Credit Rating Postponed, Adjustment Becomes Visible After Q3 Earnings Announcement

'Directly Hit' Sectors Like Hotels and Airlines Targeted for Adjustment

[Asia Economy reporters Kangwook Cho and Jehun Yoo] Paradise, a casino operator, conducted a demand forecast (pre-subscription) targeting institutions on the 14th to issue 100 billion KRW worth of corporate bonds with a three-year maturity, but not a single purchase order was received. Of the unsold bonds, 70 billion KRW will be underwritten by the government’s Special Purpose Vehicle (SPV) for corporate liquidity support, and the remaining 30 billion KRW will be divided between the lead underwriters Mirae Asset Daewoo and SK Securities. Earlier this month, credit rating agencies downgraded Paradise’s credit rating one after another.

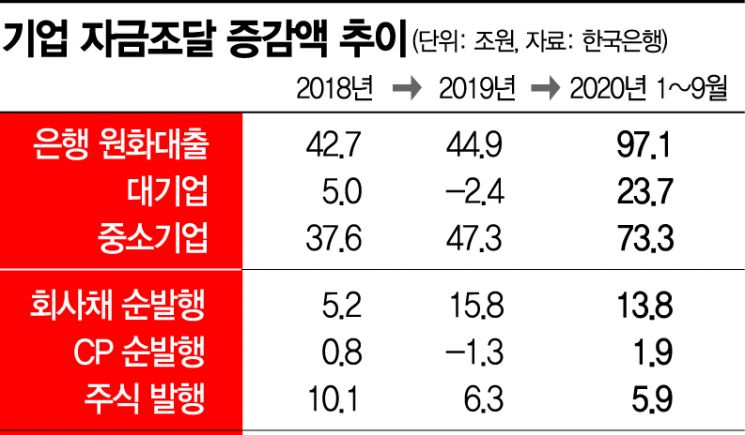

Recently, starting with Paradise, there are forecasts that the credit ratings of companies hit hard by the COVID-19 pandemic will be massively downgraded after the third-quarter earnings announcements. Companies in service sectors such as hotels, retail, and film, as well as industries severely affected by COVID-19 such as airlines, refining, and steel, are being mentioned as targets for rating downgrades. Many of these companies had their credit rating adjustments deferred during the first half of this year due to the impact of COVID-19. If credit rating agencies actually lower the credit ratings of individual companies, there are concerns that risk will inevitably transfer to the financial market, which is already burdened with soundness issues due to COVID-19 financial support.

According to the financial sector on the 30th, the three domestic credit rating agencies are preparing to conduct rating adjustments for industries under watch based on the regular evaluation of corporate commercial paper (CP) in the second half of the year and third-quarter corporate earnings. Currently, the number of companies receiving a 'negative' outlook, meaning there is a risk of a credit rating downgrade, is 57 according to Korea Ratings. NICE Investors Service assigned a negative outlook to 55 companies, and Korea Credit Rating gave a negative outlook to 51 companies. Most of these companies, including AA-rated S-Oil, Lotte Shopping, Hotel Lotte, and SK Incheon Petrochem, as well as Lotte Cultureworks, Hanwha Hotels & Resorts, Korean Air, and Polaris Shipping, have been severely hit by COVID-19.

Industries such as hotels, retail, and film, which have been significantly negatively impacted by COVID-19 like Paradise, are highly likely to see mass credit rating downgrades in this regular evaluation. The credit ratings of auto parts manufacturers, which are directly affected by upstream industries, are also key monitoring targets. Additionally, companies in industries such as airlines, refining, and steel are under strong downward pressure on their credit ratings.

In fact, in the airline industry, the 'cash cow' international flight operation rate has plummeted by more than 90%. Korean Air’s operating profit on a consolidated basis for the first half of this year (27.3 billion KRW) decreased by 83% compared to the previous year. Asiana Airlines’ operating loss more than doubled to 268.5 billion KRW. The situation is even more severe for low-cost carriers (LCCs) with no escape routes such as cargo business. Jeju Air’s operating profit for the first half deteriorated sharply from a surplus of 111.1 billion KRW to a deficit of 90.7 billion KRW.

Especially, Asiana Airlines, whose sale fell through, was recently placed under rating watch from 'uncertainty review' to 'downgrade review.' Asiana Airlines’ current credit rating is BBB-, and if it is downgraded by just one notch, early redemption triggers on asset-backed securities (ABS) could be activated. Korean Air maintains a BBB+ rating, but credit rating agencies such as Korea Credit Rating have assigned a 'negative' outlook.

Experts are concerned that the crisis may intensify next year when the effects of various self-help plans and policy funds bottom out.

Professor Moonkil Yoon of Korea Aerospace University said, "Even in the most optimistic scenario, it is difficult to expect a recovery in air travel demand until the end of next year or early the year after. Airlines will have to endure losses for four to five quarters, and it is questionable how many airlines will be able to withstand this."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.