<Sharp Surge in Publicly Announced Property Price Realization Rates... Simulation Results>

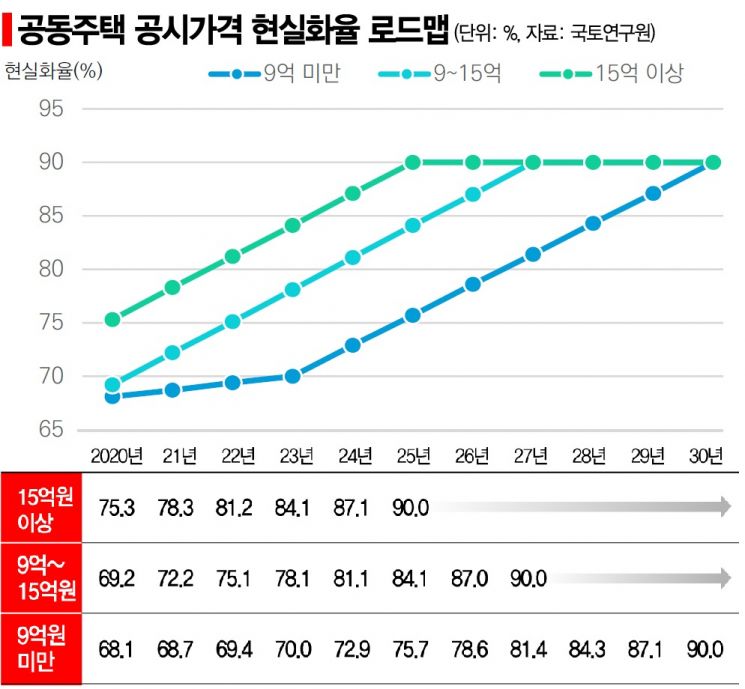

Government to Raise Realization Rate to 90% for Homes Over 1.5 Billion Won by 2025

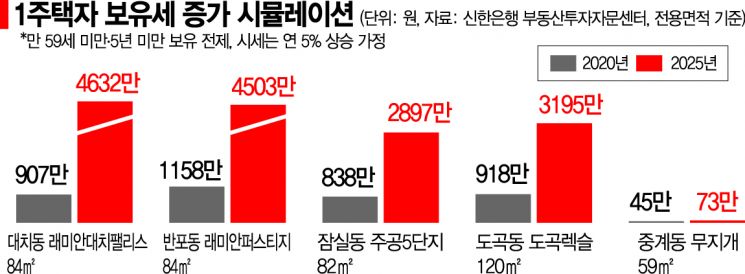

Raemian Daechi Palace 84㎡ Rises from 9.07 Million Won This Year to 46.32 Million Won in 5 Years, a 5.1-Fold Increase

Junggye Mujigae 59㎡ Also Up 60%... Tax Resistance Expected to Be Significant

[Asia Economy Reporters Chunhee Lee and Mune Won] Mr. A, in his 40s, living in an 84㎡ (exclusive area) unit of 'Raemian Daechi Palace' in Daechi-dong, Gangnam-gu, Seoul, will have to pay 46.32 million KRW in holding tax in 2025, five years from now, even if the house price rises by only 5% annually. This is 5.1 times higher compared to this year's holding tax of 9.07 million KRW, which combined property tax and comprehensive real estate tax. This is because the government has announced a plan to raise the official property price realization rate by 3 percentage points annually over five years starting next year for high-priced homes valued over 1.5 billion KRW, aiming to match 90% of the market price by 2025 through the 'Official Price Realization Plan.'

As the government plans to significantly increase the official price realization rate, there have been repeated reactions centered around Gangnam, saying, "Is the government telling salaried workers not to live in Gangnam?" This is because even if the annual salary reaches 100 million KRW, which is roughly the level of a department head at a large corporation, the holding tax on just one house approaches half of the annual salary.

90% of Market Price in 5 Years... High-Priced Homes Over 1.5 Billion KRW Targeted

Raemian Daechi Palace Apartment in Daechi-dong, Seoul. According to the government's roadmap for the actualization rate of publicly announced prices, the property tax burden for this apartment's 84㎡ (exclusive area) is expected to increase 5.1 times by 2025. (Photo by Lee Chunhee)

Raemian Daechi Palace Apartment in Daechi-dong, Seoul. According to the government's roadmap for the actualization rate of publicly announced prices, the property tax burden for this apartment's 84㎡ (exclusive area) is expected to increase 5.1 times by 2025. (Photo by Lee Chunhee)

According to sources inside and outside the government on the 28th, the Ministry of Land, Infrastructure and Transport is preparing a plan to raise the official property price, which serves as a benchmark indicator in 60 fields including real estate holding tax and health insurance premiums, up to 90%.

At a related public hearing hosted by the Korea Research Institute for Human Settlements the previous afternoon, the institute presented three options for the official price realization rate target: 80% (Option 1), 90% (Option 2), and 100% (Option 3). However, within the ruling party, the 90% option is practically considered a fait accompli. On the same day in the morning, Jung Ae Han, the Policy Committee Chair of the Democratic Party of Korea, also mentioned at a party strategy meeting that "the Korea Research Institute for Human Settlements' roadmap for official property price realization aims to match 90% of the market price by 2030."

