Asset Soundness Also Good Contrary to Concerns

[Asia Economy Reporters Sunmi Park and Hyojin Kim] The five major financial holding companies?KB Financial Group, Shinhan Financial Group, Hana Financial Group, Woori Financial Group, and NH Nonghyup Financial Group?posted 'surprise results' in the third quarter of this year despite the impact of the novel coronavirus disease (COVID-19). The remarkable performance of non-bank affiliates was particularly notable.

KB Financial Group and Shinhan Financial Group continued their neck-and-neck competition for the 'leading financial group' position in the third quarter, while NH Nonghyup Financial Group surpassed Woori Financial Group, accelerating cracks in the 'Big 5 system.' As the ranking battle among financial holding companies intensifies, it is expected that the rankings for this year will change again depending on the fourth quarter results.

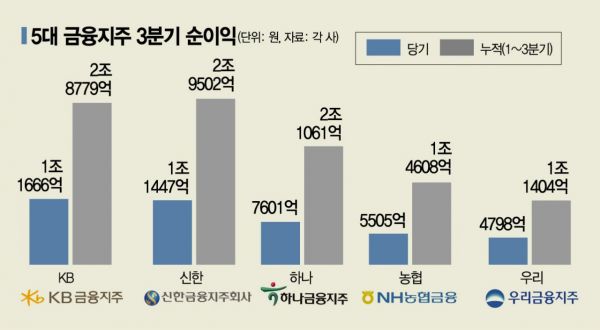

◆KB and Shinhan Surpass 1 Trillion Won... All Five Major Holding Companies Perform Well = According to the financial sector on the 30th, KB Financial Group and Shinhan Financial Group recorded net profits of 1.1666 trillion won and 1.1447 trillion won respectively in the third quarter, ushering in an era of quarterly net profits exceeding 1 trillion won. KB Financial Group's third-quarter net profit increased by 24.1% compared to the same period last year, while Shinhan Financial Group's rose by 16.6%. Compared to the previous quarter, they increased by 18.8% and 31.1%, respectively. Hana Financial Group achieved a net profit of 760.1 billion won in the third quarter. Although it declined by 9.15% compared to the same period last year, it rose by 10.3% compared to the previous quarter. Woori Financial Group also recorded a net profit of 479.8 billion won, down 1.13% year-on-year, but more than doubled with a 238% increase compared to the previous quarter. NH Nonghyup Financial Group posted a net profit of 550.5 billion won in the third quarter, up 38.8% year-on-year but down 3.7% from the previous quarter.

On a cumulative basis, KB Financial Group recorded 2.8779 trillion won, up 3.6% year-on-year, and Shinhan Financial Group recorded 2.9502 trillion won, up 1.9%. Hana Financial Group's cumulative net profit was 2.1061 trillion won, up 3.2% year-on-year, and NH Nonghyup Financial Group increased by 4.8% to 1.4608 trillion won. Woori Financial Group was relatively sluggish with 1.1404 trillion won, down 31.6%.

Analysts attribute these results largely to the strong performance of non-bank affiliates. Among KB Financial Group's affiliates, KB Securities' performance stands out. KB Securities' third-quarter net profit was 209.7 billion won, up 39.6% from the previous quarter. The cumulative net profit for the third quarter also increased by 50.6% year-on-year to 338.5 billion won. For Shinhan Financial Group, Shinhan Investment Corp. achieved a net profit of 127.5 billion won, soaring 1121.3% compared to the previous quarter. Hana Financial Investment posted a cumulative net profit of 288 billion won, up 36.2% year-on-year.

NH Investment & Securities recorded a cumulative net profit of 501.4 billion won, up 39.6% year-on-year. Its third-quarter net profit was 239.7 billion won, the highest quarterly figure ever. A financial sector official interpreted this as "a clear demonstration of the importance of diversifying and broadening business portfolios." The surge in 'all-in' and 'debt investment' trends and increased loan demand related to COVID-19 also had some impact.

◆Asset Quality Better Than Expected Despite Concerns = Asset quality was also evaluated as better than initially feared by the market. The non-performing loan (NPL) ratio improved across all five major financial holding companies. The NPL ratio is a soundness indicator showing the status of bad loans; the lower the ratio, the healthier the bank's loan portfolio. As of the end of September, KB Financial Group and Shinhan Financial Group had NPL ratios of 0.46% and 0.54%, respectively, both improving by 0.02 percentage points compared to the end of June. Hana Financial Group and Nonghyup Financial Group also improved by 0.04 percentage points to 0.41% and 0.45%, respectively, compared to the previous quarter. Woori Financial Group's NPL ratio also decreased by 0.03 percentage points from 0.43% at the end of the second quarter to 0.40%.

Financial holding companies are on high alert regarding when and to what extent the cumulative COVID-19 financial support will become a burden, as it could act as a trigger for asset quality deterioration. There are particular concerns that a significant portion of loan extensions related to COVID-19, which are set to expire by March next year, could lead to delinquencies immediately after the measures end. According to financial authorities and the financial sector, as of the 23rd of this month, the scale of loan maturity extensions by commercial banks was about 238,000 cases amounting to 68 trillion won. Loans related to COVID-19 by commercial banks totaled 725,000 cases and 43.2 trillion won.

Meanwhile, based on the third-quarter results, the competition for rankings between the first and second, as well as the fourth and fifth financial holding companies, has intensified. Based on cumulative net profits, Shinhan Financial Group leads, followed by KB Financial Group, Hana Financial Group, NH Nonghyup Financial Group, and Woori Financial Group. The net profit gap between first and second place is only 72.3 billion won. Shinhan Financial Group led in the first quarter, but KB Financial Group posted higher profits in the second and third quarters, so the 'leading financial group' title for this year will be decided by fourth-quarter performance. Both KB Financial Group and Shinhan Financial Group are posting record-breaking quarterly results, so the competition for first place in the fourth quarter is expected to be even fiercer.

Woori Financial Group and NH Nonghyup Financial Group are competing for fourth place. Until last year, the 'Big 5 financial holding companies' system was firmly maintained outside of the 'Big 4 financial holding companies' system consisting of KB Financial Group, Shinhan Financial Group, Hana Financial Group, and Woori Financial Group. However, in the first half of this year, NH Nonghyup Financial Group entered the 'Big 4' by achieving a net profit of 910.2 billion won, surpassing Woori Financial Group's 660.5 billion won, and in the third quarter, widened the net profit gap with Woori Financial Group to 320 billion won.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.