Battery Spin-off Approved at General Meeting

Physical Division as a 100% Subsidiary

Various Funding Methods Possible

"Listing Timing Not Yet Decided"

[Asia Economy Reporters So-yeon Park, Yoon-joo Hwang] With the battery business spin-off plan passing as originally proposed, LG Chem's strategy to solidify its global No.1 competitiveness through expanded investment has gained momentum. LG Chem is expected to raise large-scale investment funds through an initial public offering (IPO) and other means.

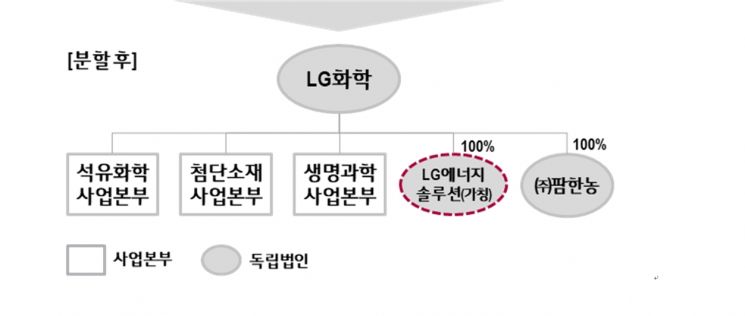

According to industry sources on the 30th, LG Chem will officially launch a newly established company dedicated to the battery business, tentatively named 'LG Energy Solution,' on December 1. The scheduled date for the spin-off registration is set for December 3. The spun-off company will be a 100% subsidiary of LG Chem, established with a capital of 100 billion KRW. The battery subsidiary to be physically divided recorded sales of approximately 6.7 trillion KRW last year.

With the spin-off plan passing the general meeting, LG Chem has somewhat eased the financial burden that had become heavy due to annual facility investments exceeding 3 trillion KRW. As the global battery business rapidly grows, the formula "investment = performance" has been established, and LG Chem had been carrying a significant financial burden.

As the scale of facility investments to expand production capacity in the battery division rapidly increased, net borrowings rose to 8 trillion KRW, and the debt ratio exceeded 100%. It is evaluated that concerns about growth constraints due to insufficient investment funds will decrease through the battery subsidiary spin-off and IPO.

Through this spin-off, LG Chem is expected to raise large-scale investment funds via IPO and other methods in the future. However, regarding the timing of the listing, the company refrained from specifics, stating, "It has not been concretely decided yet, and we will continue to review it going forward." LG Chem's position is that since the new company will be a 100% subsidiary through a physical division, various methods of fundraising are possible.

The newly established battery company of LG Chem plans to respond quickly and flexibly to rapidly changing market conditions, establish an efficient operating system optimized for the industry's characteristics, and further strengthen structural competitiveness. An LG Chem official said, "By alleviating financial burdens, we plan to strengthen our strategy to lead the market with competitive high-performance product development based on material technologies such as high-capacity cathodes, high-efficiency silicon-based anodes, and high-safety separators, as well as leading process technologies."

LG Chem intends to develop the new company into a differentiated competitive enterprise not only in battery materials, cell, and pack manufacturing and sales but also in battery solutions that provide various services across the battery lifetime, including battery care, leasing, charging, and reuse. Alongside this, LG Chem plans to focus timely investments in petrochemicals, advanced materials, and bio sectors to establish itself as a "Global Top 5 Chemical Company" with a balanced business portfolio alongside the battery business.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.