Ministry of the Interior and Safety: Over Half of Tax-Exempt Houses Priced Between 150 Million and 300 Million Won

30s Account for 40% by Age... 200 Billion Won Tax Relief Expected by End of Next Year

[Asia Economy Reporter Jo In-kyung] It has been revealed that approximately 30,000 people received acquisition tax reductions for first-time home purchases over the past three months. The amount reached about 36.5 billion KRW.

The Ministry of the Interior and Safety announced on the 27th that, after a mid-term review of the operation status of the 'First-Time Home Acquisition Tax Reduction' system implemented as part of the 'Housing Market Stabilization Supplementary Measures' on July 10, approximately 29,579 cases nationwide and 36.5 billion KRW were reduced over about three months until the 10th of this month.

By region, 12,870 cases (43.5%) and 18.1 billion KRW were reduced in the metropolitan area, while 16,709 cases (56.5%) and 18.4 billion KRW were reduced in non-metropolitan areas. By housing price, homes priced at 150 million KRW or less accounted for 9,990 cases (33.8%) and 10.6 billion KRW, and homes priced between 150 million and 300 million KRW accounted for 16,007 cases (54.1%) and 19.1 billion KRW in reductions.

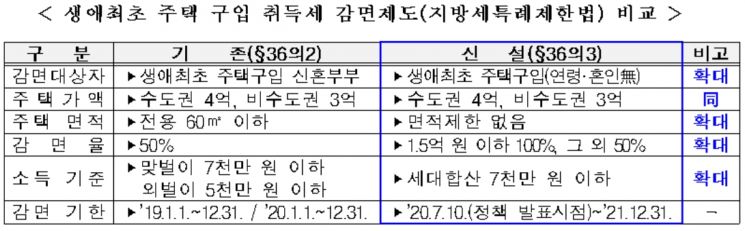

The first-time home acquisition tax reduction system exempts 100% of acquisition tax for households with an annual income of 70 million KRW or less purchasing a home priced at 150 million KRW or less for the first time in their life, and reduces acquisition tax by 50% for homes priced between 150 million and 300 million KRW (up to 400 million KRW in the metropolitan area).

Although this system was implemented from August 12 after parliamentary discussions, it was designed to be retroactively applied to homes purchased after the policy announcement date of July 10, so the reduction benefits have actually been provided over the past three months.

Homes priced between 300 million and 400 million KRW, which apply only to the metropolitan area, accounted for 3,582 cases (12.1%) and 6.8 billion KRW in reductions. By area, homes with an exclusive area of 60㎡ (approximately 25 pyeong) or less accounted for 46.7% of the total reductions, while homes exceeding 60㎡ accounted for 53.3%, more than half.

In particular, the existing acquisition tax reduction system for newlyweds only applied to homes of 60㎡ or less, but the newly implemented system does not set a separate area standard, thus expanding the range of housing choices within the price limit.

By age of the beneficiaries, those in their 30s accounted for the highest proportion with 11,760 cases (39.8%), followed by those in their 40s (26.2%), 50s (14.7%), 20s (11.2%), and 60s or older (8.1%). It was found that those aged 40 and above accounted for 49% of the total cases, indicating that tax reduction benefits for first-time home purchases are available regardless of age, even if they are not newlyweds.

The first-time home purchase acquisition tax reduction system is scheduled to be applied until the end of next year, and if the current trend continues, acquisition tax reductions worth about 200 billion KRW are expected over one and a half years.

An official from the Ministry of the Interior and Safety said, "We will closely monitor the operation status so that citizens can conveniently receive reduction benefits on site, and we will collect field opinions to supplement and improve inconvenient parts."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.