Bank of Korea 'October 2020 Consumer Sentiment Survey'

Consumer Sentiment Index Rebounds at Largest Rate Since April 2009

[Asia Economy Reporter Eunbyeol Kim] Consumer sentiment, which had declined due to the resurgence of the novel coronavirus infection (COVID-19), rebounded again in October. The magnitude of the rebound was the largest since April 2009, right after the financial crisis, raising expectations for a recovery in consumer sentiment.

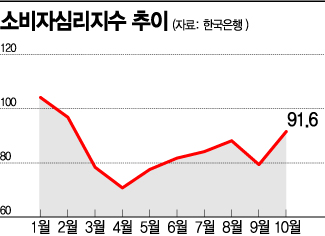

According to the 'October 2020 Consumer Survey' released by the Bank of Korea on the 28th, the Consumer Confidence Index (CCSI) in October rose by 12.2 points from the previous month to 91.6. The increase was the largest since April 2009 (20.2 points), right after the financial crisis.

The CCSI, which had been depressed due to COVID-19 since early this year, had been rising for four consecutive months since May. However, with the resurgence of COVID-19 after mid-August, the CCSI fell again by 8.8 points to 79.4 in September.

Hwang Hee-jin, head of the Statistical Survey Team at the Bank of Korea's Economic Statistics Bureau, explained, "The CCSI rose as perceptions of the economy and household financial conditions improved due to the easing of social distancing measures following the slowdown in the spread of COVID-19."

The CCSI is an indicator calculated using six of the 15 indices that make up the Consumer Survey Index (CSI): current living conditions, living conditions outlook, household income outlook, consumption expenditure outlook, current economic conditions, and future economic outlook. A value below 100 indicates pessimism in consumer sentiment compared to the long-term average (2003?2019). Before COVID-19 began spreading significantly in Korea, the CCSI was 104.2 in January and 96.9 in February. Although it has not yet reached the February level, it shows a considerable recovery.

All Consumer Survey Indices (CSI) that make up the CCSI rose simultaneously. The current living conditions CSI (86) and living conditions outlook CSI (91) increased by 5 points and 6 points respectively from the previous month. The household income outlook CSI (94) also rose by 6 points, and the consumption expenditure outlook CSI recorded 100, up 8 points.

Perceptions of the economic situation also improved. The current economic conditions CSI (58), future economic outlook CSI (83), and employment opportunity outlook CSI (75) all jumped significantly by 16 points, 17 points, and 15 points respectively. The interest rate level outlook CSI rose by 6 points to 95. The current household savings CSI (89) and household savings outlook CSI (92) also increased by 2 points and 3 points respectively from the previous month. While the current household debt CSI (103) remained at the previous month's level, the household debt outlook CSI (100) fell by 1 point.

Meanwhile, the housing price outlook CSI, which surveys expectations for house prices one year ahead, rose by 5 points from the previous month to 122. After falling from 125 in August to 117 in September, suggesting a weakening in housing price expectations, it rose again in October. Although the government's strong real estate measures slowed the nationwide apartment price increase and caused the housing price outlook CSI to decline, in October, many people expected house prices to rise further. The price level outlook CSI (139) remained at the previous month's level, and the wage level outlook CSI (109) rose by 4 points from the previous month.

Perceptions of the consumer price inflation rate over the past year remained at 1.9%, while the expected inflation rate for the next year fell by 0.1 percentage points from the previous month to 1.8%. However, Team Leader Hwang explained, "If you look at the expected inflation rate to the second decimal place, it was 1.86% in September and 1.83% in October," adding, "Since it only fell by 0.03 percentage points, the actual decline is minimal."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.