Socially Responsible Investment Fund and Green Growth Fund Increase by 150 Billion KRW and 90 Billion KRW in 3 Months

[Asia Economy Reporter Eunmo Koo] Since the outbreak of the novel coronavirus disease (COVID-19), there has been a growing consensus on the importance of a sustainable economic system, leading to increased interest in ESG (Environment, Social Responsibility, Governance) investment, which considers environmental, social responsibility, and governance factors. Recently, ESG funds have not only served as an ethical justification for investment but have also translated into tangible returns, resulting in an expansion of capital inflows.

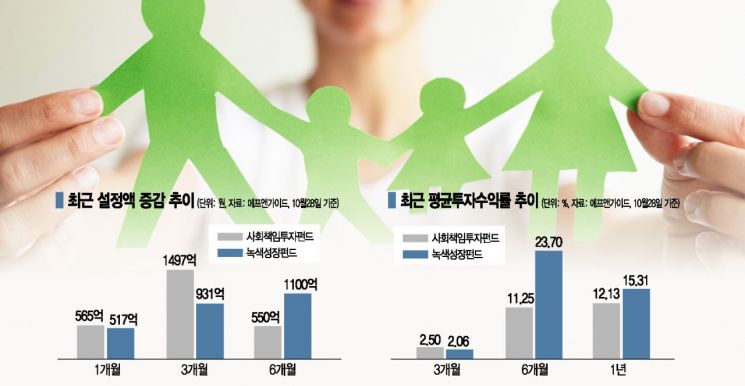

According to FnGuide, a fund rating agency, as of the 28th, the total assets under management of 45 domestic Socially Responsible Investment (SRI) funds with over 1 billion KRW in assets reached 881.6 billion KRW, increasing by 56.5 billion KRW in the past month and 149.7 billion KRW over the past three months. The total assets of 21 green growth funds, which primarily invest in renewable energy, also rose to 284.7 billion KRW, increasing by 51.7 billion KRW and 93.1 billion KRW during the same periods, respectively. This contrasts with the outflow of 2.8308 trillion KRW and 33.6 billion KRW from domestic and overseas equity funds, respectively, over the past three months.

The economic crisis triggered by COVID-19 has served as an opportunity to recognize the importance of securing sustainable growth engines, thereby increasing interest in related investments. Hujeong Kim, a researcher at Yuanta Securities, explained, "The assets under management of domestic socially responsible funds had been declining until 2017, but as institutional investors' interest in socially responsible investment grew, the assets under management began to increase. This year, with a brighter outlook for SRI funds, fund setups are increasing, and capital inflows into funds are rapidly rising."

ESG funds select investment companies by considering non-financial factors such as environmental, social responsibility, and governance aspects. They were created based on the perspective that investing in companies considering ESG factors also benefits operational performance. ESG funds tend to have a relatively high proportion of renewable energy investments and a relatively low proportion of investments in companies with high carbon emissions. As this trend of expanding investments in such companies is expected to continue, investors are also increasing their investments in SRI funds. In Korea, ESG funds are often used interchangeably with SRI funds; however, ESG funds specify and clarify the methods and scope of SRI more concretely.

The recent increase in interest in ESG funds is not solely due to the justification of improving environmental or social values. They are also delivering actual investment returns. The average six-month return of 45 domestic SRI funds recorded 11.25% as of the 28th, while the average return of 21 green growth funds reached 23.70% during the same period.

Looking at individual funds, among SRI funds, KTB Asset Management's KTB ESG Top Stock Fund recorded the highest return at 31.05%, followed by Hanwha Korea Legend Responsible Investment Fund (30.93%), VI Socially Responsible Investment Fund (30.29%), and Midas Responsible Investment Fund (29.26%). Among green growth funds during this period, Alpha Global Renewable Energy Fund (77.97%), Multi-Asset Global Clean Energy Fund (75.72%), and Kiwoom Future Energy Fund (64.33%) ranked at the top in returns.

In the past, the value of a sustainable economy was emphasized mainly from the ethical responsibility perspective of institutional investors. However, since COVID-19, with the rise of renewable energy and other factors, it has translated into tangible returns, suggesting that domestic ESG investment is expected to continue expanding steadily in the future.

Bongju Kang, a researcher at Meritz Securities, forecasted, "Starting next year, pension funds, led by the National Pension Service, plan to develop benchmark indices for ESG investment and actively expand entrusted investments. Large listed companies will strengthen disclosure activities necessary for ESG evaluation, domestic asset managers will expand the launch of ESG funds, and securities firms will participate in forming the ESG investment ecosystem by expanding related research."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.