Non-face-to-face? Non-contact PF Asset Promotion? Responding to Digital Innovation and Preventing COVID-19 through Sales

[Asia Economy Reporter Park Sun-mi] The Korea Deposit Insurance Corporation (KDIC) is currently selling project financing (PF) assets held as loan collateral from 30 bankrupt savings banks. On the 30th, it announced that it achieved sales of 156 billion KRW from 22 PF assets, including an apartment project in Seo-gu, Incheon, from January to September this year.

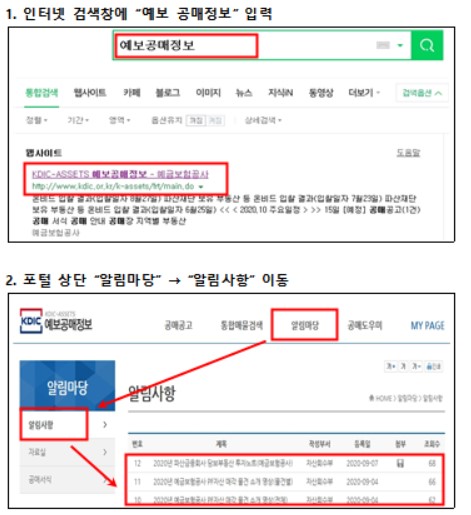

In particular, KDIC is focusing on promoting and selling through non-face-to-face and contactless methods using new technologies to respond to the government's digital innovation, one of the Korean New Deal projects, and to prevent COVID-19.

First, to enhance the convenience of buyers who require on-site inspections and to deliver vivid information such as aerial views, KDIC produces promotional videos for each PF project site using new technologies like drones and provides them through KDIC's public auction information and KDIC's YouTube channel. Additionally, detailed investment notes containing information on transportation conditions, location, and precautions when purchasing for each PF project site are produced in PDF and booklet formats, posted on KDIC's website, and provided to institutional and individual investors via email and mail as part of a 'visiting untact service.'

Public competitive bidding for the sale of PF assets is actively utilizing the Korea Asset Management Corporation's online auction system (Onbid), conducting the entire process from bid announcement to winner determination in a non-face-to-face and contactless manner without direct contact.

A KDIC official stated, "We will continue to do our best to promptly normalize PF project sites that have been suspended for a long time through various sales and recovery efforts that actively respond to changing market conditions. At the same time, we aim to compensate depositors of bankrupt savings banks with the recovered funds and secure the soundness of the deposit insurance fund."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)