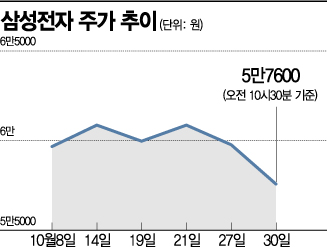

[Asia Economy Reporter Kum Boryeong] Samsung Electronics' stock price has fallen back to the 50,000 won range, drawing attention to when it might have the potential to rebound.

According to the Korea Exchange on the 30th, Samsung Electronics' closing price on the previous day was 58,100 won. It has continued a downward trend for three consecutive trading days since the 27th, dropping to the 58,000 won range. As of 10:30 AM on the same day, it recorded 57,600 won, down 0.86% (500 won) compared to the previous session. Samsung Electronics' closing price had been in the 60,000 won range every day except one from the 12th to the 26th.

Although it recorded an earnings surprise in the third quarter, the stock price is undergoing a correction as the results were already anticipated and priced in. Samsung Electronics' operating profit for the third quarter was 12.35 trillion won, and sales were 66.96 trillion won. Compared to the previous year, operating profit increased by 58.83%, and sales increased by 8%.

Researcher Lee Soonhak of Hanwha Investment & Securities explained, "Samsung Electronics announced strong third-quarter results, but investors' attention is already focused on the fourth quarter and next year," adding, "Operating profit is expected to decline somewhat in the fourth quarter due to inventory adjustments." KB Securities estimated Samsung Electronics' fourth-quarter performance, expecting a decline in all business units except for the display division due to seasonal factors, projecting operating profit of 10 trillion won and sales of 63.9 trillion won.

Investors had been waiting for an enhancement in shareholder returns centered on dividends, but the postponement of the shareholder return policy announcement to next year during the conference call held the previous day also contributed to the stock price decline. Samsung Electronics Vice Chairman Seo Byunghoon stated, "We plan to share the exact size of the remaining funds and begin execution at the end of January next year after closing this year's performance." Samsung Electronics announced a three-year shareholder return policy in 2017, committing to return 50% of free cash flow (FCF) to shareholders. Researcher Kim Sunwoo of Meritz Securities analyzed, "Although the decision to delay the disclosure of shareholder returns is somewhat disappointing, its essence remains valid."

In the securities industry, some opinions suggest that the stock price correction period should rather be seen as a buying opportunity. Researcher Lee emphasized, "Samsung Electronics is the safest investment amid uncertain conditions," and recommended "active buying during the stock price correction." Researcher Song Myungseop of Hi Investment & Securities also said, "The slowdown in fourth-quarter performance will provide a good opportunity to buy Samsung Electronics stock at a low point ahead of next year's performance improvement."

Target stock prices for Samsung Electronics by securities firms were highly optimistic, with Hana Financial Investment at 86,000 won, Shinhan Financial Investment at 82,000 won, KB Securities at 80,000 won, Meritz Securities at 76,000 won, and Hanwha Investment & Securities at 76,000 won. Individual investors also appear to be betting on Samsung Electronics' rise. While the stock price continuously declined from the 27th to the previous day, individual investors net purchased Samsung Electronics shares worth 783.3 billion won.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.