"Executive Disciplinary Action" VS "Broad Interpretation of the Law"... No Conclusion, Re-discussion on the 5th of Next Month

[Asia Economy Reporter Park Jihwan] The Financial Supervisory Service (FSS) held the first disciplinary committee meeting targeting three securities firms involved in the sale of Lime Asset Management's private equity funds but postponed the conclusion. The main issue in this disciplinary hearing was whether the securities firms' CEOs could be held accountable and disciplined for internal control failures.

According to industry sources on the 30th, the FSS's disciplinary committee deliberated on the sanctions related to the Lime incident until 10 p.m. the previous day but failed to reach a conclusion. The hearing was conducted in a grand hearing format, where both the FSS investigation department and the subjects of the sanctions appeared together to present their opinions. Initially, the committee planned to proceed with Shinhan Financial Investment, followed by Daishin Securities and KB Securities. However, the explanations from the selling securities firms took longer than expected, causing significant delays. The disciplinary hearing, which started at 2 p.m., first reviewed the measures against Shinhan Financial Investment, but even after a marathon meeting lasting over six hours, no final decision was made. The discussion on Daishin Securities sanctions, which began at 9 p.m., also ended without a conclusion. Due to time constraints, the review of KB Securities was postponed.

The core issue of this disciplinary hearing was the "failure of internal control." Previously, the FSS had pre-notified five current and former CEOs?including former Shinhan Financial Investment representatives Kim Hyung-jin and Kim Byung-chul, former Daishin Securities representative Na Jae-cheol (current chairman of the Korea Financial Investment Association), former KB Securities representative Yoon Kyung-eun, and current KB Securities representative Park Jung-rim?of severe disciplinary actions considering "suspension of duties." Suspension of duties is the second-highest level of sanction after dismissal recommendation.

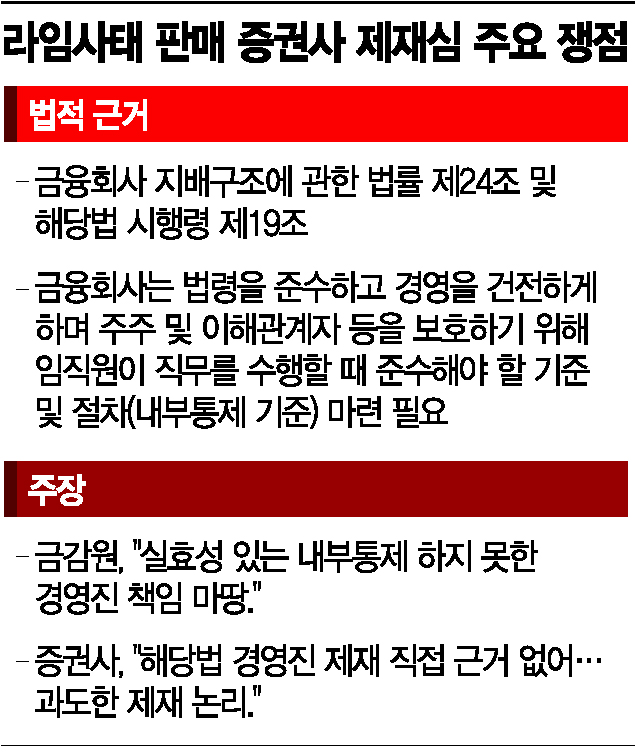

The FSS cited Article 24 of the Financial Companies Governance Act (Internal Control Standards) and Article 19 of its Enforcement Decree, which addresses "inadequate establishment of internal control standards," as grounds for severe sanctions against CEOs. The law stipulates that financial companies must establish standards and procedures (internal control standards) that employees must follow when performing their duties to comply with laws, maintain sound management, and protect shareholders and stakeholders. Based on the Enforcement Decree, the FSS argues that management can be held responsible for failing to implement effective internal controls.

However, the selling securities firms strongly opposed this, calling it an "excessive sanction rationale" and accusing the authorities of overinterpreting the law. They argue that the regulation only mandates the establishment of internal control standards and does not provide legal grounds to discipline CEOs when financial accidents occur. In particular, they contend that even if strong internal control standards exist, the CEO is not obligated to supervise employees to ensure perfect compliance, so holding the CEO excessively responsible is unjustified. If the severe sanctions pre-notified by the FSS are confirmed, the CEOs in question will face employment restrictions in the financial sector for up to five years, effectively amounting to expulsion.

Amid the dispute between both sides, the disciplinary committee plans to continue discussions on the 5th of next month. An FSS official stated, "Since there is a significant difference in positions on the agenda, the disciplinary committee may be held several more times," adding, "We expect this to be a long-term issue rather than one resolved quickly." Previously, during the sanctions on Woori and Hana Banks related to derivative-linked funds (DLF), the sanction levels were decided after three meetings.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.