If this plan is finalized, the holding tax burden is expected to surge immediately from next year in Gangnam, where most apartments are high-priced, exceeding 1.5 billion KRW. This is because the government has announced plans to raise the official property price by 3 percentage points annually for apartments in this price range. The current official price realization rate for high-priced homes, which stands at 75.3%, is expected to rise to 90% within five years. According to the public hearing materials, the Korea Research Institute for Human Settlements plans to achieve a 90% realization rate by 2027 for apartments priced between 900 million KRW and less than 1.5 billion KRW, and by 2030 for apartments under 900 million KRW.

According to a holding tax increase simulation commissioned by Asia Economy to Shinhan Bank's Real Estate Investment Advisory Center, the holding tax for a single homeowner owning one 84㎡ unit of 'Raemian Daechi Palace' in Daechi-dong, Gangnam-gu, will increase 5.1 times from 9.07 million KRW this year to 46.32 million KRW in 2025. The simulation assumes the owner is under 59 years old and the housing price increases by 5% annually. This level is difficult to bear unless one has a considerable high income.

It was analyzed that the holding tax for most high-priced apartments in the Gangnam area will triple on average over five years. The holding tax for an 84㎡ unit of 'Raemian Prestige' in Banpo-dong, Seocho-gu, is also estimated to increase by 289%, from 11.58 million KRW to 45.03 million KRW during the same period, and for a 120㎡ unit of 'Dogok Rexle' in Dogok-dong, Gangnam-gu, it will rise 3.5 times from 9.18 million KRW to 31.95 million KRW.

Burden Jumps for Ordinary Citizens Too... Tax Resistance Likely to Grow

If the official property price increases as planned by the government, the holding tax burden will inevitably increase not only for multi-homeowners but also for mid- to low-priced homes. For example, the holding tax for a 59㎡ unit of 'Junggae Mujigae' in Junggae-dong, Nowon-gu, which recently set a new record price at 600 million KRW on the 21st, will increase by 60% over five years. Especially since the government plans to suppress fluctuations to less than 1 percentage point annually for homes under 900 million KRW for three years until 2023, and then increase by 3 percentage points annually thereafter, the tax burden for mid- to low-priced homes is expected to rise sharply after 2024.

The ruling party and government have also started preparing supplementary measures to lower property tax rates only for mid- to low-priced homes under 900 million KRW, likely considering such backlash. It is reported that they are reviewing a plan to reduce the property tax rate, currently between 0.1% and 0.4% depending on the tax base, by 0.05 percentage points. The property tax reduction target is likely to be homes with official prices under 900 million KRW, but the ruling party is also considering the 600 million KRW level. The ruling party and government plan to announce such tax burden relief measures around the time the final official price realization plan is released.

However, tax resistance due to soaring holding tax burdens is also expected to be significant. Since the government has already raised the comprehensive real estate tax rate up to 6% through the July 10 real estate measures, strong opposition is expected mainly from multi-homeowners and owners of high-priced homes. Especially retirees and elderly people who own only one house without sufficient income will find it difficult to bear holding tax increases that can amount to tens of millions of KRW.

Industry insiders also predict that the number of properties on the market may increase significantly before the comprehensive real estate tax imposition date in June next year, mainly from homeowners who cannot bear such tax burdens.

Single-Family Homes and Land Difficult to Price... Ensuring Fairness Remains a Challenge

The "Public Hearing for Establishing a Plan to Realize the Actual Value of Officially Announced Real Estate Prices" was held on the afternoon of the 27th at the Korea Appraisal Board Metropolitan Headquarters on Seoun-ro, Seocho-gu, Seoul, hosted by the Ministry of Land, Infrastructure and Transport. A designated discussion is taking place with Jo Juhyun, Honorary Professor at Konkuk University (fourth from the left), serving as the chair. /Photo by Joint Press Corps

The "Public Hearing for Establishing a Plan to Realize the Actual Value of Officially Announced Real Estate Prices" was held on the afternoon of the 27th at the Korea Appraisal Board Metropolitan Headquarters on Seoun-ro, Seocho-gu, Seoul, hosted by the Ministry of Land, Infrastructure and Transport. A designated discussion is taking place with Jo Juhyun, Honorary Professor at Konkuk University (fourth from the left), serving as the chair. /Photo by Joint Press Corps

Unlike multi-family housing, it is often difficult to raise the official property price for single-family homes and land, which have low transaction volumes. Currently, there are many criticisms that official prices vary widely even among similar types and locations of single-family homes, leading to poor fairness in tax burdens. If the official price realization rate is raised to 90% without establishing a proper official price assessment system, tax fairness could deteriorate further, causing a flood of complaints.

In fact, the Ministry of Land, Infrastructure and Transport was already criticized by the Board of Audit and Inspection in May for discrepancies between official prices and market prices, and imbalances in official prices by type and region. A ministry official explained, "It is true that the possibility of official price variation is higher in single-family homes than in multi-family housing," but added, "Now that we have sufficient actual transaction data and improved survey techniques, we believe accuracy can be enhanced."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.