Starting Next Year, Insurance Premiums Will Vary Based on Medical Usage

Perception That Previously Purchased Indemnity Insurance Is Better Remains

[Asia Economy Reporter Oh Hyung-gil] Choi Sang-jik (41, pseudonym), who subscribed to indemnity medical insurance in 2012, recently received a call from his insurer urging him to switch to the "Good Indemnity" plan. The explanation was that although the product and coverage were not different from what he had, the premium was cheaper. Choi asked an acquaintance who is an insurance planner whether switching was a good idea, but the answer was a firm "Never switch."

Choi said, "The planner told me that the insurance I subscribed to is renewable every three years, covers up to age 100, and has a deductible as low as 10%, which is better coverage than the current indemnity plan," adding, "Even so, if I had switched at the insurer's recommendation, I would have been the only one at a loss," expressing his disbelief.

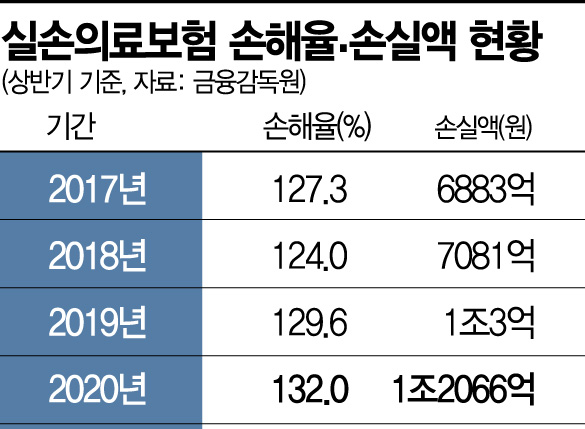

As the loss ratio of indemnity insurance, known as the "second health insurance," has surged, a system to differentiate premiums based on medical usage is set to be implemented from next year. Some express concerns that premiums will skyrocket for the elderly and patients with severe illnesses. Moreover, the perception that maintaining the existing indemnity insurance with better coverage is the only way to avoid losses remains strong, raising doubts about the effectiveness of the premium differentiation system.

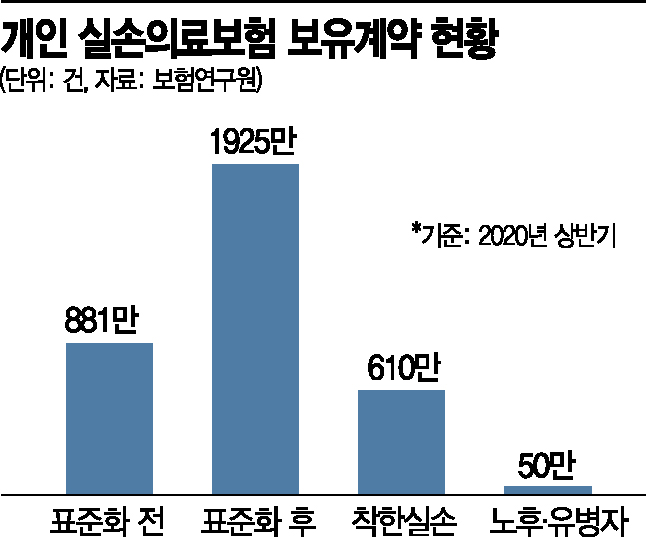

According to the insurance industry on the 28th, as of the first half of the year, there are 34.66 million individual indemnity insurance contracts. Among these, about 28.06 million contracts are standardized or post-standardized indemnity insurance, accounting for nearly 80%, representing the majority of indemnity insurance contracts.

Indemnity insurance is a product that covers some insured benefits not covered by health insurance and all non-covered medical expenses. Depending on the sales period, it is classified into "pre-standardized" products sold until September 2009, "standardized indemnity" sold from October 2009 to March 2017, and "new indemnity (Good Indemnity)" sold after April 2017.

The new indemnity plan has a deductible of 10% for insured benefits and 20% for non-covered services. Additionally, MRI, manual therapy, and non-covered injections are covered at 70%, resulting in a high out-of-pocket burden. Notably, coverage conditions may change every 15 years, which can lead to losses upon re-subscription.

Introduction of 4th Generation Insurance with Premiums 10% Cheaper Expected

The financial authorities are pushing for a revision of the 4th generation indemnity insurance, which is up to 10.3% cheaper on average than the Good Indemnity plan. The Korea Insurance Research Institute proposed dividing indemnity coverage into a basic plan covering insured medical services and a special rider covering non-covered services, with premium surcharges applied to the rider portion if non-covered usage is high.

In particular, there is ongoing discussion about raising the deductible rates for insured and non-covered premiums from the current 10% and 20% to 20% and 30%, respectively. However, the insurance industry points out that this has limitations in solving the problems of the "pre- and post-standardized" indemnity insurance, which has seen a sharp increase in loss ratios. This is because the new product structure cannot be applied to current subscribers. Although insurers encourage policyholders to switch contracts, few consumers respond.

An industry official said, "The system has been revised several times, but each time the perception that the old indemnity insurance is better has grown," adding, "If existing indemnity insurance cannot be changed, the effect of the premium differentiation system will inevitably diminish, so various measures, such as excluding non-covered items to prevent medical overuse, need to be discussed."

Meanwhile, the Financial Services Commission announced, "We will finalize and announce the restructuring plan for indemnity insurance products in November." The commission expects that while the 4th generation indemnity insurance may increase premiums for some subscribers, it will provide premium discounts to the majority.

Indemnity insurance has also faced issues such as high loss ratios due to over-treatment by some patients and hospitals, continuous premium increases, and fairness problems among subscribers. There have been ongoing calls for fundamental improvements to the product structure of indemnity insurance.

A Financial Services Commission official explained, "While only a portion of subscribers will be subject to surcharge grades due to non-covered usage, most are accident-free (discount grade), so the majority of subscribers will benefit from premium discounts."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.