Rising as a Hot Topic: Discussion on the 'Samsung Life Insurance Act'

If the '3% Total Assets' Limit is Imposed, Electronic Stake Must Be Sold

Market on Alert Over Stock Trends of Samsung Electronics and Others

[Asia Economy Reporter Oh Hyung-gil] The amendment to the Insurance Business Act has emerged as the biggest variable in the management system changes of Samsung Group following the passing of Samsung Chairman Lee Kun-hee.

The amendment, commonly referred to as the 'Samsung Life Insurance Act,' was proposed in June by Park Yong-jin and Lee Yong-woo, members of the National Assembly's Political Affairs Committee from the Democratic Party of Korea. This amendment is considered a major factor that could alter Samsung Group's governance structure.

According to the insurance industry on the 26th, the current Insurance Business Act allows insurance companies to hold stocks of major shareholders or affiliates up to 3% of total assets based on the 'acquisition cost' to prevent asset loss risks.

However, the amendment aims to change the evaluation standard for insurance companies' holdings of other companies' stocks from the 'cost price' at acquisition to the 'market price.'

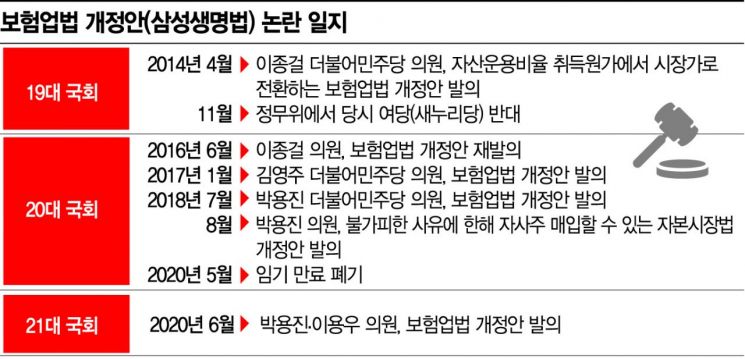

Similar amendments were proposed in the 19th and 20th National Assemblies but failed to pass. However, in the 21st National Assembly, the ruling party is eager to pass the bill, making its passage within the year possible.

The ruling party argues that the proportion of a single company within an insurance company's total assets is excessively high, which could pose a significant risk to the financial market.

On July 29, during the Political Affairs Committee plenary session, Representative Park stated, "The stock proportion relative to total assets of other life insurance companies, excluding Samsung Life Insurance, is only 0.7%. The impact Samsung Life Insurance experiences due to fluctuations in Samsung Electronics' stock price is 20 times greater than that of other companies."

Representative Park asserted, "If a crisis hits Samsung Electronics later, Samsung Life Insurance will become a super-spreader of that crisis to our economy."

Governance Structure Reaches Turning Point Following Passage of Insurance Business Act Amendment

If this bill passes as proposed, Samsung Life Insurance will have to sell the excess portion exceeding 3% of Samsung Electronics shares it holds, which currently stands at 8.5% (581.6 million shares). Including Samsung Fire & Marine Insurance's 1.5%, the sale volume is expected to exceed 20 trillion won.

In this case, the group's governance structure could be shaken. Currently, Samsung Life Insurance is the largest shareholder of Samsung Electronics excluding the National Pension Service. A major overhaul of the governance structure, which follows the chain 'Vice Chairman Lee Jae-yong of Samsung Electronics → Samsung C&T → Samsung Life Insurance → Samsung Electronics,' will become inevitable.

On the 26th, Jeong Dong-ik, a researcher at KB Securities, explained, "There are discussions about selling Samsung Biologics shares held by Samsung C&T, acquiring Samsung Electronics shares held by Samsung Life Insurance, splitting Samsung Electronics into investment and business divisions, and then merging the investment division with Samsung C&T."

He added, "Considering the forced conversion of Samsung C&T into a holding company, Samsung Electronics' lack of treasury stock, and the grace period provisions of the Insurance Business Act amendment, early visibility of governance restructuring is unlikely."

The insurance industry has expressed concerns that evaluating held stocks at market price could cause greater confusion due to stock price volatility.

An insurance industry official pointed out, "If the stock price of the company falls, the support limit for that company increases, which is the opposite effect. Depending on stock price fluctuations, additional shares may be purchased or sold, potentially destabilizing asset management standards."

Meanwhile, only South Korea and Japan separately regulate investment limits for major shareholders or affiliates in insurance companies. Even in Japan, stocks of subsidiaries and related companies are evaluated based on acquisition cost when calculating investment limits.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)