Concerns Over Economic Contraction as Europe Reimposes Lockdowns

Europe's Largest Software Company SAP Plummets 23%

US Major Stock Indexes Also Plunge Amid US Presidential Election Uncertainty

[Asia Economy Reporter Hyunwoo Lee] Additional lockdown concerns due to the resurgence of the novel coronavirus infection (COVID-19), which is raging in the United States and Europe, pulled down both the US and European stock markets. On Wall Street, there were concerns that the COVID-19 resurgence was unfolding faster than expected and could deliver a second shock to the economy. However, there is also growing credibility to the assessment that the markets will recover starting next month, as uncertainties are expected to be resolved after the US presidential election and additional economic stimulus measures are implemented.

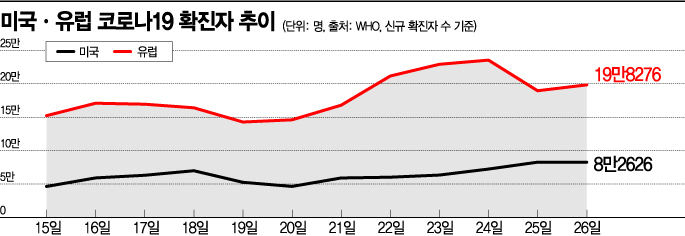

While it is generally common for virus activity to become more active as cold weather arrives, the COVID-19 resurgence is appearing faster than anticipated. According to the World Health Organization (WHO) data on the 26th (local time), the daily confirmed cases in the US exceeded 80,000 for two consecutive days, reaching 82,626. CNN reported that the 7-day average of new cases nationwide in the US hit a record high of 68,767, and in 37 out of 50 states, the average number of new cases in the past week increased by more than 10% compared to the previous week.

In Europe, daily confirmed cases also approached 200,000, setting a record high. According to WHO data, the total daily confirmed cases in Europe on that day were 198,276. France, which surpassed its previous record of 50,000 daily cases over the past weekend, is considering additional measures following a nighttime curfew, while Spain declared a state of emergency and implemented nighttime movement restrictions. Italy also announced the resumption of lockdown measures, such as limiting restaurant and bar operating hours to 6 p.m., with several countries following suit.

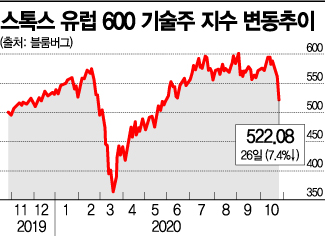

The resumption of lockdown measures means an immediate blow to the economy. SAP, Europe's largest software company, led a sharp decline by announcing a negative earnings outlook on the same day. According to The Washington Post (WP), SAP announced that it was abandoning its previous profit targets and that the recovery from COVID-19 would take longer than expected. SAP's stock price plunged 23.16% that day. As a result, European indices also fell, including Germany's DAX30 dropping 3.71%, the UK's FTSE100 down 1.16%, and France's CAC40 down 1.90%.

SAP's negative earnings outlook was interpreted as concerns based on a shrinking online advertising market. This quickly spread to fears about major US tech stocks. Large social networking service (SNS) companies such as Alphabet (-2.98%), Facebook (-2.70%), and Twitter (-2.85%), along with software-based companies like Microsoft (MS, -2.84%) and Salesforce (-3.41%), also experienced simultaneous declines.

The difficulty in negotiations over economic stimulus between the US Democratic Party and the Donald Trump administration ahead of the US presidential election is also negatively affecting the stock market. According to CNN, on that day, Nancy Pelosi, Speaker of the US House of Representatives, and Steven Mnuchin, US Treasury Secretary, continued discussions on the COVID-19 economic stimulus package but again failed to reach an agreement. Drew Hammill, spokesperson for the US House Speaker, posted on Twitter, "Speaker Pelosi and Secretary Mnuchin had a 52-minute phone call, but disagreements over nationwide COVID-19 testing and tracing plans continued, resulting in a failure to agree on the stimulus package."

Experts on Wall Street forecast that although the stock market temporarily plunged sharply due to the combined effects of COVID-19 and political uncertainty ahead of the US presidential election, it will recover once uncertainties dissipate after the election and expectations for economic stimulus grow again. According to CNBC, Jim Tierney, Chief Investment Officer (CIO) of US asset management firm AllianceBernstein, said, "With the US presidential election now just ten days away, the cautious stance contributed to the sharp drop in stock prices," adding, "The stock market had been near all-time highs, so the correction was significant." Another expert said regarding the stimulus, "The question is not whether it will happen, but when it will happen." Ed Kean, CIO of QMA, said, "Traditionally, after the election ends, uncertainties are resolved, and optimism grows in the market due to expectations for economic stimulus," adding, "The upward trend will continue." He emphasized, "Corporate earnings and outlooks remain strong."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.