"Relief as Household Loan Growth Slows Down"

[Asia Economy Reporters Kim Hyo-jin and Kim Min-young] Yoon Seok-heon, Governor of the Financial Supervisory Service (FSS), stated on the 26th that the sanction procedures against banks that sold Lime funds will be carried out within this year.

Before attending the 'FSS Governor-Invited Bank CEOs Meeting' hosted by the Korea Federation of Banks at Front1, a startup complex support space in Mapo-gu, Seoul, in the afternoon, Governor Yoon was asked by reporters about the status of sanctions review for bank CEOs related to Lime funds. He said, "It is difficult to specify the exact timing," but added, "If possible, we plan to do it within this year."

The FSS Sanctions Review Committee will hold a sanction hearing on the 29th for three securities firms?Shinhan Financial Investment, KB Securities, and Daishin Securities?that sold Lime Asset Management funds.

Former and current CEOs of these securities firms have been pre-notified of severe disciplinary actions, including suspension from duty, for failing to properly establish internal control standards and neglecting management responsibilities. Once the sanction procedures for the securities firms are completed, sanction procedures against banks that sold Lime funds, such as Woori Bank and Hana Bank, will follow.

Regarding this, Governor Yoon said at the bank CEOs meeting, "There is a need to promptly restore the trust damaged by incomplete fund sales in the banking sector," urging banks to actively compensate financial consumers for their damages.

"Banking Sector Must Actively Compensate Consumers for Fund Losses"

On suspicions of FSS employees being involved in the fund scandal, Governor Yoon drew a clear line, stating, "I believe that (FSS) employees were not directly significantly involved."

At the National Assembly's Political Affairs Committee comprehensive audit on the 23rd, he also said, "There is only very indirect evidence such as retired employees being involved or employees without direct work connections being involved," and added, "So far, no evidence has been found that our employees engaged in any wrongdoing during their work."

He emphasized, "The employee who had a significant impact on this issue was actually dispatched as a Blue House administrative officer, but I do not see major problems in other areas."

Regarding the sharp slowdown in household loan growth at major commercial banks this month, Governor Yoon said, "I think it is fortunate," and added, "We will need to continue requesting cooperation from the banking sector to manage loans."

On additional loan regulations such as the expansion of the Debt Service Ratio (DSR) regulation, Governor Yoon explained, "We are considering various options and discussing different matters," and said, "We will have to wait a little longer to see the outcome."

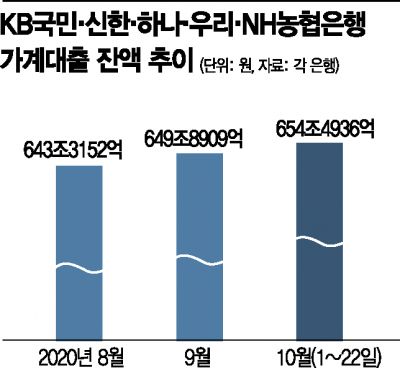

As of the 22nd of this month, the outstanding household loans at the five major commercial banks?KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup?amounted to 654.4936 trillion won, an increase of 4.6027 trillion won compared to the end of September (649.8909 trillion won). Although there are still business days left this month, the increase is 30% less than last month's 6.5757 trillion won and 45% less than August's record high increase of 8.4098 trillion won, indicating a clear slowdown.

This is analyzed to be influenced by the banking sector's reduction of preferential interest rates and loan limits following financial authorities' directives, as well as a decrease in loan demand related to apartment transactions.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.