September Stocks and Corporate Bonds 17.2834 Trillion KRW

IPOs and Paid-in Capital Increase Up 466% and Down 59% Respectively

[Asia Economy Reporter Minji Lee] Last month, the number of companies raising funds in the capital market through initial public offerings (IPOs), rights offerings, and corporate bond issuances increased compared to the previous month. In the stock market, the performance significantly improved due to IPOs by large companies such as Kakao Games.

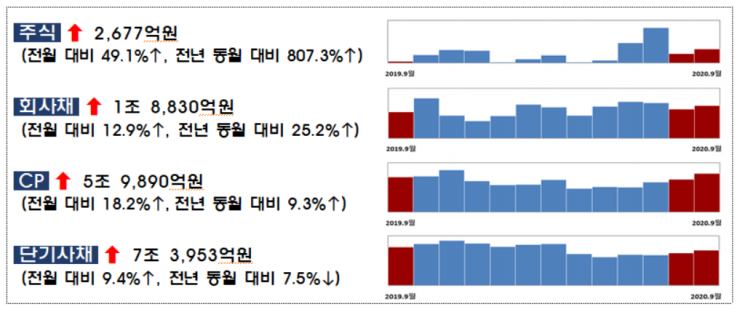

According to the "Direct Financing Performance of Companies in September 2020" announced by the Financial Supervisory Service on the 28th, companies raised a total of 17.2834 trillion KRW in the capital market last month. This is an increase of 2.1507 trillion KRW compared to August.

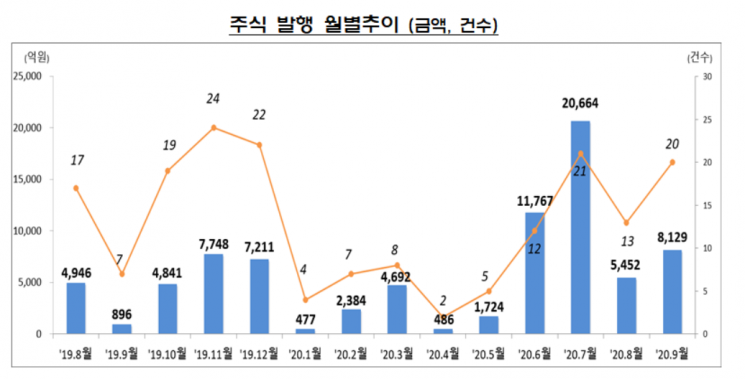

The amount of stocks issued by companies last month was 812.9 billion KRW (20 cases), an increase of 267.7 billion KRW (49.1%) compared to the previous month. IPOs increased, while rights offering performance decreased. A total of 12 companies went public, recording 637.1 billion KRW, a 466.3% increase from the previous month. All were listed on the KOSDAQ market, with Kakao Games (384 billion KRW) having the largest scale. Other companies that went public include Paen KPibu Clinical Research Center, BBC, Baxel Bio, and Nextin.

A total of 8 companies conducted rights offerings, recording 175.8 billion KRW, a 59.4% decrease from the previous month. On the KOSPI market, Hanchang, Vivian, and Maniker conducted rights offerings, while on the KOSDAQ market, Crucialtec, Korea Union Pharmaceutical, K& W, and Wave Electronics raised funds.

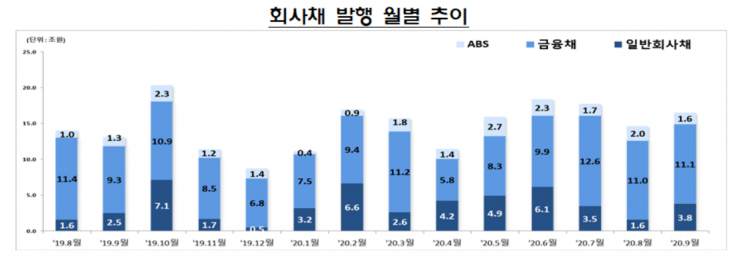

The scale of corporate bond issuance last month was 16.4705 trillion KRW, an increase of 12.9% (1.884 trillion KRW) compared to the previous month. Both general corporate bonds and financial bonds increased issuance. Corporate bonds issued through public offerings by general companies amounted to 3.76 trillion KRW (37 cases), about 138% more than the previous month. Last month, companies increased the issuance of medium- to long-term bonds for debt repayment purposes, issuing 2.2585 trillion KRW for refinancing. By rating, bond issuance below A grade increased compared to the previous month. While there were no issuances below BBB and BB grades in the previous month, 50 billion KRW and 15 billion KRW worth of bonds were issued in September, respectively.

Financial companies' financial bond issuance performance was 11.124 trillion KRW, a 1% increase from the previous month, totaling 196 cases. Although issuance of financial holding company bonds and bank bonds decreased, bond issuance increased mainly by securities companies and credit card companies, leading to an increase in issuance in the other financial bonds sector. Financial holding company bonds were 950 billion KRW (6 cases), down 20.8% from the previous month. Bank bonds amounted to 3.418 trillion KRW (17 cases), down 15% from the previous month. Commercial banks issued 3.188 trillion KRW, a 16.5% decrease during the same period, while regional banks increased by 15% to 230 billion KRW. Other financial bonds were issued at 6.756 trillion KRW (173 cases), a 16.6% increase from the previous month (5.7917 trillion KRW). Securities companies and credit card companies increased issuance by 1.42 trillion KRW and 75 billion KRW, respectively, compared to the previous month.

At the end of last month, the outstanding balance of corporate bonds was 559.7909 trillion KRW, an increase of 0.6% (3.3122 trillion KRW) from the previous month. Corporate bonds shifted to net redemption as redemption amounts increased more than issuance amounts.

In the short-term money market, both commercial papers (CP) and short-term bonds increased issuance, rising 12% from the previous month to 124.7576 trillion KRW. CP issuance totaled 38.9241 trillion KRW, an 18.2% increase from the previous month. Short-term bonds totaled 85.8335 trillion KRW, about 9.4% higher than the previous month.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.