[Asia Economy Reporter Eunmo Koo] Domestic accounting firms achieved external growth last year as the number of registered accountants and sales revenue both increased, while the implementation of the auditor registration system for listed companies has led to a trend of medium- and large-scale firms.

On the 28th, the Financial Supervisory Service (FSS) analyzed the business reports of accounting firms registered with the Financial Services Commission for the 2019 fiscal year. The total number of accounting firms was 185, an increase of 3 compared to 2018, and the number of registered accountants was 21,758, up by 874.

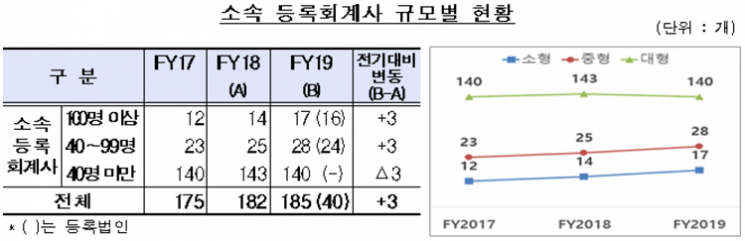

As of the end of March this year, the number of domestic accounting firms was 185, an increase of 3 from 2018. While 12 firms were newly established, 8 firms were merged and 1 firm was dissolved. By size, large firms with 100 or more registered accountants increased from 12 in 2017 to 17, and medium-sized firms with 40 to 99 accountants also rose from 23 to 28. Meanwhile, the number of small firms with fewer than 40 accountants remained steady at 140, showing an increase in large and medium-sized firms.

The FSS analyzed that the implementation of the auditor registration system for listed companies has led to numerous mergers among small and medium-sized accounting firms, resulting in a trend toward medium- and large-scale accounting firms. Audits of listed companies can only be conducted by accounting firms with 40 or more certified public accountants (20 or more for regional accounting firms) to ensure audit quality.

The number of registered accountants also increased. Last year, the total number of registered accountants was 21,758, a 4.2% increase from 2018. Among them, 12,240 accountants belonged to accounting firms, accounting for 56.3% of the total, which is a 7.1% increase from the previous year. Accountants belonging to registered corporations accounted for 9,598, or 44.1% of the total, representing 78.4% of accountants in accounting firms. The Big Four accounting firms had 5,849 accountants, a 5.2% increase from the previous year, but their share among all accounting firms slightly decreased by 0.8 percentage points to 47.8%.

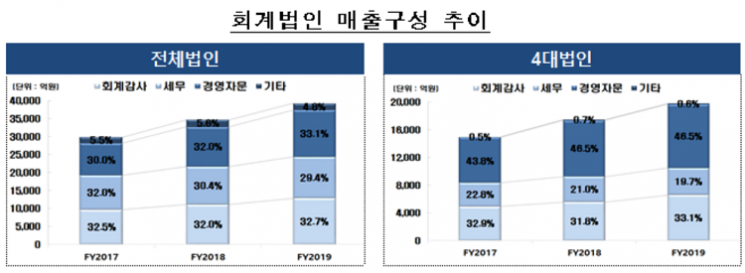

Total sales revenue increased by more than 10%. Last year, the total sales revenue of accounting firms was 3.9226 trillion KRW, a 13.2% (456.3 billion KRW) increase from 3.4663 trillion KRW in 2018. The Big Four accounting firms' sales revenue was 1.9796 trillion KRW, up 13.2% (231.4 billion KRW) from the previous year, maintaining a similar share of 50.5% of the total accounting firm sales. By service type, management consulting accounted for 1.3013 trillion KRW (33.1%), audit services 1.2815 trillion KRW (32.7%), tax services 1.1518 trillion KRW (29.4%), and others 188 billion KRW (4.8%).

In particular, the growth in management consulting sales continued, expanding its share of accounting firm revenue from 30.0% in 2017 to 33.1% last year. The FSS analyzed that the increase was driven by services related to the establishment and evaluation (operation) of internal accounting control systems, corporate accounting advisory services, and increased mergers and acquisitions (M&A) consulting. Audit revenue also increased by 15.6% (173.4 billion KRW) compared to the previous year due to the introduction of standard audit hours, periodic designation system, and internal accounting control audits following amendments to the External Audit Act.

Although external audit performance under the External Audit Act slightly decreased, average audit fees rose, especially among the Big Four accounting firms. The total number of individual financial statement external audits conducted by all accounting firms was 27,939, a 3.3% (968 cases) decrease from 2018 due to the expansion of exemptions for entities such as asset-backed securitization companies.

However, the average audit fee (38.2 million KRW) increased by 21.6% compared to the previous year due to increased audit hours and strengthened risk management. The FSS estimated that overall audit fees rose due to increased audit input time, and particularly for the Big Four accounting firms, this reflected a tendency to reduce audit engagements with low fees relative to audit risk.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.