Korea Exchange Market Surveillance Committee Announces 'Market Surveillance Weekly Brief'

Overall Decrease Compared to Last Year Except for Investment Caution Measures

Persistent Illegal Trading and Insider Information Use... Discovered Market Manipulation Case Worth 25 Billion KRW

Fraud/Photo by Getty Images Bank

Fraud/Photo by Getty Images Bank

[Asia Economy Reporter Minwoo Lee] As of the third quarter of this year, the Korea Exchange (KRX) has taken more than 6,700 investment caution measures. This is more than four times the total of 1,661 cases last year. Amid market turmoil caused by the spread of the novel coronavirus (COVID-19), vaccine development, and the U.S. presidential election, the number of measures has steadily increased.

On the 28th, the KRX Market Surveillance Committee released a "Market Surveillance Weekly Brief" containing this information. This was part of follow-up measures to the "Comprehensive Plan to Eradicate Illegal and Unsound Practices in the Securities Market," jointly announced with the Financial Services Commission and the Financial Supervisory Service on the 19th.

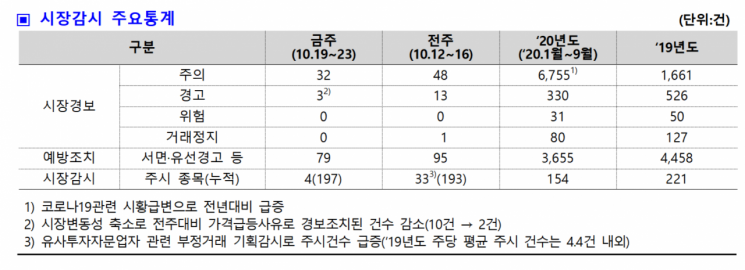

Previously, the Exchange has operated a market alert system that designates and publicly announces stocks in three stages (Investment Caution → Investment Warning → Investment Risk) when a small number of accounts concentrate trading on specific stocks or when stock prices surge sharply in the short term. According to the Exchange, during the five trading days from the 19th to the 23rd, a total of 35 market alert measures were taken, including 32 Investment Caution cases and 3 Investment Warning cases. This is nearly half the 61 cases (48 caution, 13 warning, 1 trading suspension) from the previous week. Among the Investment Caution cases, excessive involvement of a small number of accounts in buying and designation due to single account trading volume accounted for about 50%, the highest proportion. Representative sectors designated with Investment Warning included electric vehicles, COVID-19 vaccine stocks, and preferred stocks.

Meanwhile, a total of 6,755 Investment Caution measures have been taken from the beginning of this year through September. This exceeds four times the total of 1,661 cases last year within just the first three quarters. However, stronger measures than Investment Caution, such as Investment Warning (330 cases), Investment Risk (31 cases), and Trading Suspension (80 cases), all decreased compared to last year during the same period.

A total of 79 preventive measures were activated in the past week, also down from 95 cases in the previous week (October 12?16). Up to the third quarter of this year, there have been 3,655 cases, about 800 fewer than last year's total of 4,458. The preventive measure request system is designed to preemptively prevent unfair trading by taking stepwise actions such as telephone warnings, written warnings, notice of refusal of acceptance, and refusal of acceptance against accounts excessively involved in price increases, accounts submitting fictitious orders, and accounts repeatedly submitting unfair orders such as collusive or fictitious trading.

Key cases include detection of a stock in the Investment Warning category where high-priced buy orders (compared to the best bid) were split and submitted about 250 times to induce a price increase. There was also a case where buy orders at the upper limit price worth about 200 million KRW were submitted during the activation time of the Volatility Interruption (VI) mechanism, raising the expected execution price to lure investor buying interest, followed by cancellation of the upper limit buy orders.

Last week, four stocks were under market surveillance and investigation for suspected unfair trading, a significant decrease from 33 cases the previous week. The cumulative total for this year is 197 cases. Up to the third quarter, there were 154 cases, a decrease of more than 40% compared to last year's total of 221 cases.

These cases involved using multiple accounts to conduct fictitious and collusive trades worth approximately 25 billion KRW during the process of acquiring shares in listed companies (price manipulation), or engaging in fraudulent trading by opening stock recommendation chat rooms (leading rooms) and following the pattern of "acquiring shares → recommending stocks → inducing price increases → selling shares." Cases of insider trading are also under investigation, where CEOs of affiliated companies sold shares before the disclosure of important information such as clinical trial failures to avoid losses.

A representative from the Exchange's Market Surveillance Committee stated, "We will do our best to prevent unfair trading in advance, promptly initiate investigations upon detecting abnormal trading, confirm whether there is suspicion, and notify financial authorities so that those involved can receive appropriate measures. We also plan to strengthen communication with investors and market participants by distributing the Market Surveillance Weekly Brief until the end of March next year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.