Financial Supervisory Service to Compile Organized Positions by Month-End

Discussion Likely to Narrow to Some Banks 'Positive on Compensation'

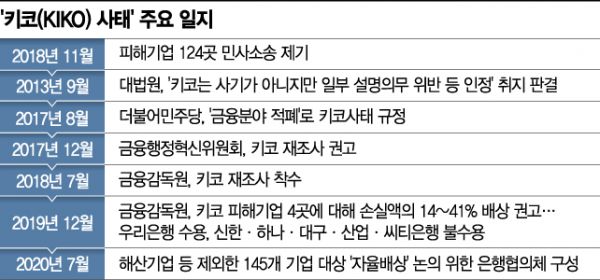

[Asia Economy Reporter Kim Hyo-jin] The autonomous adjustment council of banks for compensating companies affected by the foreign exchange derivative product KIKO is expected to conclude as early as this week. The financial supervisory authorities intend to select banks that are positive about autonomous adjustment and compensation and proceed with the next steps. Since many banks participating in the council remain negative about compensation, the scale of discussions is expected to shrink significantly compared to the authorities' initial expectations.

According to the financial sector on the 29th, the Financial Supervisory Service (FSS) requested the banks participating in the council to summarize their positions based on the discussions so far and inform them by the end of this month. The aim is to determine whether they are willing to prepare a specific compensation plan or, if not yet decided, to understand the current status of discussions.

An FSS official explained, "The council-level discussions cannot be prolonged indefinitely," adding, "This policy was communicated to the banks earlier this month."

The council includes 10 banks: KB Kookmin, Shinhan, Hana, Woori, NH Nonghyup, IBK Industrial Bank, Korea Citi, SC First, HSBC, and Daegu Bank. It was formed with the goal of preparing an autonomous compensation plan for 145 companies, excluding 61 companies that have already filed lawsuits or have been dissolved among the affected companies.

Some of these banks are known to have internally reviewed reports positively considering autonomous adjustment and the resulting compensation.

However, many banks are still reported to be negative about compensation. This is due to unresolved concerns such as the possibility that compensating after the expiration of the civil law statute of limitations for damage claims could be considered a breach of trust.

A bank official participating in the council said, "I understand that about two or three banks are positive," adding, "Although banks have shared information several times on legal issues, the stance of the negative banks has not significantly changed."

The council is known to have held only one or two face-to-face meetings since its launch in July. It is viewed that banks positive about preparing an adjustment plan were reluctant to take the lead in council activities.

No Bank Taking the Lead

Alternative Win-Win Fund Also Unlikely

The FSS initially hoped that the council would actively discuss and reach a consensus on autonomous adjustment, but it is now considered unlikely. A banking sector official predicted, "In the end, only a small number of banks with positive stances will continue individual discussions with the FSS."

Banks are also generally negative about the win-win fund proposal suggested as an alternative by the KIKO Victims Joint Countermeasure Committee. A bank official predicted, "The negative stance on compensation will not change just because its form changes."

KIKO is a derivative product structured so that if the exchange rate fluctuates within a certain range, foreign currency can be sold at the agreed rate, but if it goes beyond that range, large losses occur. Exporting small and medium-sized enterprises subscribed to hedge exchange rate risks but suffered losses when exchange rates fluctuated sharply during the 2008 financial crisis.

Last December, the FSS Dispute Mediation Committee recommended that Shinhan, Woori, Hana, Daegu, Korea Citi, and KDB Industrial Bank, which sold KIKO products, compensate four companies for 15-41% of their losses, recognizing their liability for incomplete sales. However, except for Woori Bank, the other banks did not accept the recommendation. Subsequently, the council was formed under the leadership of the FSS.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.