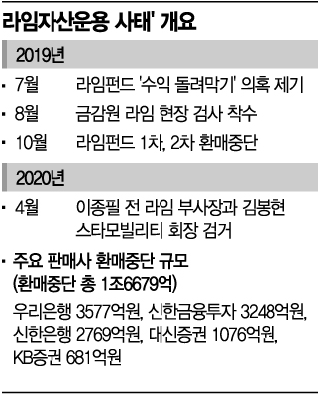

[Asia Economy Reporter Park Jihwan] The first disciplinary committee meeting by financial authorities regarding securities firms that sold Lime Asset Management funds, which caused a large-scale private equity fund redemption suspension worth about 1.6 trillion KRW, will be held on the 29th. It is expected that fierce disputes will arise during this disciplinary hearing over the grounds for sanctions and the scope of responsibility targeting CEOs (Chief Executive Officers) between the financial authorities and the selling securities firms.

The Financial Supervisory Service (FSS) plans to conduct the disciplinary hearings in order with Shinhan Financial Investment, Daishin Securities, and KB Securities at 2 p.m. at the FSS headquarters in Yeouido, Seoul. Each institution has been pre-notified of severe disciplinary actions such as corrective and suspension orders. In particular, severe disciplinary actions including 'suspension of duties' have also been notified to the CEOs of the three securities firms, so intense disputes are anticipated at the hearing. The targets include current and former CEOs who were in office during the Lime Asset Management incident: Park Jung-rim, CEO of KB Securities; Yoon Kyung-eun, former CEO of KB Securities; Kim Byung-chul, former CEO of Shinhan Financial Investment; and Na Jae-cheol, former CEO of Daishin Securities (currently Chairman of the Korea Financial Investment Association).

The core issue of this disciplinary hearing is whether management can be sanctioned for poor internal controls. The FSS cited inadequate internal controls as the basis for the severe disciplinary actions against the securities firms’ CEOs. The legal grounds for the FSS’s move to impose CEO suspensions are Article 24 (Internal Control Standards) of the Act on the Corporate Governance of Financial Companies and Article 19 of its Enforcement Decree concerning 'failure to establish internal control standards.' These regulations stipulate that financial companies must establish standards and procedures (internal control standards) that employees must follow when performing their duties to comply with laws, conduct sound management, and protect shareholders and stakeholders. The logic is that management can be held accountable for failing to implement effective internal controls.

In response, the securities industry is pushing back, arguing that the disciplinary measures are excessive and lack sufficient legal basis. Since the regulations themselves are declarative and broad in nature, some voices say it is excessive to punish CEOs who are not directly related just because they are responsible parties.

A financial investment industry insider said, "While sanctions against institutions are acceptable, expanding punishment to CEOs as actors due to deficiencies in internal control standards is an excessive measure." Another insider expressed concern, "If CEO sanctions actually proceed, securities firms might completely avoid handling risky products in the future."

If the 'suspension of duties' is confirmed through this disciplinary hearing and the Financial Services Commission’s resolution, the affected CEOs will be barred from employment in the financial sector for 3 to 5 years. This is effectively a dismissal measure. In this case, KB Securities, where the incumbent CEO Park Jung-rim is, is expected to face the greatest turmoil.

However, it is unlikely that the final disciplinary level will be decided at this hearing. Unlike the Lime Asset Management disciplinary hearing, which concluded in one day on the 20th, this time the FSS and the securities firms and CEOs subject to sanctions are expected to have sharp confrontations. Previously, the disciplinary hearings for the DLF incident were concluded only after three sessions. FSS Governor Yoon Seok-heon said to reporters before a bank president dinner meeting on the 26th, "We will review securities firms on the 29th and November 5th."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.