3Q Performance 'Solid' Even Excluding Line

3Q Sales Up 24% YoY to 1.36 Trillion Won...Operating Profit Also 290 Billion Won

Including Line, Quarterly Sales Surpass 2 Trillion Won for First Time

Foreign Buying Reverses Trend...Net Purchases Exceed 270 Billion Won This Month

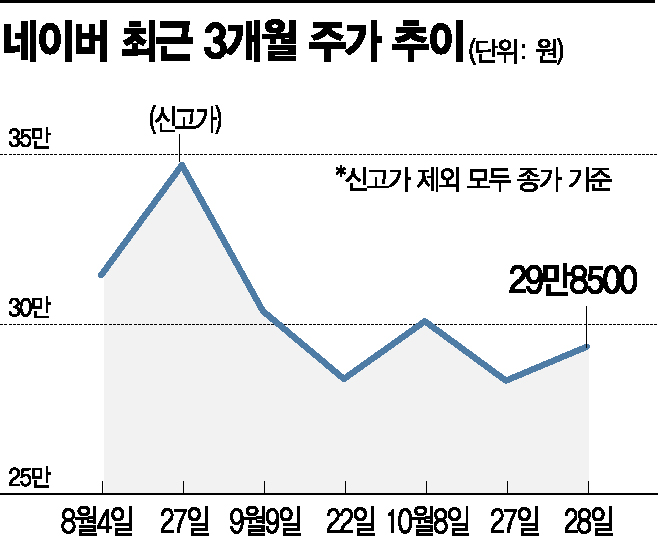

[Asia Economy Reporter Minwoo Lee] Attention is focused on whether NAVER's stock price, which had been stagnant, will continue its upward trend following a sharp rebound.

According to the Korea Exchange on the 29th, NAVER closed at 298,500 KRW, up 5.29% from the previous session. This is the largest increase since June 22. After hitting a record high of 347,000 KRW on August 27, the stock price had been steadily declining but has now started to rebound. As of 9:03 AM on the same day, it recorded 301,000 KRW, up 0.8% from the previous day. This is interpreted as reflecting expectations for future growth along with strong third-quarter earnings and collaboration with the CJ Group.

On the same day, NAVER announced consolidated third-quarter results for this year, reporting sales of 1.3608 trillion KRW, operating profit of 291.7 billion KRW, and net profit of 235.3 billion KRW. Sales increased by 24.2% compared to the same period last year, setting a new record. Operating profit also rose by 1.8% during the same period. NAVER excluded the consolidated results of its Japanese subsidiary Line from this quarter after the management integration of Line and Yahoo passed antitrust review. Including Line, third-quarter sales amount to 2.0598 trillion KRW. This is the first time quarterly sales have surpassed 2 trillion KRW. Operating profit also increased by about 60 billion KRW compared to 230.6 billion KRW in the previous quarter, which included Line. This is evaluated as a result of steadily expanding new growth businesses centered on NAVER's domestic headquarters.

The collaboration with the CJ Group is regarded as a long-term positive factor. On the 26th, NAVER announced plans to strengthen strategic business alliances through a 600 billion KRW share swap with CJ Logistics, CJ ENM, and Studio Dragon. NAVER agreed to exchange treasury shares worth 300 billion KRW and 150 billion KRW with CJ Logistics and CJ ENM, respectively, and plans to acquire shares from Studio Dragon through a new stock subscription by contributing treasury shares worth 150 billion KRW in kind.

Researcher Donghwan Oh of Samsung Securities said, "Through the share swap with CJ Logistics, both companies will be able to more actively advance the logistics fulfillment business (managing the entire logistics process from order to delivery, storage, inventory management, exchange, and refund) they are collaborating on," adding, "Strengthening alliances with CJ ENM and Studio Dragon will create synergy for NAVER in terms of enhancing its lacking online video service (OTT) and video production of intellectual property (IP)."

Foreign investors are also turning their attention. On the previous day alone, they purchased stocks worth 36.3 billion KRW, ranking second in daily net buying by foreigners. They have already net bought 277.5 billion KRW this month, marking the highest monthly net purchase record this year. Foreign investors had consistently been selling, starting with -141.2 billion KRW in February, followed by -386.7 billion KRW in May, -350.6 billion KRW in June, -341.3 billion KRW in July, and -112.1 billion KRW in August, before turning to net buying (2.4 billion KRW) last month.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.