[Asia Economy Reporter Moon Chaeseok] The price decline of Renewable Energy Certificates (REC), a major source of income for small-scale solar power operators and others, is prolonging. The main cause is an oversupply of RECs, prompting calls to reassess the Renewable Portfolio Standard (RPS) system.

REC Prices, Which Determine Operator Profitability, Slashed to One-Third

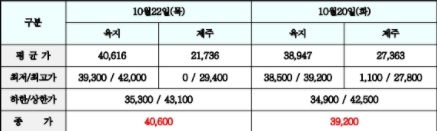

According to the latest data from the Korea Power Exchange's '6th Spot Market Report for October 2020' on the 27th, the closing price of REC as of the 22nd dropped to 40,600 KRW. The closing price on the 20th fell below 40,000 KRW to 39,200 KRW.

Compared to the REC trading price maintaining around 120,000 KRW during the same period in 2017, it has been cut to one-third in three years.

REC is a supply certificate issued when electricity is generated from renewable energy sources such as solar power, wind power, biomass, and fuel cells. It represents the value obtained by multiplying the electricity production volume (MWh) by the weighting factor for each power source.

Renewable energy operators sell the electricity they generate at the System Marginal Price (SMP) and sell RECs to generate additional revenue. Therefore, REC prices significantly impact profitability.

Facilities Increase... But Prices Plummet Due to Oversupply

On July 17, just three days after the government's announcement of the 'Korean New Deal' on July 14, Deputy Prime Minister and Minister of Education Yoo Eun-hye, along with Kim Tae-nyeon, the floor leader of the Democratic Party of Korea, inspected the solar power facilities installed on the rooftop of Gonghang High School in Gangseo-gu, Seoul, ahead of the press conference announcing the 'Green Smart Future School Project Plan.' (Photo by Yonhap News)

On July 17, just three days after the government's announcement of the 'Korean New Deal' on July 14, Deputy Prime Minister and Minister of Education Yoo Eun-hye, along with Kim Tae-nyeon, the floor leader of the Democratic Party of Korea, inspected the solar power facilities installed on the rooftop of Gonghang High School in Gangseo-gu, Seoul, ahead of the press conference announcing the 'Green Smart Future School Project Plan.' (Photo by Yonhap News)

Previously, the government introduced the RPS system in 2012 and established the REC market. To build the initial renewable energy market, it was deemed necessary to mandate energy-intensive users to use a certain proportion of renewable energy and to have a structure for trading it at an appropriate price.

The RPS requires power producers with facilities of 500MW or more to supply 7% (as of 2020) of their total electricity from renewable energy sources. Obligated suppliers can either produce electricity by installing renewable energy facilities themselves or fulfill the requirement by purchasing RECs.

The capacity of renewable energy facilities increased from 4,229 MW in 2012 to 19,092 MW this year. However, REC demand has not kept pace with the rate of facility deployment, causing a supply-demand imbalance. Naturally, prices have no choice but to fall. Each year, as new facilities enter the market, the supply of RECs increases, but sales do not keep up accordingly.

Small-scale private operators, who typically invest expecting returns over 10 to 15 years, complain that they cannot even recover their investment. Many operate their businesses while repaying principal and interest monthly on loans taken out over about 10 years.

Also Under Scrutiny at the National Assembly Audit... "RPS and REC Systems Need Revision"

Democratic Party lawmaker Go Min-jung is seen questioning Minister of Trade, Industry and Energy Sung Yun-mo about LED masks during the Ministry of Trade, Industry and Energy's audit held on the morning of the 7th at the full meeting room of the Industry, Trade, Energy, Small and Medium Enterprises Committee in the National Assembly, Yeouido, Seoul. (Photo by Yonhap News)

Democratic Party lawmaker Go Min-jung is seen questioning Minister of Trade, Industry and Energy Sung Yun-mo about LED masks during the Ministry of Trade, Industry and Energy's audit held on the morning of the 7th at the full meeting room of the Industry, Trade, Energy, Small and Medium Enterprises Committee in the National Assembly, Yeouido, Seoul. (Photo by Yonhap News)

According to the Korea Energy Agency, REC has been consistently oversupplied since 2017. Last year, the RPS mandatory fulfillment volume was about 27 million RECs, while the actual supply was approximately 32 million RECs. About 5 million RECs were excessively introduced into the market.

If the oversupply trend continues, REC prices are likely to fall further.

Therefore, the Legislative Research Office pointed out in its '2020 National Assembly Audit Issue Analysis' report in August that "since many renewable energy operators are facing difficulties due to REC price instability, the overall stability of the RPS system should be reexamined."

Issues related to adjusting REC weighting also came under scrutiny during the Ministry of Trade, Industry and Energy's national audit.

Democratic Party lawmaker Go Minjung said, "To achieve energy transition, floating offshore wind power should be actively utilized in the future, and REC should be reasonably adjusted considering the characteristics of facilities installed far offshore."

Under the current RPS system, REC weighting is differentially applied according to the type of renewable energy, and this weighting significantly affects operators' profits and losses.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.