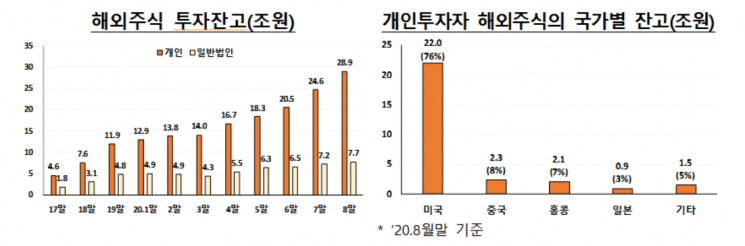

Overseas Stock Investment by Country: US 76% → China 8% → Hong Kong 7%

Increase in High-Risk Financial Products Investment Such as Overseas Exchange-Traded Derivatives and FX Margin Trading

[Asia Economy Reporter Minji Lee] The Financial Supervisory Service (FSS) has urged caution against indiscriminate investing as individual investors' direct overseas stock investments have increased amid heightened global stock market volatility due to the impact of the novel coronavirus infection (COVID-19), noting that information accessibility is lower compared to domestic stocks.

According to the 'Trends in Individual Investors' Overseas Investment and Investor Precautions' data released by the FSS on the 27th, as of the end of August, the balance of individual investors' overseas stock investments reached 28.9 trillion KRW, an increase of about 142.6% compared to the end of last year (12 trillion KRW). The balance of overseas stock investments by general corporate investors recorded 7.7 trillion KRW, a 60% increase from the end of last year. By country, U.S. stocks accounted for the majority (76%, 22 trillion KRW), followed by China (8%, 2.3 trillion KRW), Hong Kong (7%, 2.1 trillion KRW), and Japan (3%, 900 billion KRW).

The evaluation gains on individual investors' overseas stock holdings showed a gradual increase. From 700 billion KRW at the end of last year, it grew to 3.4 trillion KRW as of the end of August this year. As individual investors' direct overseas stock investments increased, securities firms' brokerage fee income from overseas stocks also rose. In the first half of this year, securities firms' brokerage fee income from individual investors' overseas stock transactions was 194 billion KRW, surpassing last year's total income of 115.4 billion KRW.

Including individual and general corporate investors and securities firms' proprietary accounts, the total transaction amount for this year as of August was 108.6 billion USD (130.7 trillion KRW applying the average exchange rate), with net purchases of 11.5 billion USD (13.9 trillion KRW), representing increases of approximately 301% and 596% respectively compared to the same period last year.

During the same period, the top five stocks by net purchase amount were Tesla (1.55 billion USD), Apple (970 million USD), Microsoft (610 million USD), Google (420 million USD), and Hasbro (410 million USD). It was observed that individual investors expanded investments in large Nasdaq tech stocks and beneficiaries of the untact (contactless) trend, and there were also temporary increases in net purchases of triple-leveraged exchange-traded funds (ETFs).

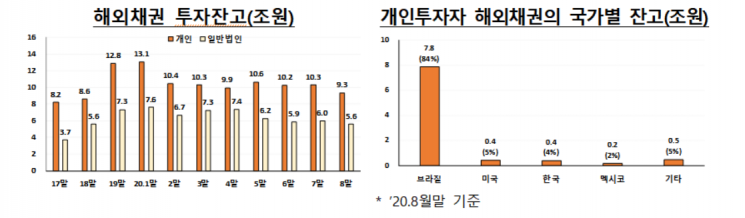

In the overseas bond market, the balance of individual investors' overseas bond investments was 9.3 trillion KRW at the end of last year, down 27.5% from 12.8 trillion KRW at the end of the previous year. The balance of overseas bond investments by general corporate investors decreased by 24% to 5.6 trillion KRW compared to last year.

By issuer nationality, Brazil accounted for 7.8 trillion KRW (84%), the U.S. 400 billion KRW (5%), Korea 400 billion KRW (4%), and Mexico 200 billion KRW (2%). Korea refers to foreign currency bonds issued by Korean companies that securities firms first underwrite and then sell in portions via over-the-counter trading to individual investor clients wishing to purchase. By type, government bonds were the largest at 8 trillion KRW (87%), followed by corporate bonds at 1.1 trillion KRW (12%), and special bonds at 100 billion KRW (1%).

Domestic individual investors have historically had large investments in Brazilian government bonds, but this year, due to the impact of COVID-19 and the decline in oil prices highlighting crises in emerging and oil-producing countries, as well as the depreciation of the Brazilian real, the balance is estimated to have decreased by 28% compared to the end of last year (10.9 trillion KRW).

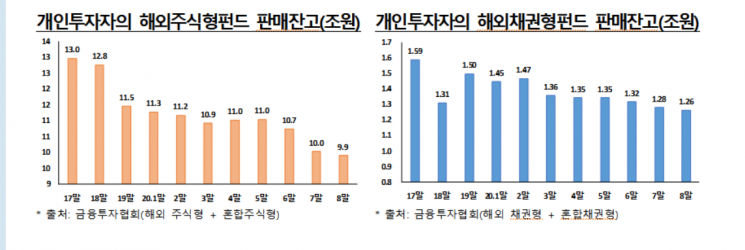

Overseas funds showed a decline in both equity and bond types. As of the end of August, the balance of individual investors' overseas equity fund sales was 9.9 trillion KRW, down 13.6% from 11.5 trillion KRW at the end of last year. Overseas bond funds also decreased by about 15.7% to 1.3 trillion KRW during the same period from 1.5 trillion KRW at the end of last year.

In the overseas derivatives market, the monthly average trading volume of individual investors' overseas exchange-traded derivatives in the first half of this year was 556.6 trillion KRW, a 60.5% increase compared to 346.9 trillion KRW last year. However, trading losses amounted to 878.8 billion KRW, more than double last year's total loss of 415.9 billion KRW. The monthly average trading volume of foreign exchange arbitrage trading (FX margin trading) also increased by 97.4% from last year to 13 trillion KRW.

Regarding this, the FSS explained, "Looking at the case of Nikola, a U.S. hydrogen electric vehicle company, overseas stocks have lower information accessibility compared to domestic stocks, so 'indiscriminate investing' relying on specific information is highly exposed to stock price volatility risks," and added, "High-risk products such as overseas exchange-traded derivatives and overseas leveraged ETFs have complex product and profit/loss structures, so thorough analysis is necessary."

The FSS further stated, "We plan to actively promote investor protection measures related to overseas product investments, which require relatively greater investor protection compared to domestic product investments."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.